FX Daily Strategy: APAC, Oct 2

Swiss CPI could reignite talk of negative CHF rates

EUR/CHF basing near 0.93

JPY has scope for further gains

GBP recovery unlikely to last

Swiss CPI could reignite talk of negative CHF rates

EUR/CHF basing near 0.93

JPY has scope for further gains

GBP recovery unlikely to last

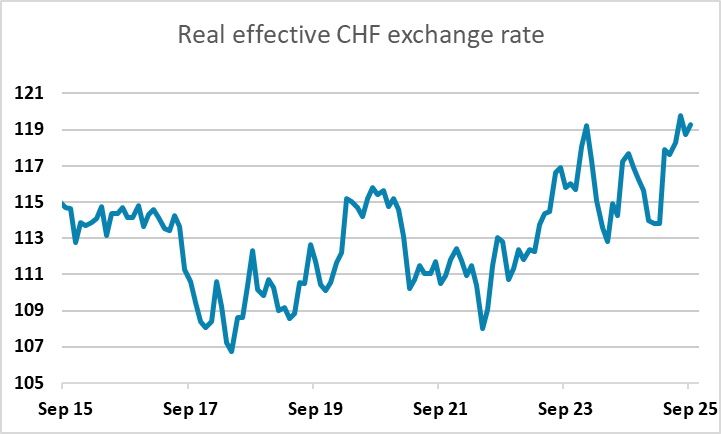

Thursday was already looking like a fairly quiet day for data even before the US government shutdown. Now there is no US jobless claims data either, so markets will have to find cues from elsewhere. The morning does see Swiss September CPI data, which could be important given the continuing strength of the CHF. It will still require a high bar for the SNB to move to a negative policy rate, but weak CPI could trigger it, although if the CHF were to weaken in anticipation, that might take the pressure off the SNB to act.

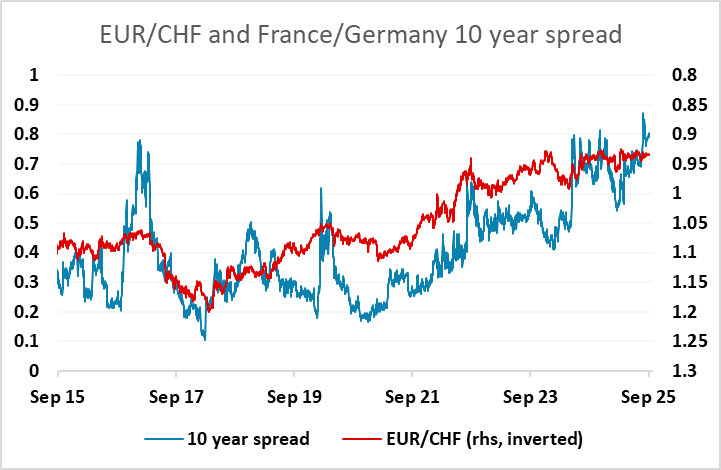

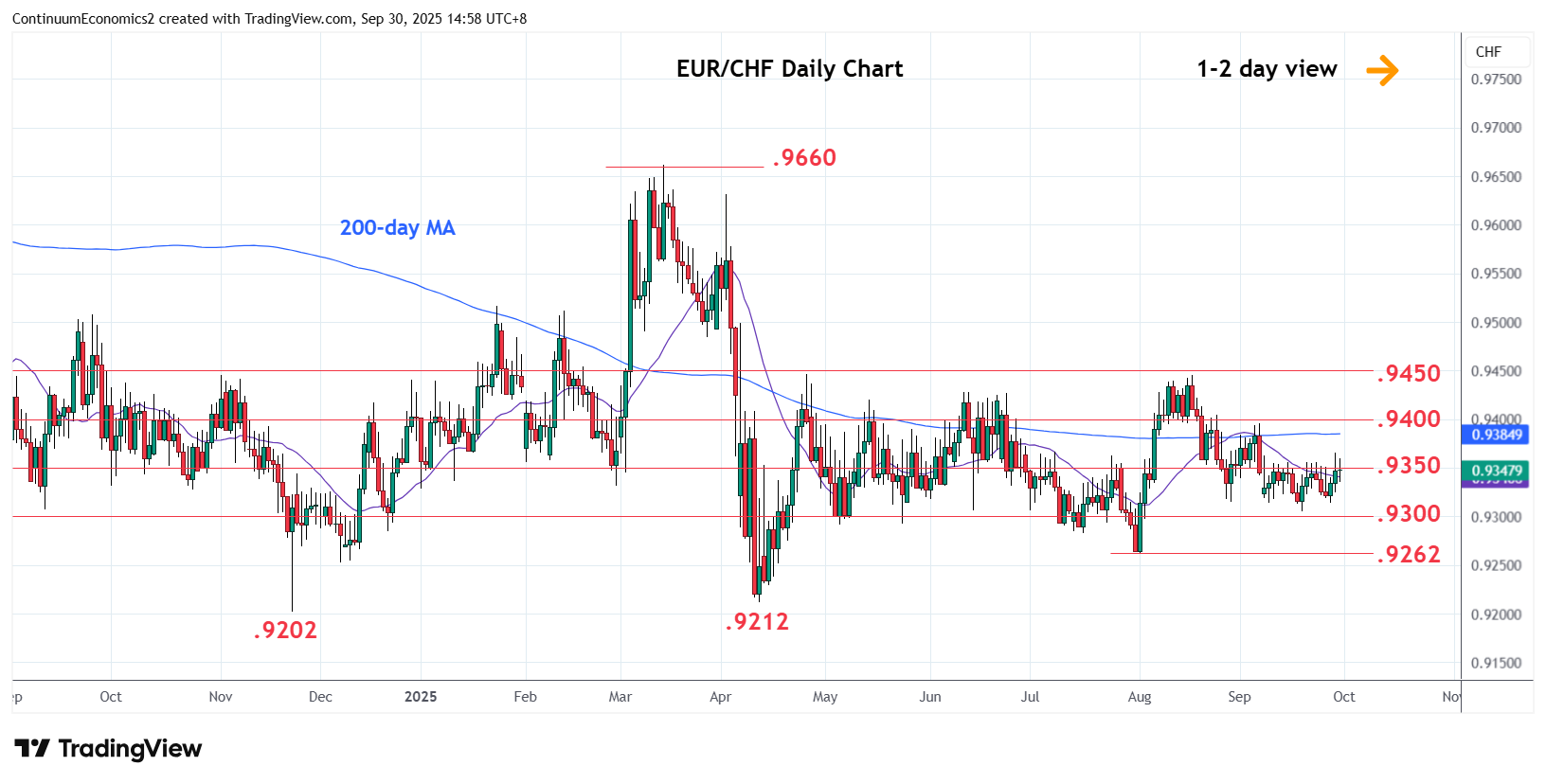

EUR/CHF has moved modestly higher in the last few days, even though risk sentiment has if anything weakened slightly due to the US government shutdown. Of course, while the CHF is traditionally a safe haven, it has remained strong in recent years despite generally positive risk sentiment and declining risk premia, so it is now probably only seen as a safe haven in relation to intra-EU tension. The France/Germany 10 year yield spread provides one measure of this, and has edged lower in the last month from the highs seen in late August. There also looks to be a strong technical base building at 0.93 in EUR/CHF, so provided that we don’t see any renewed EUR break-up concerns, there is scope for EUR/CHF to continue to edge a little higher.

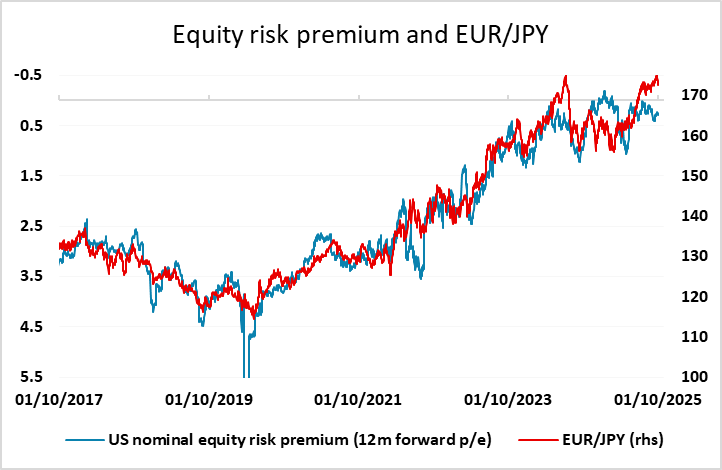

The theme on Wednesday was some continued JPY strength, encouraged both by the US government shutdown and the weaker than expected US ADP employment data which showed the largest decline since the pandemic and the third in the last four months. This certainly weighs in favour of a Fed ease in October even if there is no official data to go on by then, and should consequently be JPY supportive. Lower US yields will both reduce the spreads with the JPY and will tend to increase the implied equity risk premium, especially in a situation where activity is likely to be held back to some extent by the government shutdown. Risk premia have already risen enough to suggest scope for a EUR/JPY decline below 170, while US/Japan yield spreads suggest scope well into the 130s. CHF/JPY continues to look the most clearly overvalued pair and could have dramatic downside.

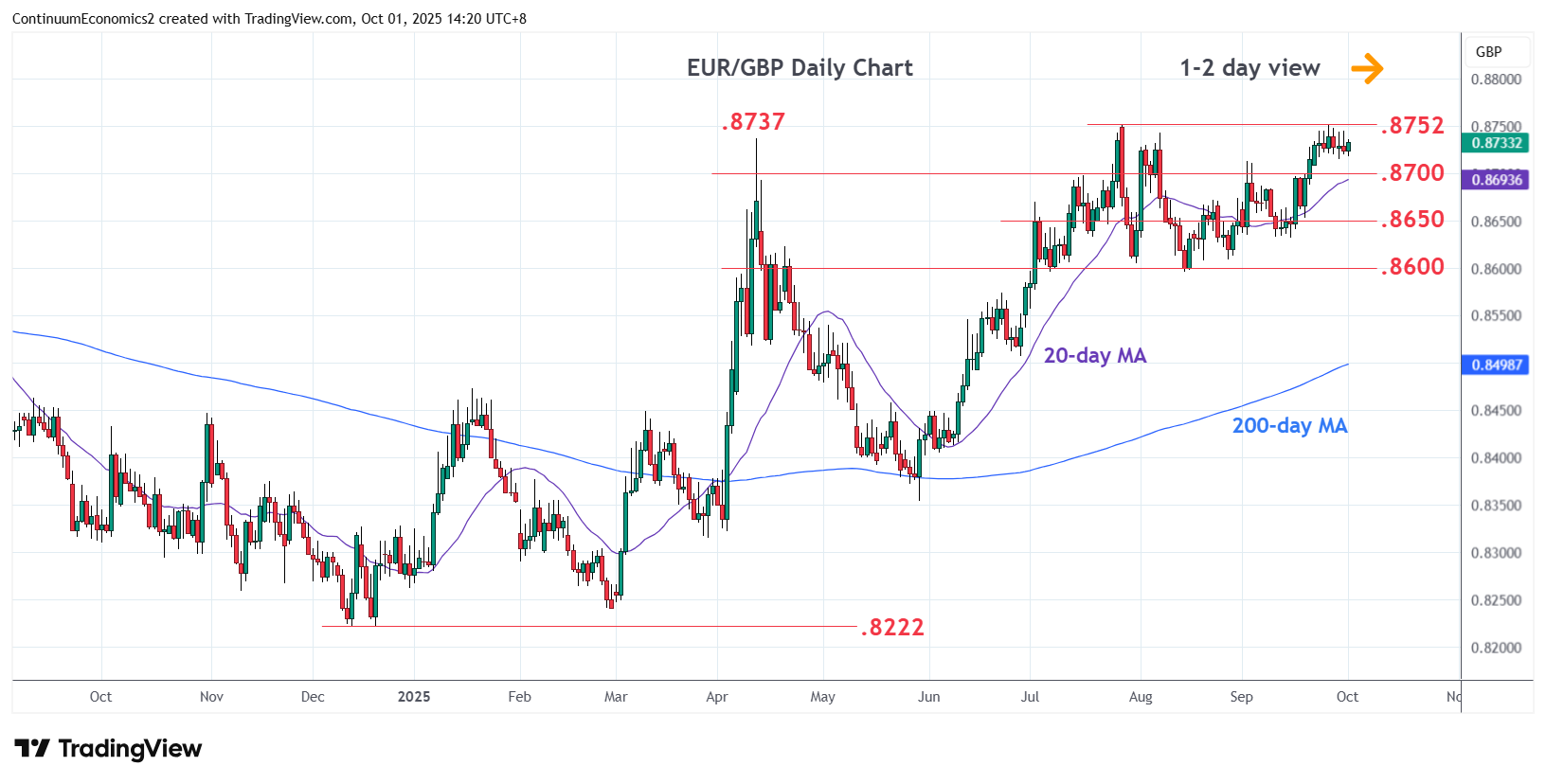

GBP showed some slightly surprising gains against the EUR on Wednesday, as UK yields fell back slightly relative to the Eurozone, and risk sentiment was generally weaker, which typically helps the EUR. We still see risks of a renewed test of the 0.8763 high of the year in EUR/GBP, especially since the upcoming November budget in the UK is likely to contain significant tax increases that will increase the chances of monetary easing in 2026.