U.S. April Durable Goods Orders - Rise fully on defense but some underlying improvement

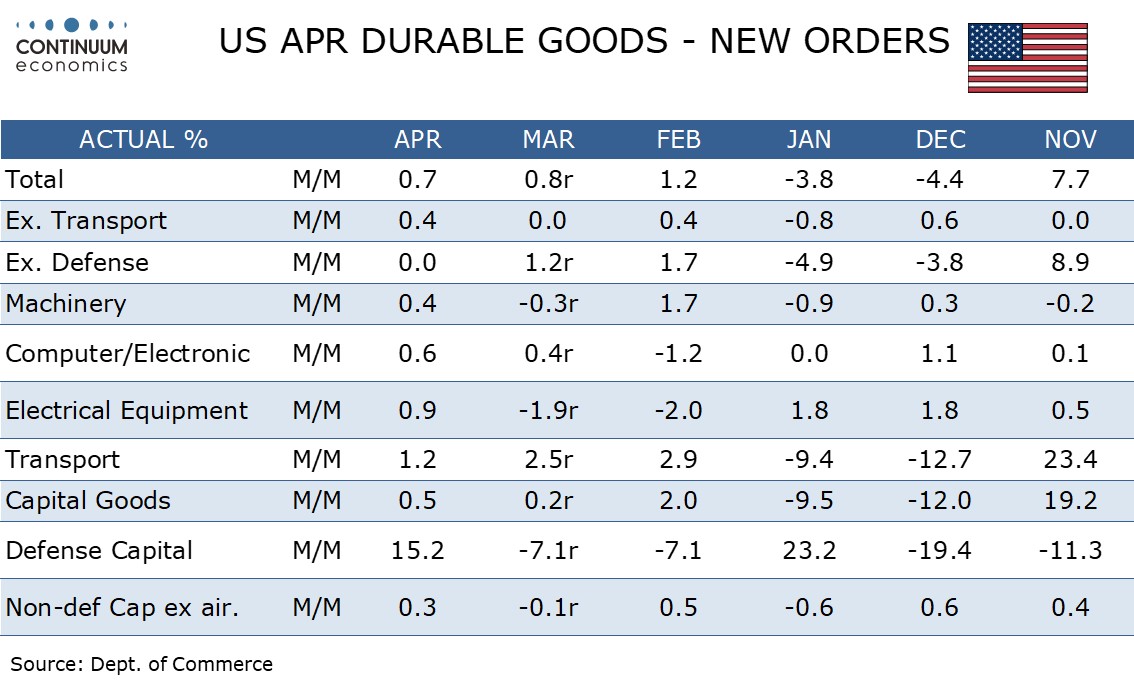

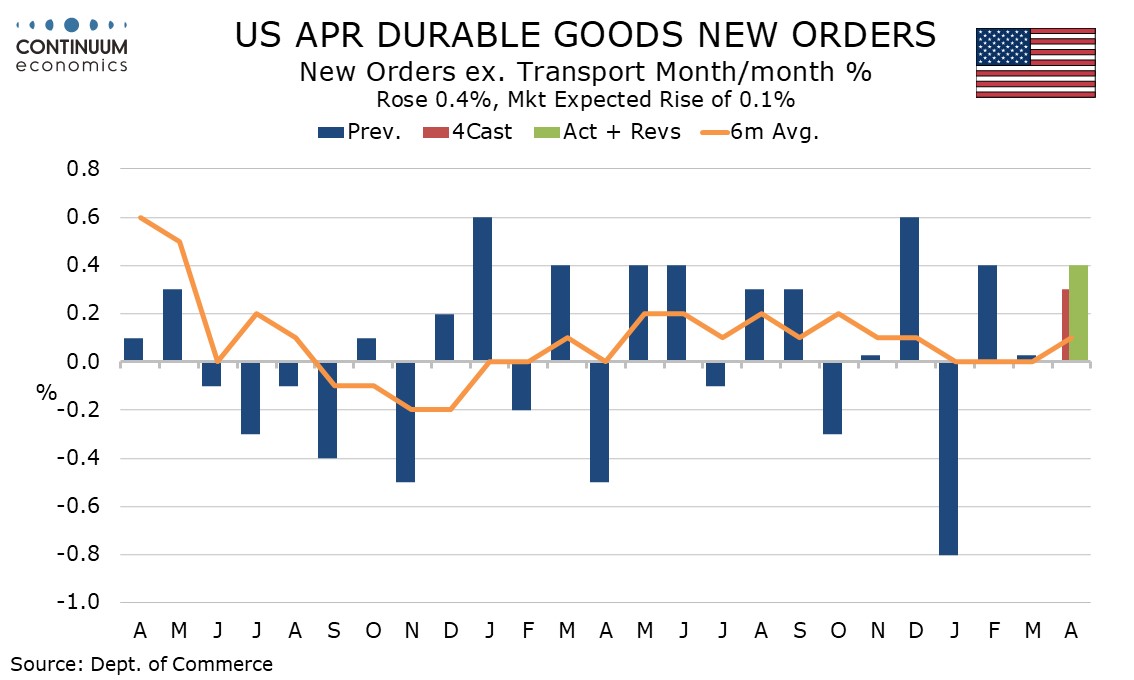

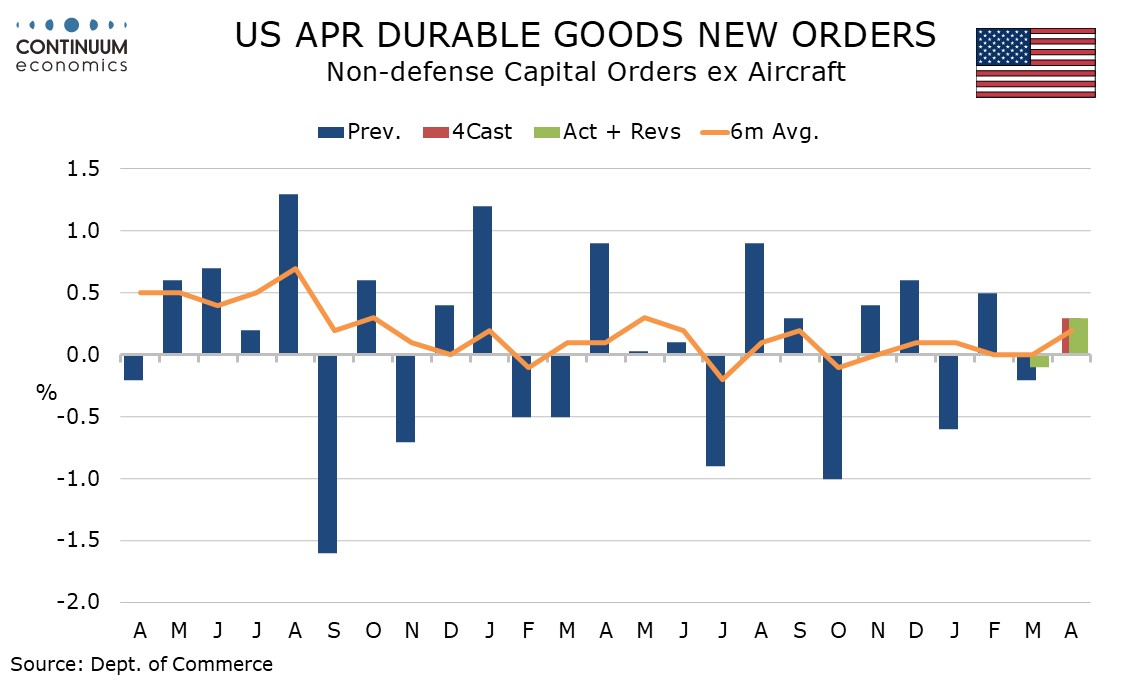

April durable goods orders are stronger than expected, and while the gains of 0.7% overall and 0.4% ex transport are moderate, they are a little above recent trend. While the overall rise came fully on defense, gains in non-defense capital ex aircraft orders of 0.3% and shipments of 0.4% suggest business investment is holding up at the start of Q2.

The headline surprised on the upside as transport avoided a decline that had been implied by Boeing data. Aircraft saw a modest decline after a modest rise in March. Boeing data implied a stronger rise in March so that puts the smaller than expected April decline in context.

Overall transport orders rose by 1.2% with autos and defense positive. Defense has a large overlap with transport and picked up after two straight declines, perhaps related to fresh funding for Ukraine, which will persist in the coming months. Orders excluding defense were unchanged.

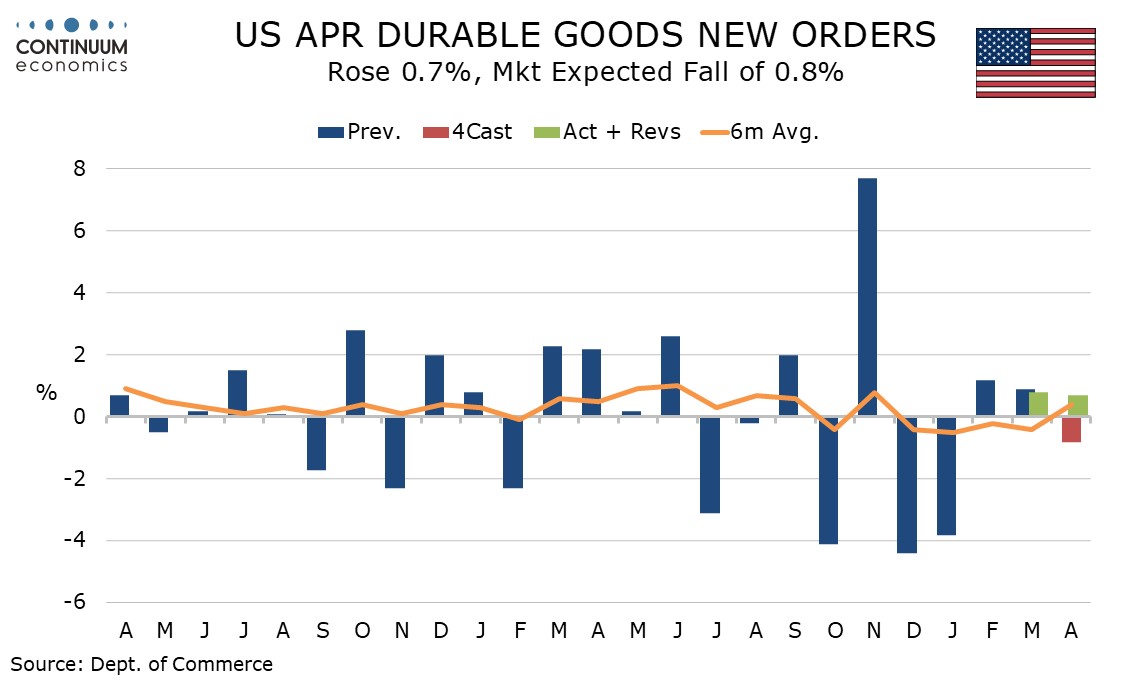

The ex-transport trend has been very flat with the 6-month average unchanged in each month of Q1, so a 0.4% April rise, after a flat March and a 0.4% rise in February is a hint that trend has improved a touch. While the change is marginal it is consistent with a slightly improved picture from indices such as the ISM’s and the S and P manufacturing survey.

Trend in non-defense capital orders ex aircraft has been similar to that of the ex-transport data, and a rise of 0.3% in April, with a 0.4% rise in shipments, makes a modestly positive start to Q2. This suggests business investment is holding up at the start of Q2 which is positive for GDP, as is signs of renewed strength in defense spending. Inventories however, with a 0.1% increase, remain subdued.