This week's five highlights

BoE MPC Splits Enlarge to Suggest Cut Soon

SNB 25bps Cut and Next Cut in September

RBA Recognized slower inflation moderation

Norges Bank Excessive Last Mile Caution?

U.S. Initial Claims, Housing Starts, Philly Fed and Current Account all disappoint

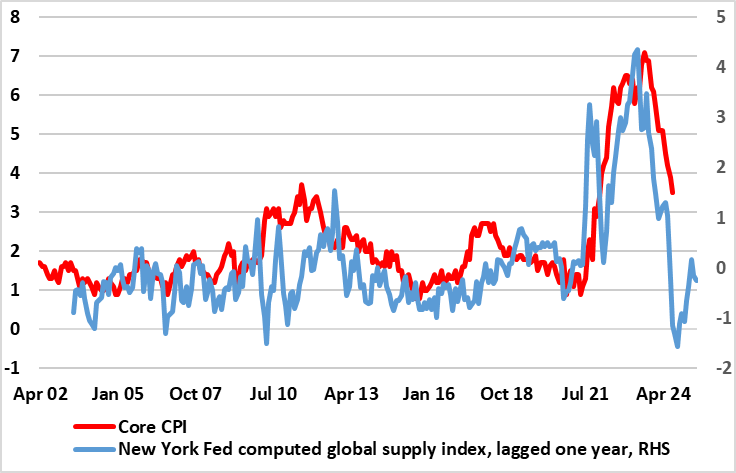

Figure: UK Disinflation – So Far Supply Driven?

As widely Bank Rate was kept at 5.25% for the seventh successive MPC meeting this month, with its rhetoric largely unchanged. But while there were still only two formal dissents, the minutes clearly suggested that for some of the remaining seven members the policy decision at this meeting was finely balanced. Indeed, for them, despite a real economy backdrop that the BoE sees another strong GDP outcome this quarter, upside news in services price inflation relative to the May Report did not alter significantly the disinflationary trajectory that the economy was on. This implies this group (which may be as large a four) could swing to an actual cut in August not least as updated forecasts due then may add to the disinflation ‘story’. The important thing is that even with a few cuts in the next six months, policy would still be clearly restrictive and the MPC has to consider ‘for how long Bank Rate should be maintained at its current level’. We see up to three 25 bp cuts this year and around four such moves next year not least against a backdrop where the disinflation to date has been largely supply driven and where weak demand factors have yet to anything fully filter through.

It is clear that real activity data are not having a material impact on MPC thinking regarding hoe durable and sizeable is the disinflation process. We are puzzled as why the BoE revised up its Q2 GDP outlook so markedly, especially against a backdrop where labor market developments (especially jobs) suggest a much weaker, if not weakening backdrop, not least domestically. Regardless, the BoE will probably agree with us that much of the recent (and possibly looming) disinflation is supply driven (Figure 1 shows the extent to which easing global supply pressures as computed by the New York Fed has probably driven UK underlying inflation). This means that even with some reduction in the excess supply picture evident in the May Monetary Policy Report (of 1% of GDP into 2027), domestic price pressures should add to this easing in supply strains – hence the clearly below target inflation outlook the BoE is likely to adhere to in August.

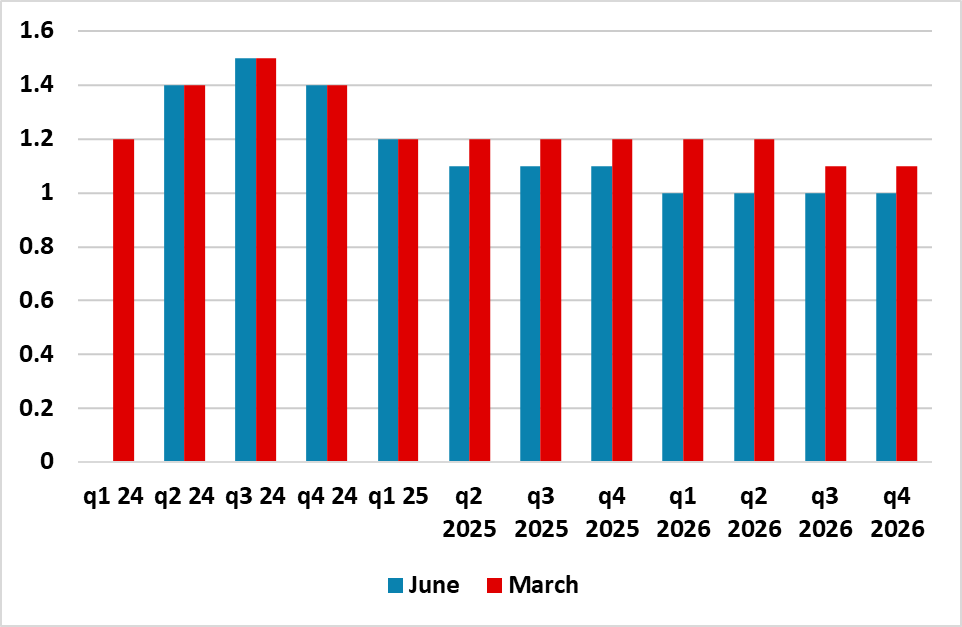

Figure: SNB CPI Inflation Projections Back Below Target

The SNB cut by 25bps to try and stop inflation undershooting. We look for a further 25bps cut in September, as the new inflation forecasts remains too far below target for SNB comfort. CHF strength will also not ebb quickly given the prospect of prolonged French political uncertainty.

The SNB cut by 25bps to 1.50% as we projected, despite some in the market not expecting a cut. The rationale for the cut is clear in the even clearer undershoot of the inflation target with the new inflation projections (Figure 1). Indeed, the 2024-26 annual projections were all cut by 0.1 ppt, even after taking account of the new policy rate. Recent actual inflation dynamics certainly suggest disinflation continues. Headline CPI look set to match the 1.4% existing projection of the SNB for the current quarter. The continued strength of the Swiss Franc is only compounding domestic disinflation, but where even the latter is slowing. GDP growth continues to be projected at 1.0% in 2024 and the SNB forecast of 1.5% in 2025 is healthy but not inflationary.

The SNB policy reaction function suggests that they will likely cut the policy rate still further, as the new inflation forecasts are consistent with a 25bps in September and this is our forecast. Though the SNB statement suggests that the new inflation projection is consistent with the SNB inflation goal, the reality is that these type of inflation forecasts are enough to keep the SNB cutting, especially if the SNB’s repeated worries about property market vulnerabilities materialise. Indeed, a further 25bps cut down to 0.75% in December is now feasible, both given the forecast inflation undershoot and if CHF strength does not ebb – we forecast that the ECB will cut in September and December and the French political uncertainty will be ongoing (here).

It is noteworthy that the SNB continues to threaten further CHF sales, with the opposition to balance sheet increase now being removed by the persistent CHF strength.

The RBA has kept the cash rate on hold at 4.35% as per our forecast. The current inflation picture does not support any change of monetary policy from the RBA despite the latest quarterly and monthly CPI both showing a 3.6% y/y growth, eliminating the possibility of any early easing from the RBA . The key forward guidance statement of "The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out." continue to points towards data dependency in future RBA's meeting. RBA continue to forecast inflation to be back in target range in mid 2025 but they have acknowledged that inflation is moderating at a slower pace than expected.

The decision aligns with RBA's rhetoric of being data dependent and patient in assessing the cumulative effect of tightening while keeping a close eye on inflation dynamics. RBA will prefer not to further tighten after a dismay q1 GDP with sluggish consumption growth being forecasted. The room for RBA to tighten without significantly hindering economic growth remains minimal. The household balance sheet are restricted by mortgage cost and inflationary living pressure, while business are facing the tightest financial conditions in months, alongside peaking labor market even as the Australian economic growth being stronger than market consensus. However, the higher than expected inflation also does not allow the RBA to perform any easing in coming months. RBA acknowledged the pace of moderation is much slower, citing excess demand, elevated cost and peaked but still high wage growth to be key factors. With no change in the timeline for CPI to return to target range, RBA is hinking higher rates will be here for longer.

RBA highlights service inflation continue to moderate slower than expected, household consumption weakens and global outlook uncertainty to be key risk towards their forecast. The RBA did not change their inflation forecast and seems to be content with the trajectory of inflation by seeing 2-3 percent in 2025. We maintained our forecast of terminal rate to be 4.35% and now only see one 25bps easing by year end 2024.

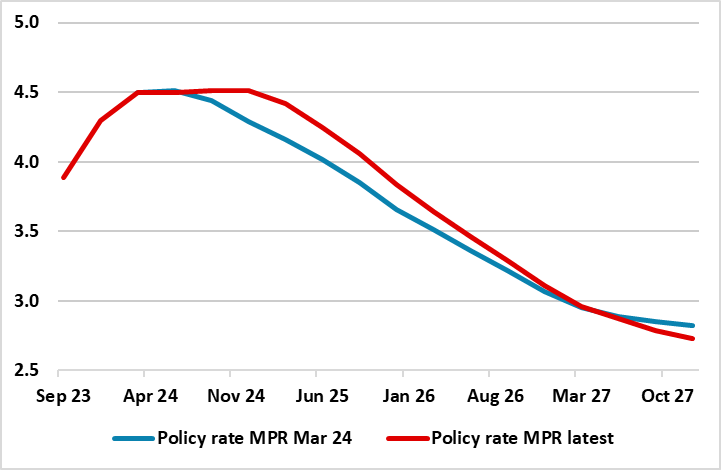

Figure: Policy Path Easing Deferred

It was always the very high likelihood that the thrust of recent data and the Board’s clear caution would mean that the Norges Bank would leave its policy rate at 4.5% for a fourth successive meeting and this is what duly occurred. Perhaps more notable was that the it was more explicit in stressing ‘policy to stay on hold for some time ahead’ rhetoric, this backed up formally with an updated policy outlook that sees no rate cut until early 2025, some three months later than hitherto. This is in spite of a downgrade to this year’s CPI outlook reflecting a broad undershoot of its inflation expectations. Instead, policy is being shaped by an upgrade to the wage outlook which results in higher CPI projections out to 2027 and where the CPI-ATE measure stays above the 2% target. Even so, the revised policy outlook sees a slightly softer rate at the end of the forecast horizon (Figure 1), the question being whether this is seen being a terminal or even neutral rate. We think continued inflation downside surprises in coming months, as weaker profit margins offset labor costs issues, will deliver at least one cut by end-year and maybe over 100 bp in 2025!

Against a backdrop of continued currency weakness, the Norges Bank Board has almost disregarded the size and cause of the recent inflation undershoot, instead preferring to focus on what it says is a perkier real economy, possibly in the hope that this may bolster sentiment in the FX market regarding the currency. Indeed, it has revised the GDP picture markedly for this year but little changes from 2025 onwards, still largely preserving a negative output gap.

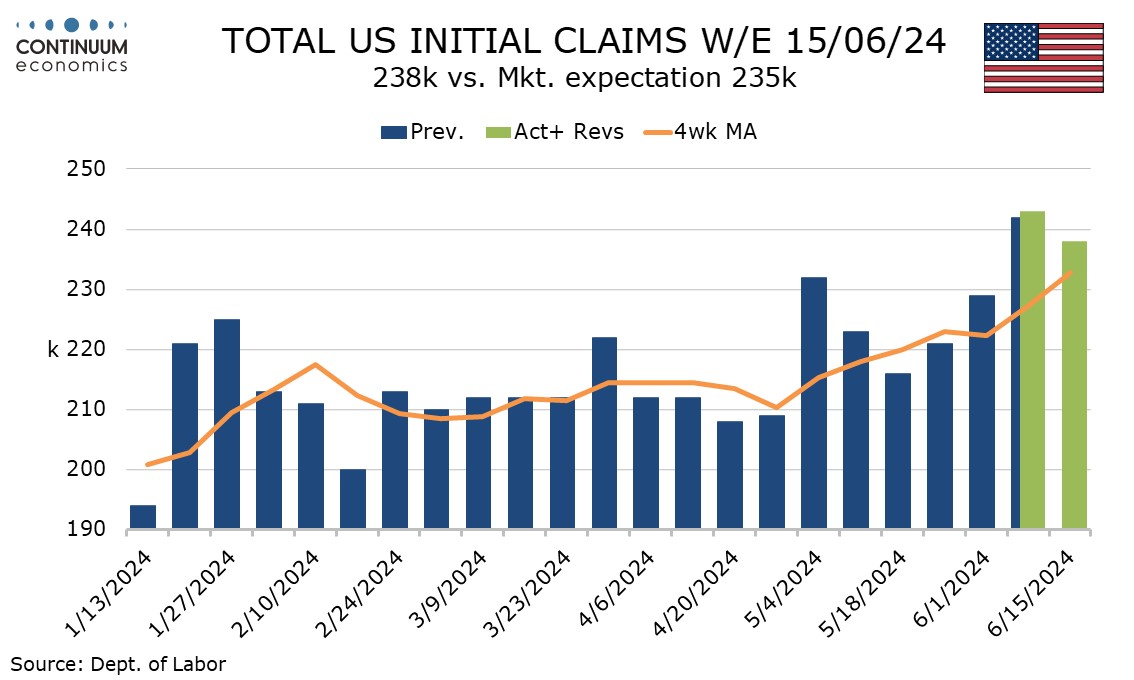

The latest round of US data is all on the weak side of expectations (though the Philly Fed survey saw higher price indices), with initial claims being of most significance in that this is the survey week for June’s non-farm payroll. While slightly lower on the week, at 238k, last week’s 14k spike to 243k has been largely sustained.

The 4-week initial claims average of 233k is the highest since September 2023 and up from 220k in May’s non-farm payroll survey week. Continued claims at 1.828k are up by 15k and this is the seventh straight gain, though the size of the gains remains quite modest if gaining some momentum in the latest two weeks. Continued claims cover the week before initial claims. May housing starts at -5.5% to 1277k and permits, -3.8% to 1386k, both saw the lowest levels since June 2020 when we were barely past the height of the pandemic. This backs other signals of slowing housing activity, including yesterday’s NAHB homebuilders’ survey for June. Both series saw slightly larger declines in the volatile multiples sector though singles in both series were weaker. In the case of single permits this is fourth straight decline after a string of thirteen straight increases, a clear sign that trend has turned. June’s Philly Fed index of 1.3 is down from 4.5 in May but still positive and the details show gains in new orders, employment, the workweek and both prices paid and received, though the new orders and employment levels are still negative. Prices received at 13.7 from 6.6 are the highest since July 2023.