Published: 2024-01-24T15:05:43.000Z

U.S. January S&P PMIs show unexpected improvement, which may be difficult to sustain

-

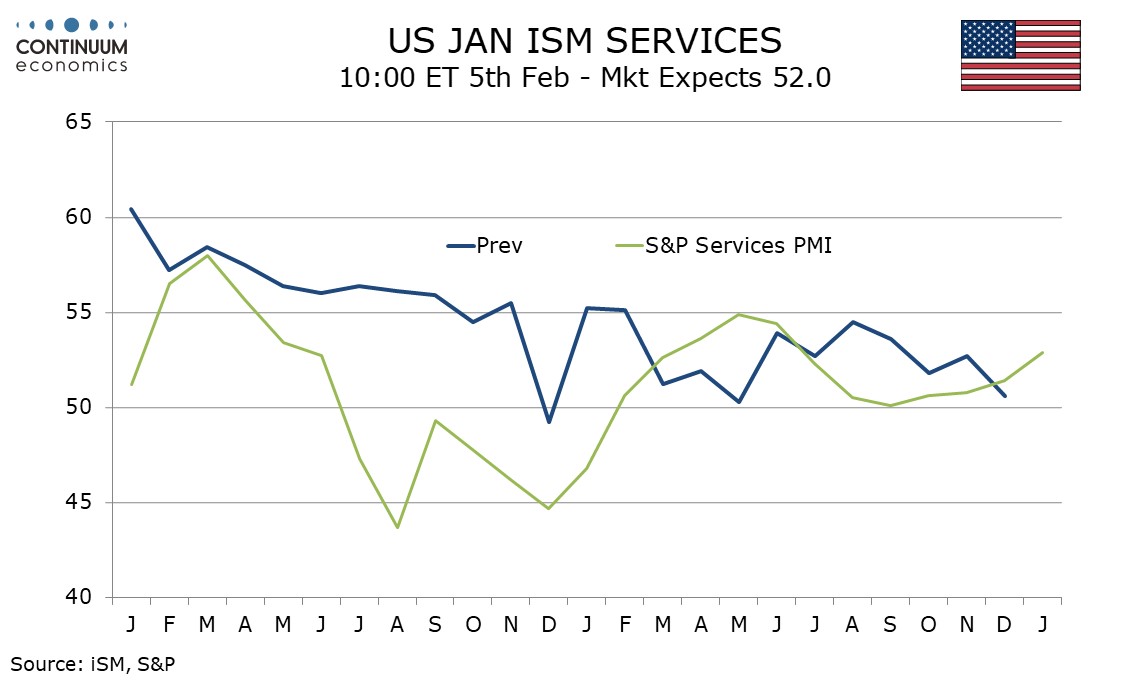

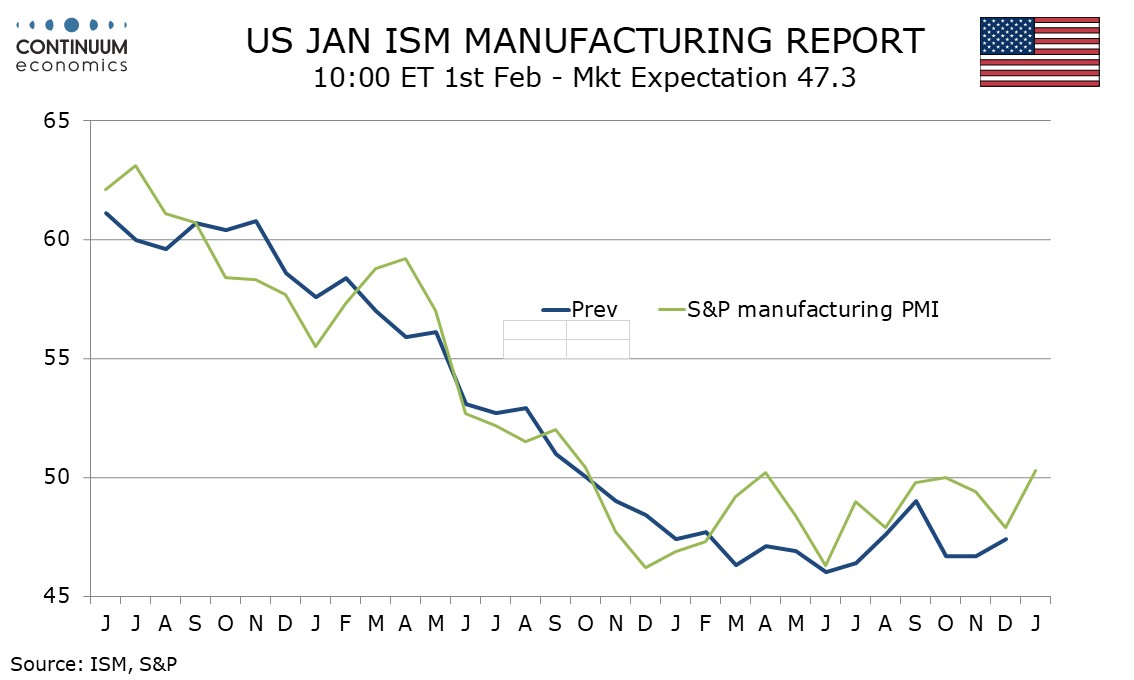

January’s preliminary S and P PMIs are stronger than expected manufacturing at 50.3 from 47.9 the highest since September 2022 (though the preliminary reading reached 50.4 in April 2023 before a final outcome of 50.2) and services at 52.9 from 51.4 the highest since June.

The manufacturing move above neutral is the more surprising outcome to us given that most survey evidence has remained negative, with the Empire State's seeing a particularly sharp slide. The S and P manufacturing index did reach neutral twice in 2023 before slipping back again and then other surveys did not see similar bounces. The latest move above 50 may also prove hard to sustain.

The S and P services index is not well correlated with its ISM counterpart. It does however appear responsive to moves in bond yields with a slide to a low of 50.1 in September before seeing four subsequent gains. If yields rise further, this recent recovery in the S and P services PMI may stall.