Preview: Due January 14 - U.S. October and November PPI - Moderate gains, with risk of some volatility

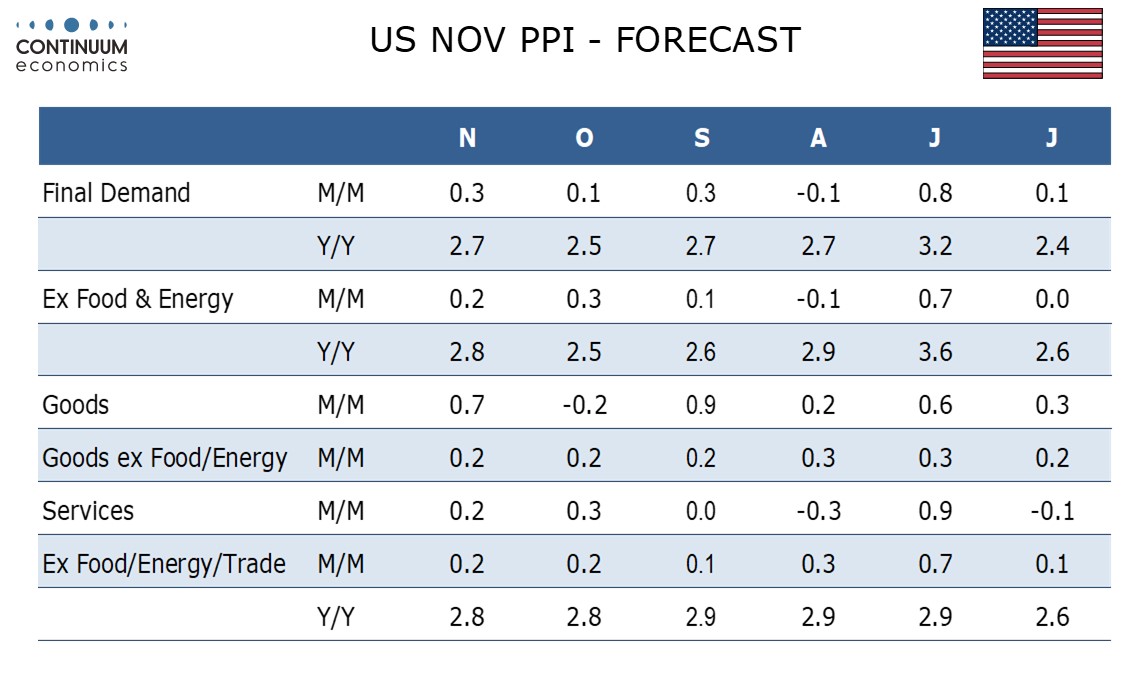

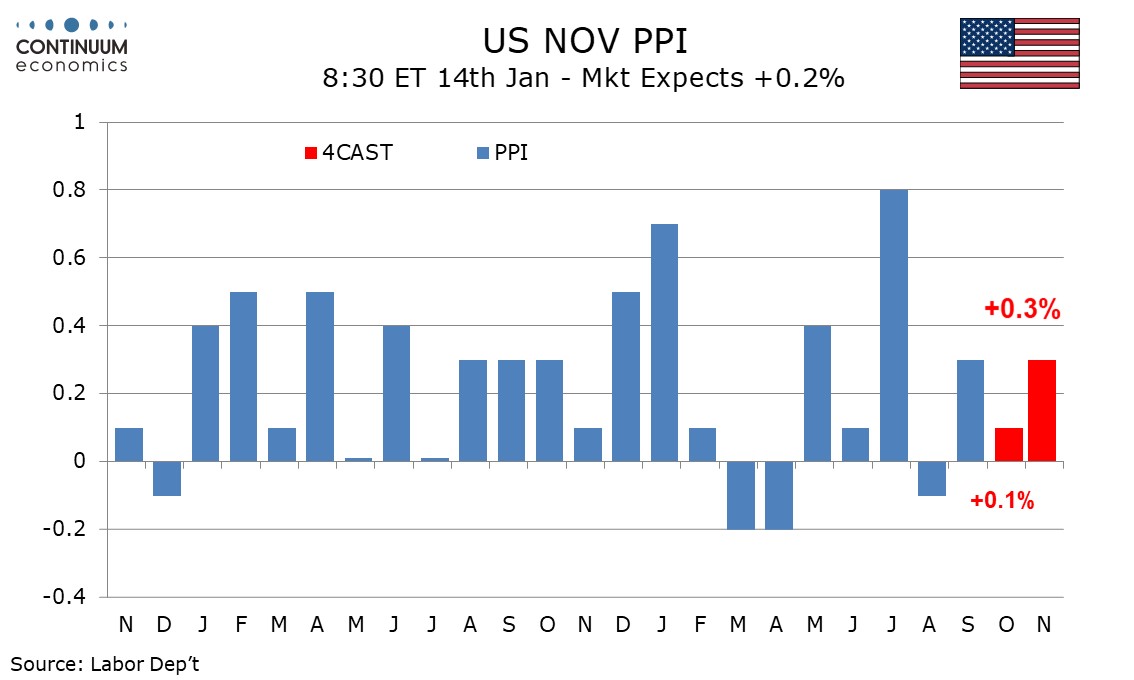

October and November PPI will be released together on January 14. Unlike CPI which was not measured in October we will see data for both months, but the October PPI data will be collected on a delay and that adds to the risk of inaccuracy. We expect PPI to rise by 0.1% in October and 0.3% in November, with ex food and energy PPI up by 0.3% in October and 0.2% in November.

As in the CPI, for which gasoline was one of the few components measured in both months due to external data sources being available, energy prices are likely to fall in October and rise in November. We expect moderate gains of 0.2% in food for both months.

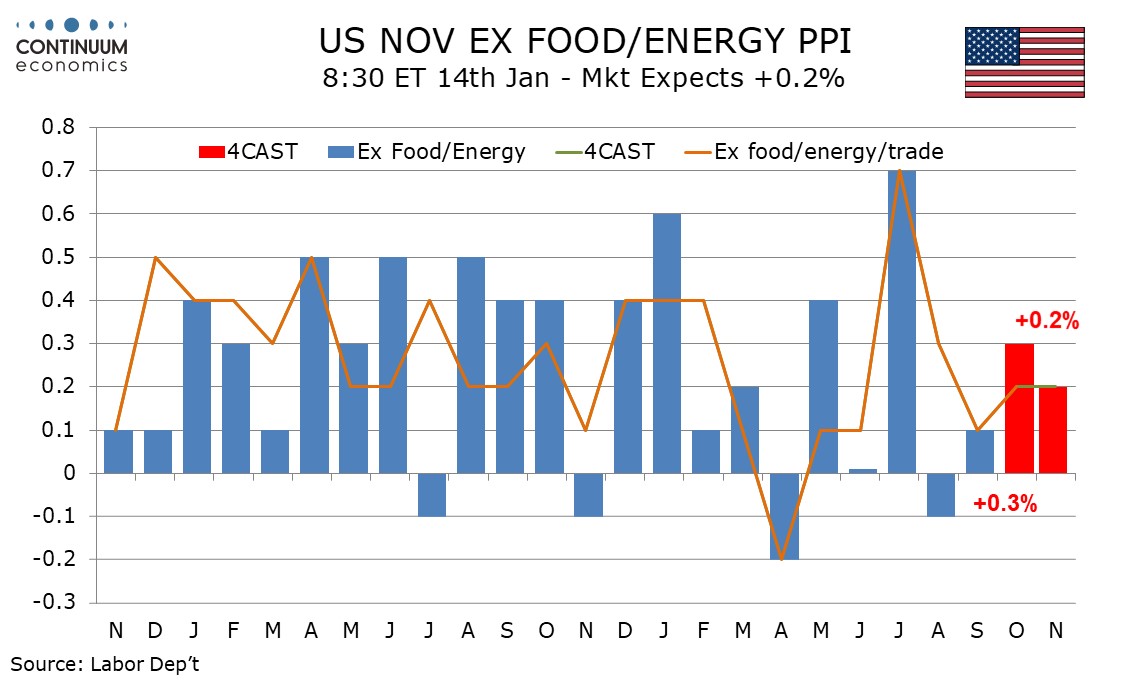

Goods PPI ex food and energy rose by 0.3% in six of the first nine months of 2025 with 0.2% gains in the other three. However we expect gains of only 0.2% in both October and November with the tariff impact probably starting to fade. We expect services PPI to rise by 0.3% in October lifted by an upward correction in trade from two straight declines, and 0.2% in November, when we see no large move in trade. Ex food, energy and trade, we expect gains of 0.2% in both October and November.

We expect yr/yr data to show November gains of 2.7% in overall PPI, and 2.8% in both core rates, ex food and energy and ex food, energy and trade. This would compare to September outcomes of 2.7% overall, 2.6% ex food and energy and 2.9% ex food, energy and trade. Each rate was above 3.0% early in the year.