U.S. March PPI - Broadly subdued, if still stronger than in late 2023

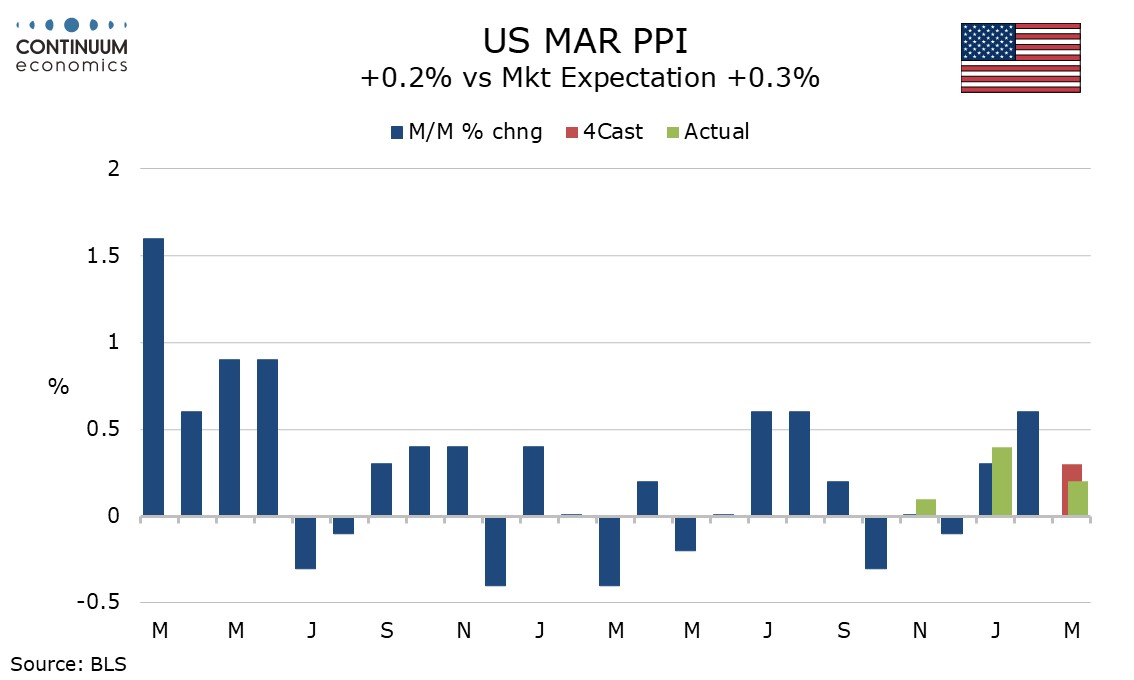

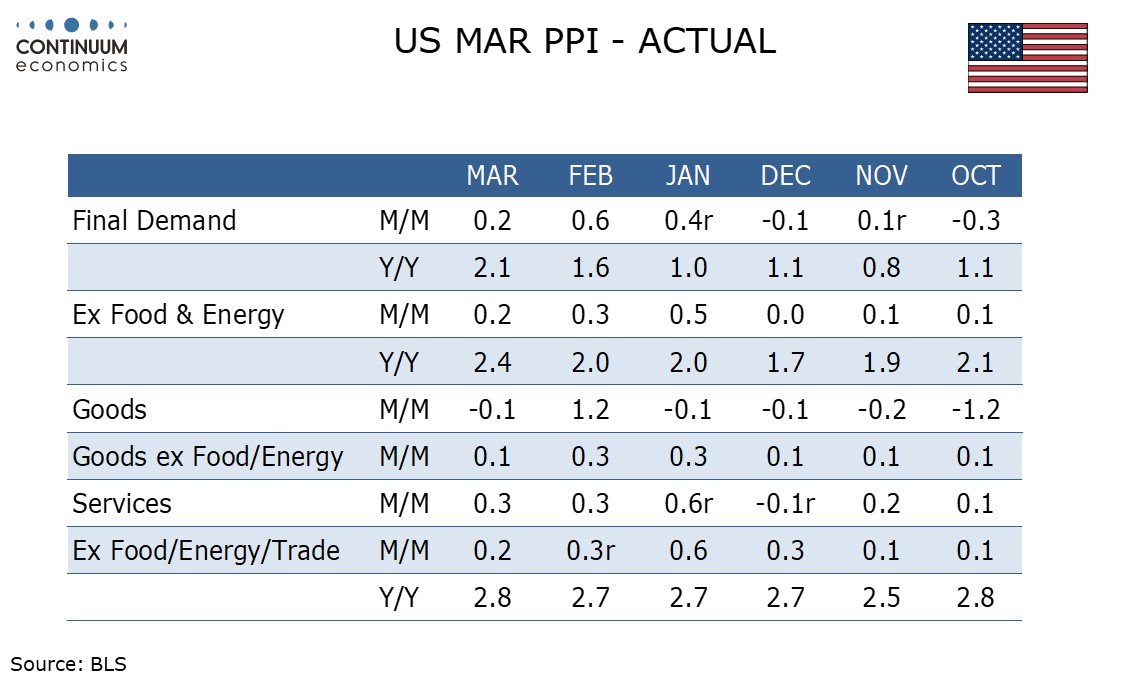

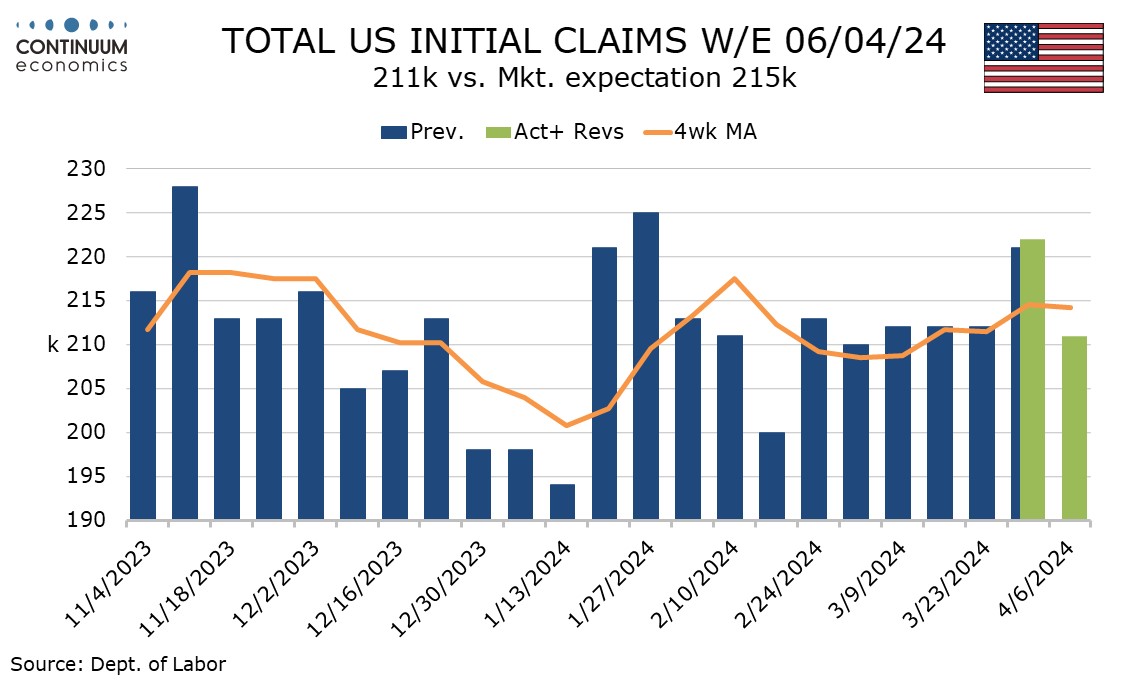

March PPI comes as some relief after the strong CPI, rising by a modest 0.2% overall and in the core rates ex food and energy and ex food, energy and trade. Initial claims at 211k have confirmed last week’s above trend 222k outcome to be a blip with the labor market still looking strong.

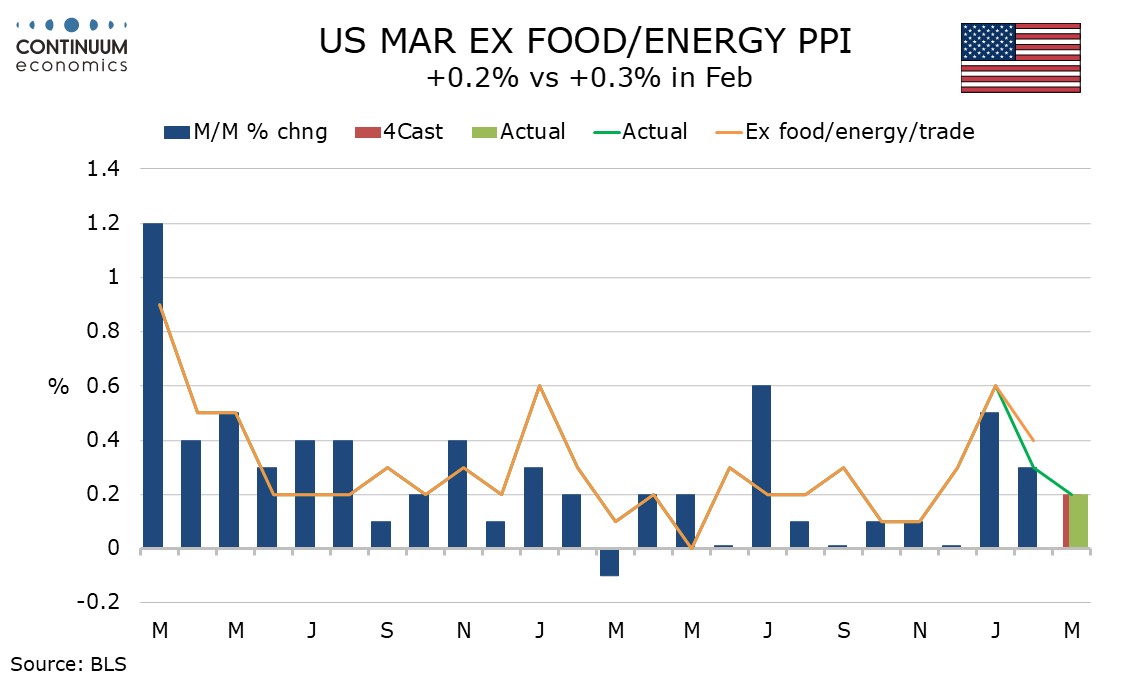

The PPI is showing some fading of New Year strength, which saw the ex food and energy rate rise by 0.5% in January and 0.3% in February, though the 0.2% March increase is still stronger than the last five months of 2023.

Both CPI and PPI may have some seasonal adjustment difficulty, with the underlying picture probably not as strong as seen in Q1 2024 but not as subdued as seen in late 2023.

PPI showed food strong for a second straight month at +0.8% but a 1.6% decline in energy to correct a 4.1% February increase. Core goods rose by 0.1% after two straight 0.3% gains while services rose by 0.3% for a second straight month, again led by transport and warehousing.

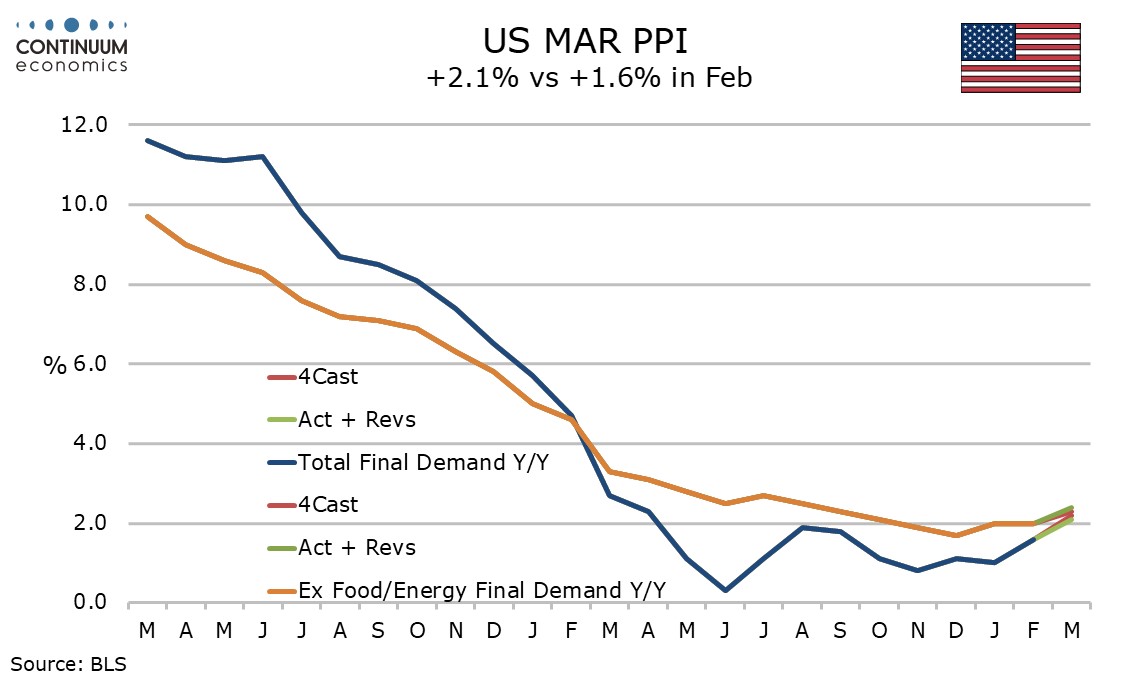

Yr/yr data is stronger with March 2023 having seen a very weak month, overall PPI at 2.1% from 1.6%, ex food and energy at 2.4% from 2.1% and ex food, energy and trade at 2.8% from 2.7%.

Intermediate PPI data looks soft with goods prices falling and services rising by only 0.2%.

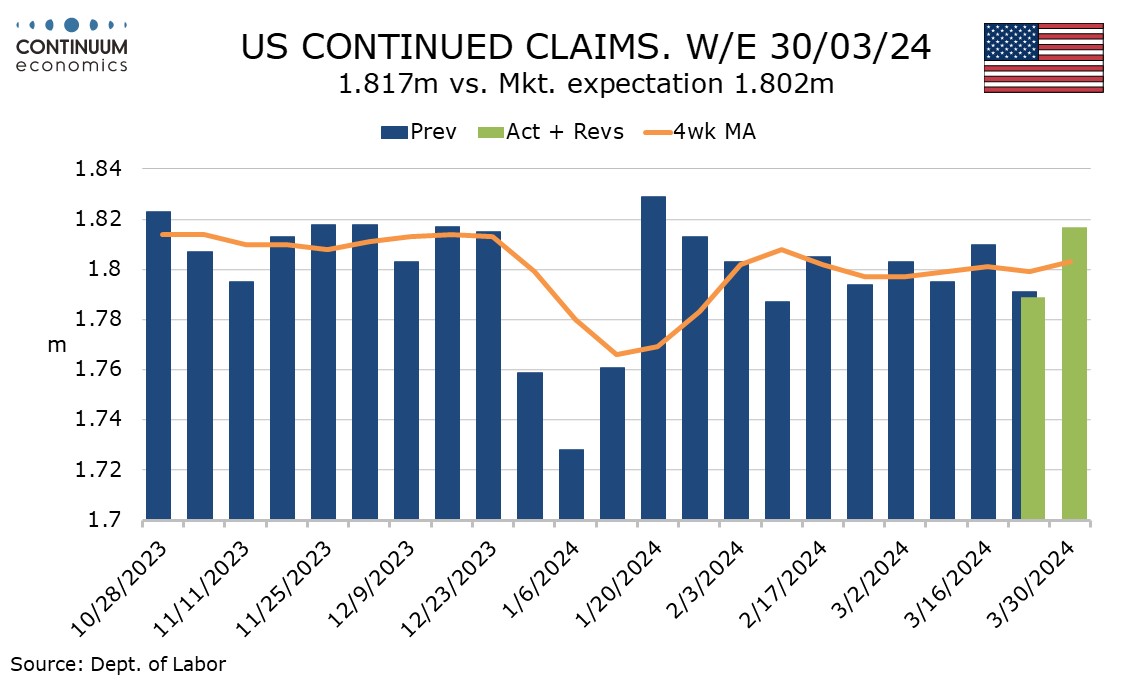

Initial claims have been very close to the latest outcome of 211k apart from last week’s bounce to 222k. Continued claims cover the week before initial claims and also showed a bounce in that week, by 28k to 1.817k. However this follows a 21k fall in the preceding week. Trend looks stable here too.