Preview: Due March 19 - Canada February CPI - Pause after a significant January slowing

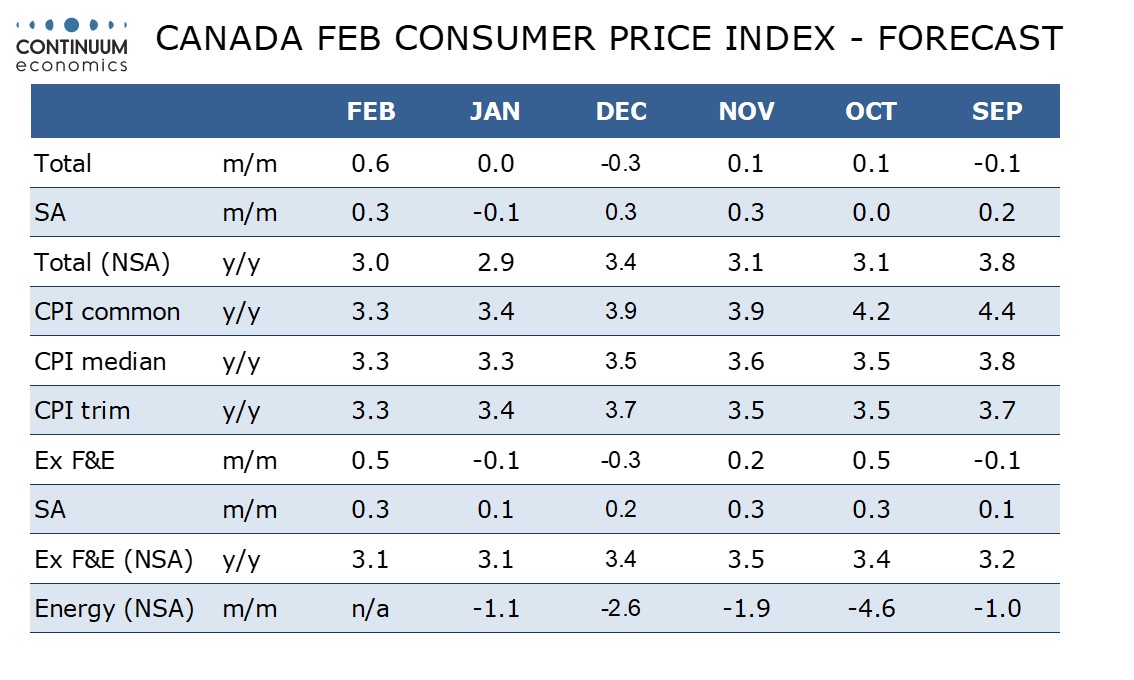

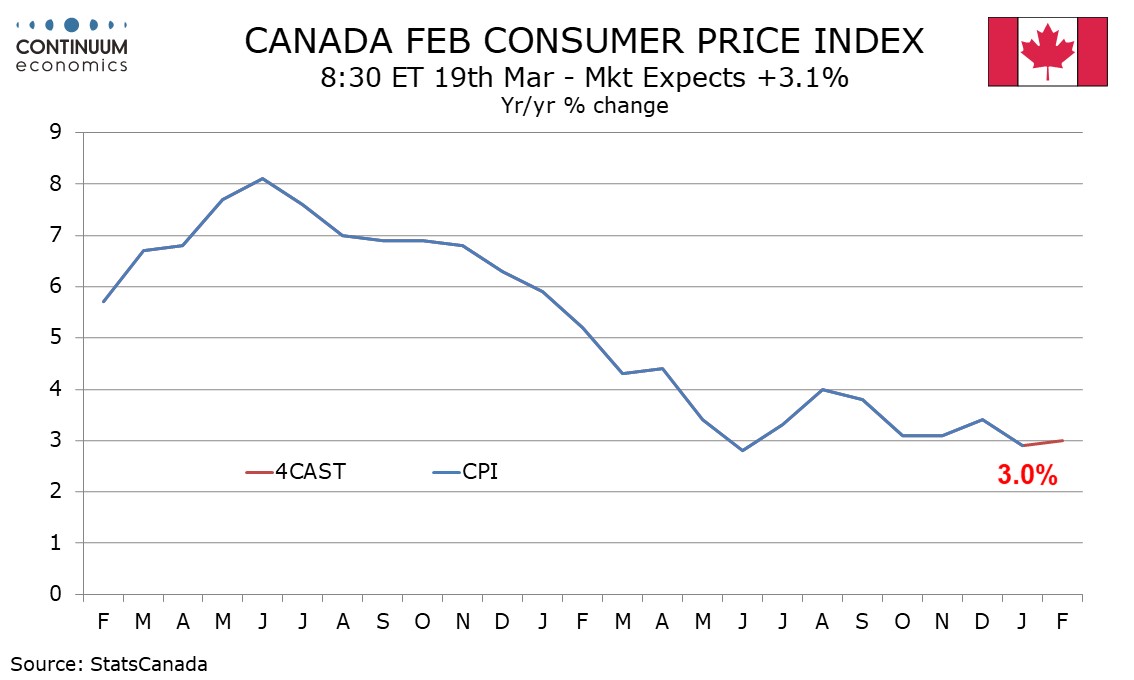

We expect February Canadian CPI to pause after seeing a significant dip in January, rising to 3.0% yr/yr from 2.9% in January, though still below December’s stronger 3.4%. We expect only marginal progress lower on the BoC’s core rates to follow more significant progress seen in January.

We expect the monthly data to show overall CPI up by 0.6% with a 0.5% increase ex food and energy, before seasonal adjustments, though much of the increase will be seasonal following recent seasonal weakness. We expect seasonally adjusted data to show 0.3% monthly increases in both series. The ex food and energy rate would be following a below trend 0.1% seasonally adjusted January rise. 2023 saw two seasonally adjusted 0.1% monthly increases ex food and energy, in June and September, both of which were followed by 0.3% increases.

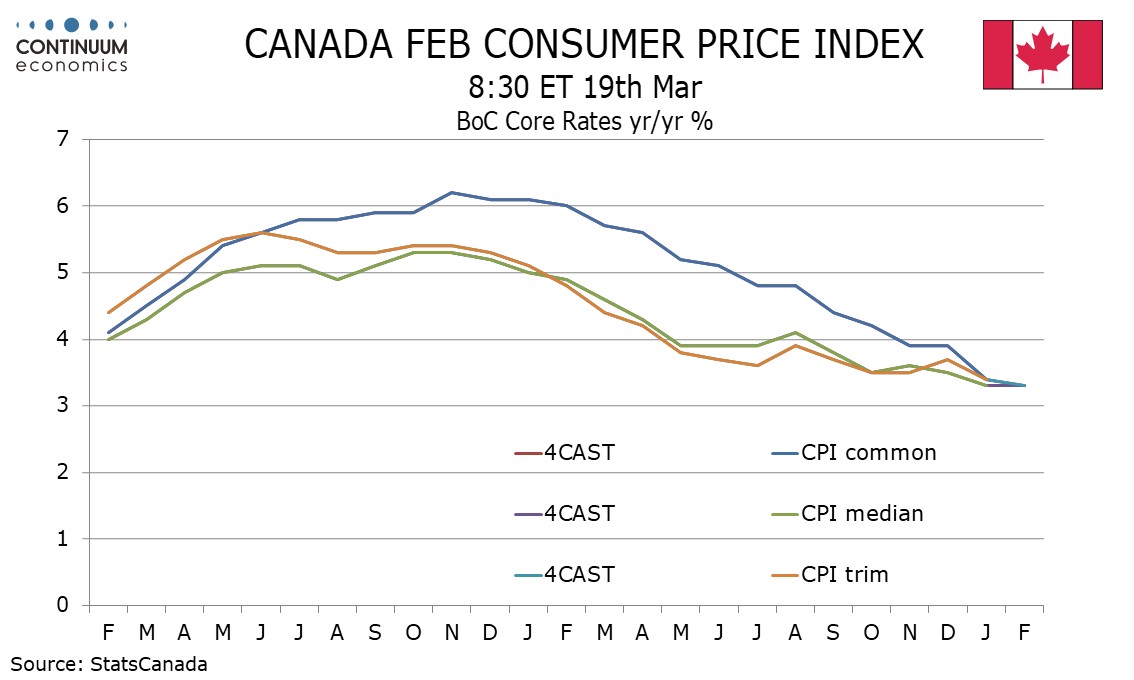

The ex food and energy rate is not one of the BoC’s core rates. For the core rates we see marginal declines in both CPI-common and CPI-trim to 3.3% yr/yr from 3.4%, but we expect CPI-median to remain at January’s 3.3% pace. The BoC’s core rates slowed significantly in January after disappointingly pausing on average in December.

January’s seasonally adjusted data showed sharp falls of 1.8% in clothing and footwear, 0.9% in health and personal care and 0.7% in recreation, which look unlikely to be repeated. Shelter, which has been stronger than most components, rose by 0.3%, below recent trend if still outperforming. If shelter avoids a February acceleration, that should be seen as an encouraging sign.