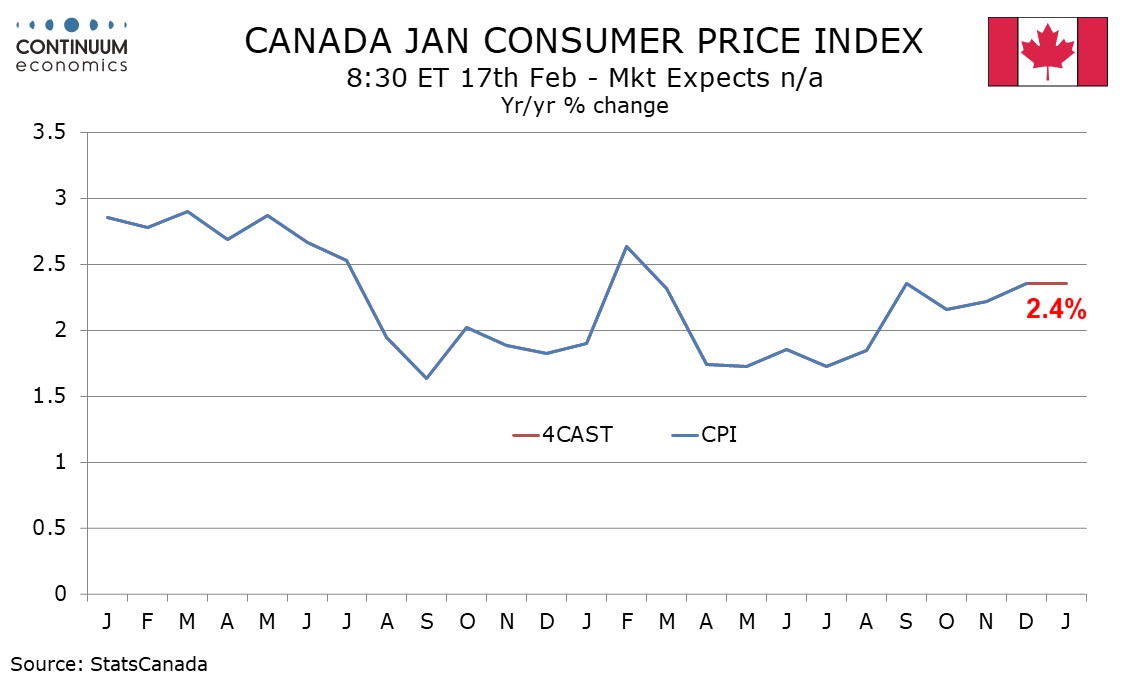

Preview: Due February 17 - Canada January CPI - Little change from December but some underlying slowing

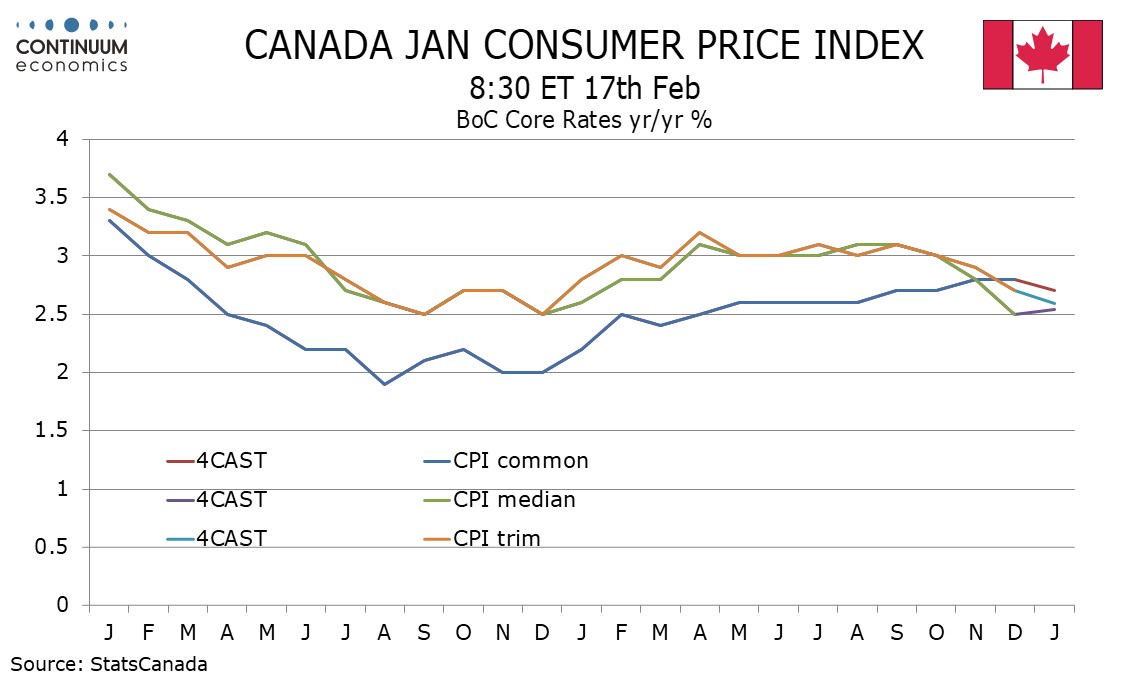

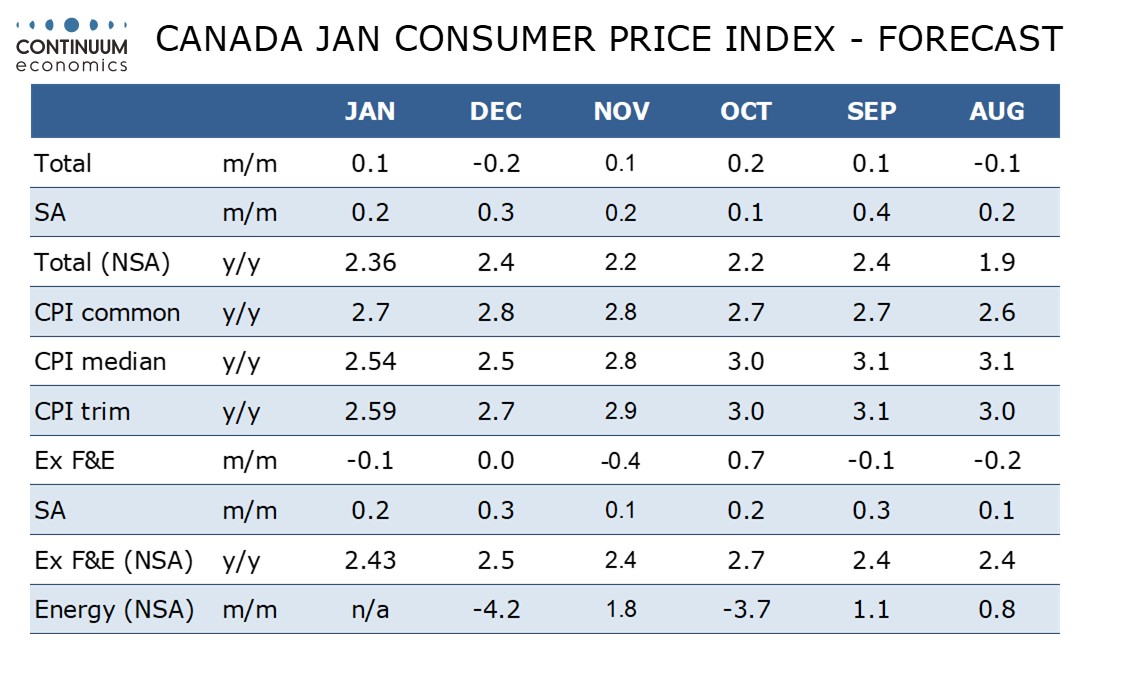

We expect January Canadian CPI to be unchanged at 2.4% yr/yr, with both December and January at 2.36% before rounding). We expect the Bank of Canada’s core rates to be on balance softer, with CPI-Trim and CPI-Common both slowing, but CPI-Median stabilizing after a sharper fall in December.

Yr/yr rates will see some upward pressure from a sales tax holiday which lasted from mid-December in 2024 through mid-February in 2025, meaning the maximum boost to the yr/yr rate will come in January. However, underlying prices were increasing at a faster rate in January 2025 than they are now, weighing against the boost to yr/yr growth coming from the tax shift.

On the month we expect CPI to rise by 0.2% both overall and ex food and energy seasonally adjusted, though unadjusted the ex food and energy rate is likely to show seasonal weakness with a 0.1% decline, partially offset by a seasonal increase in gasoline, seeing overall CPI up by 0.1% unadjusted. The seasonally adjusted ex food and energy pace will be following an above trend 0.3% rise in December that rebounded from a below trend 0.1% increase in November. December’s gain was inflated by a sharp rise in air fares which is unlikely to be repeated. On a yr/yr basis we see the ex food and energy rate at 2.4% (2.43% before rounding), down from 2.5% in December.

CPI ex food and energy is not one of the BoC’s three core rates. While these are less sensitive to tax changes, the monthly gains in December, particularly CPI-Median, were very soft, and we doubt they will be quite as soft in January. After falling to 2.5% in December from 2.8% in November we expect CPI-Median to remain at 2.5% in January (2.54% before rounding) though we see scope for slowing in the other two core rates, CPI-Common to 2.7% from 2.8% and CPI-Trim to 2.6% from 2.7%.