Published: 2025-03-18T16:08:20.000Z

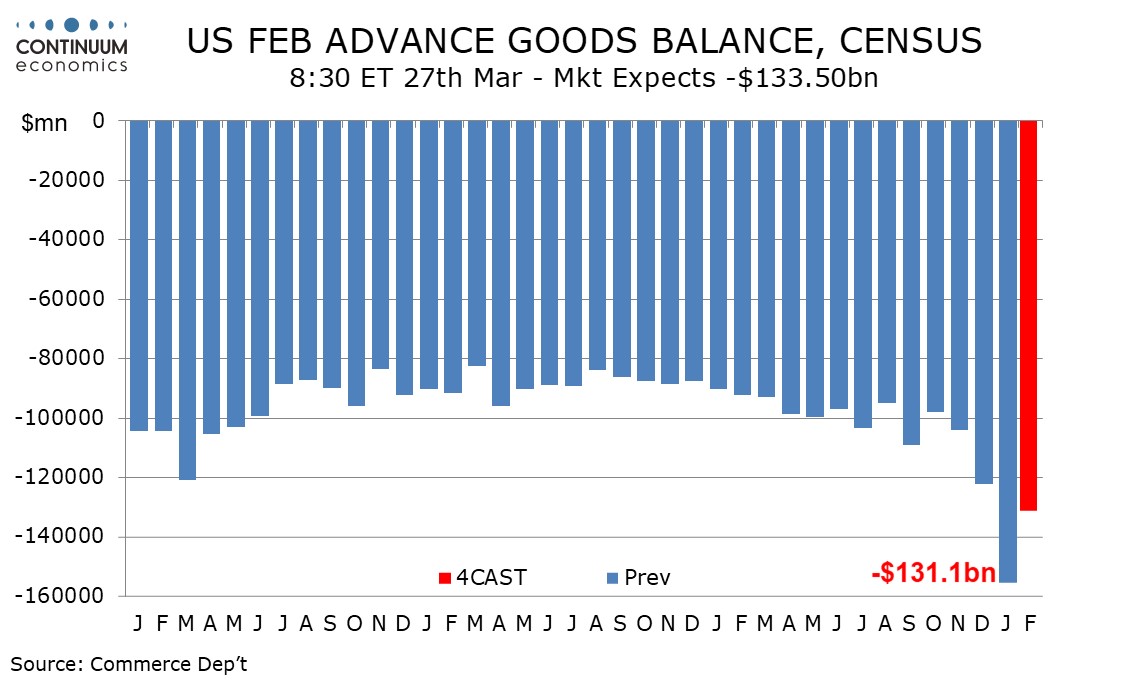

Preview: Due March 27 - U.S. February Advance Goods Trade Balance - Deficit to correct lower, but remain wide

4

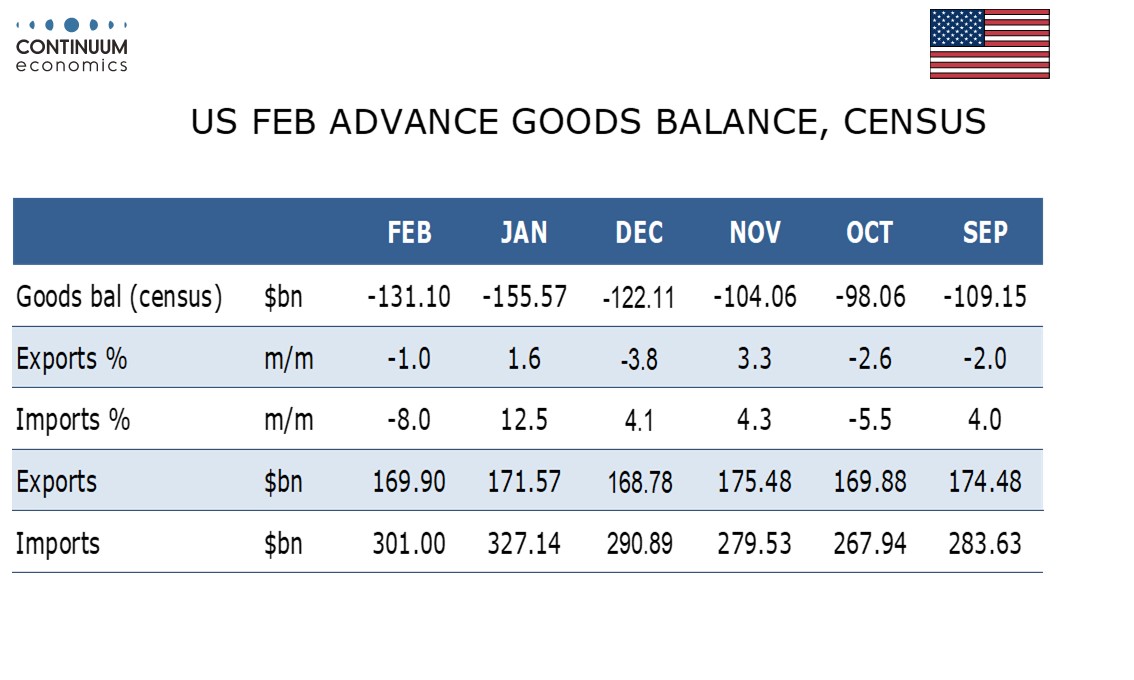

We expect a February advance goods deficit of $131.1bn, down from January’s dramatic import-led surge to $155.6bn, but still above December’s $122.1bn, which itself was a record high until January’s data was released.

We expect exports to fall by 1.0% after a 1.6% increase in January while imports fall by 8.0% after a surge of 12.5% in January. The focus is clearly on imports which surged in January in an attempt to beat threatened tariffs. February is likely to see a correction, particularly in fixed metal shapes which explained 57.5% of January’s rise, but with tariffs still threatened imports may remain above normal levels in February.

Released with the advance goods data will be advance February retail and wholesale inventories, which if strong could offset downside GDP implications coming from the trade data. January inventory data however provided only a limited offset, with wholesale inventories up by 0.8% but retail inventories unchanged.