U.S. September ADP Employment - Stronger increase consistent with lower initial claims

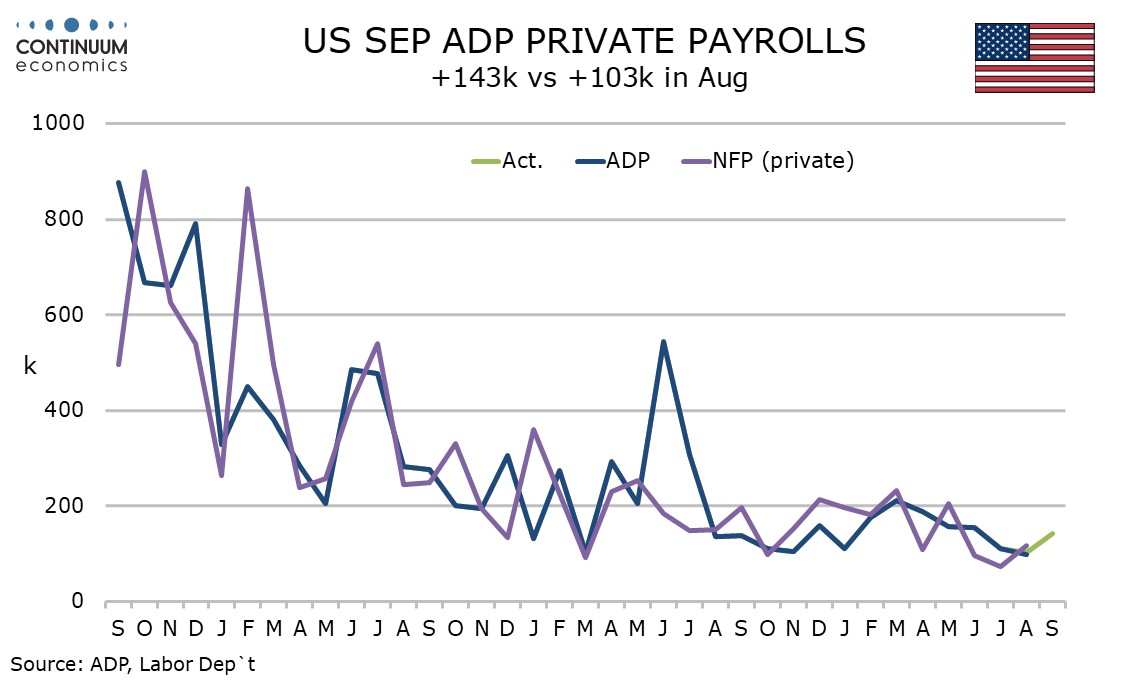

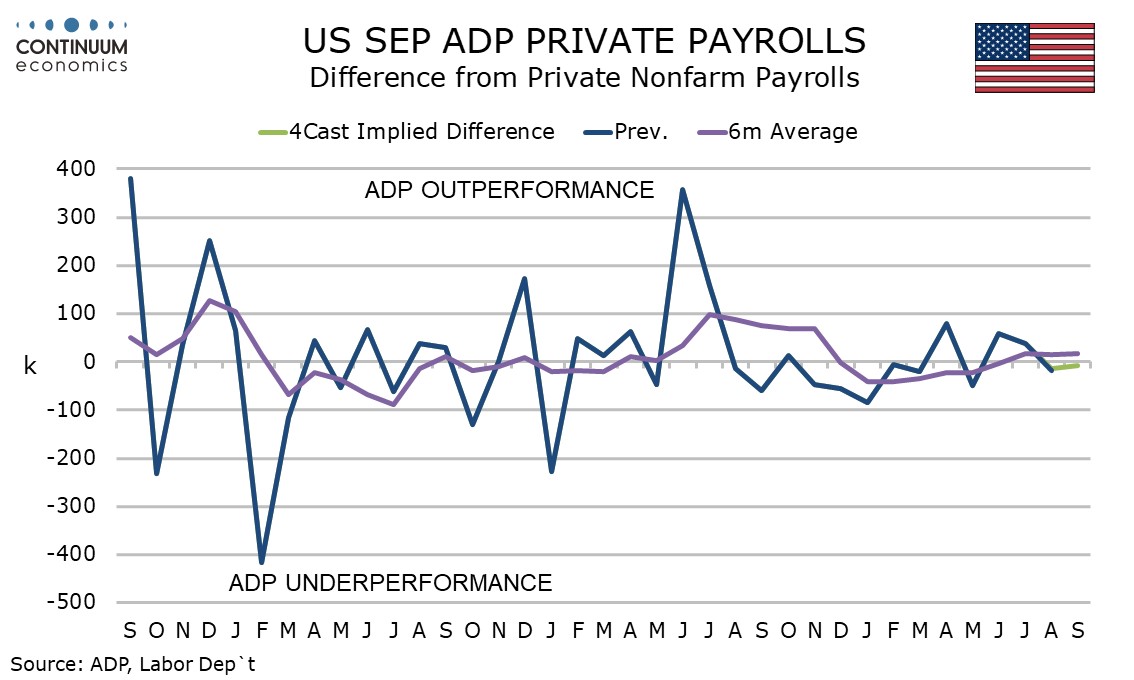

ADP’s September estimate for private sector employment growth of 143k is on the firm side of expectations and stronger than in July or August. This follows lower initial claims data in September. While ADP is far from a reliable guide to payrolls, we continue to expect a similar 150k rise in private sector non-farm payrolls, and a 180k increase in overall payrolls.

ADP detail shows goods up by 42k led by a 26k rise in construction with natural resources and mining up by 14k and manufacturing up by a marginal 2k, its first increase since April.

Services increased by 101k, with leisure and hospitality the strongest gainer at 34k, followed by education and health at 24k. The latter sector is trending stronger in non-farm payrolls than ADP data. Only information at -10k was negative.

Wage growth slowed marginally to 4.7% yr/yr from 4.8% for job stayers and more significantly to 6.6% from 7.3% for job changers, a sign that jobs are becoming less easy to find.

The latest data suggests quite a healthy labor market if September’s payroll is consistent with ADP data. However October may be weaker, if strikes at East Coast ports and Boeing persist into the survey week. Together the strikes could take close to 100k off the October payroll.