U.S. Initial Claims edging up from low levels, Productivity and Costs consistent with falling inflation

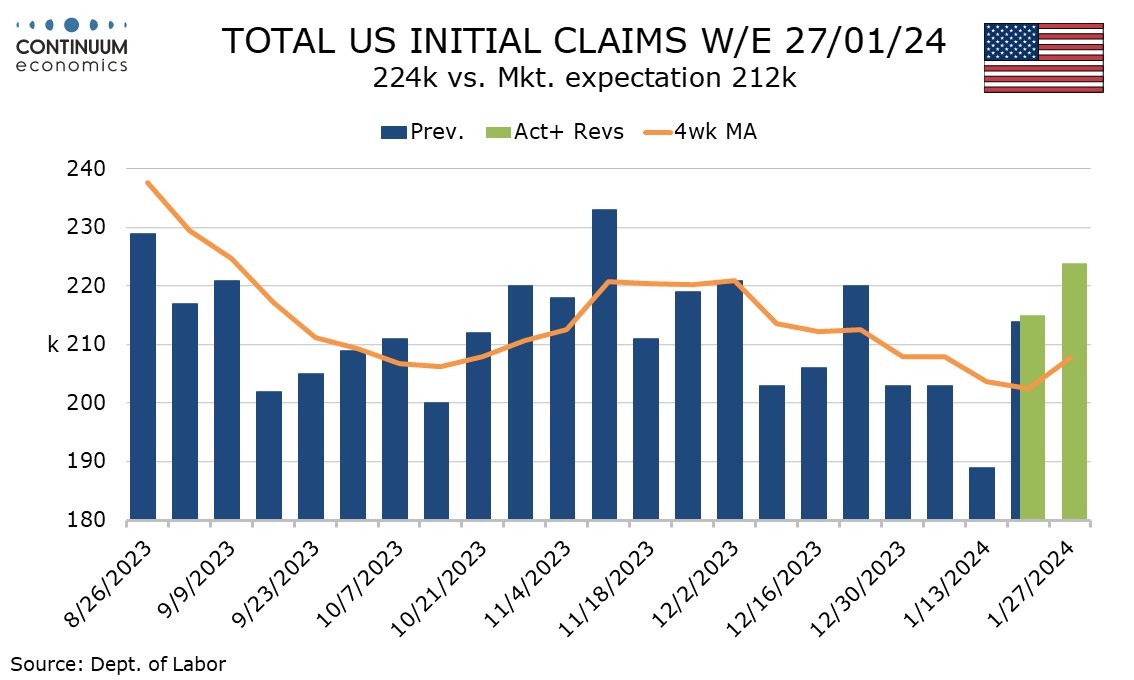

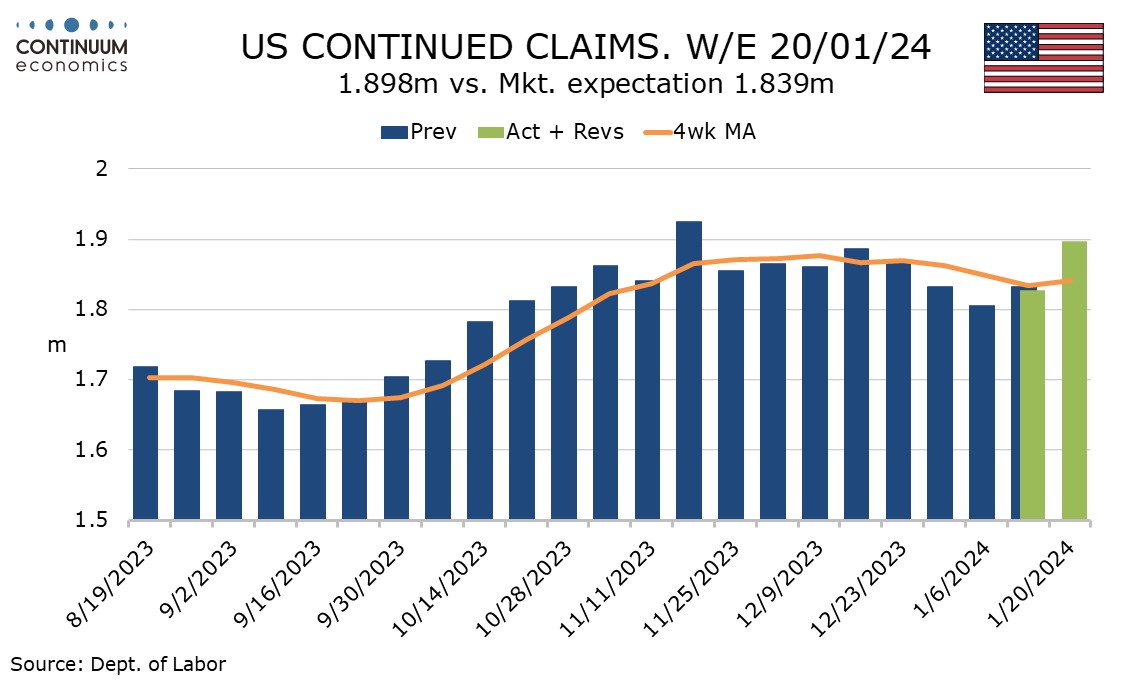

Initial claims at 224k from 215k are higher than expected and hint that a recent downturn in initial claims is finding a base. Continued claims are also higher than expected, up 70k to 1.898k. Both series are at their highest levels since November. Q4 productivity and costs data is consistent with easing inflationary pressure.

Last week’s initial claims number of 215k looked corrective from the exceptionally low 189k seen the week before, with that low coming in the survey week for January’s non-farm payroll. Today’s data saw the 4-week average pick up to 207.75k from a low of 202.5k. Initial claims still hint at a strong January payroll, but February may see some slowing.

Continued claims have now seen two straight gains after three straight declines, with the latest rise of 70k being the biggest since November. Continued claims cover the week before initial claims. Last week’s modest 22k rise in continued claims came in the payroll survey week.

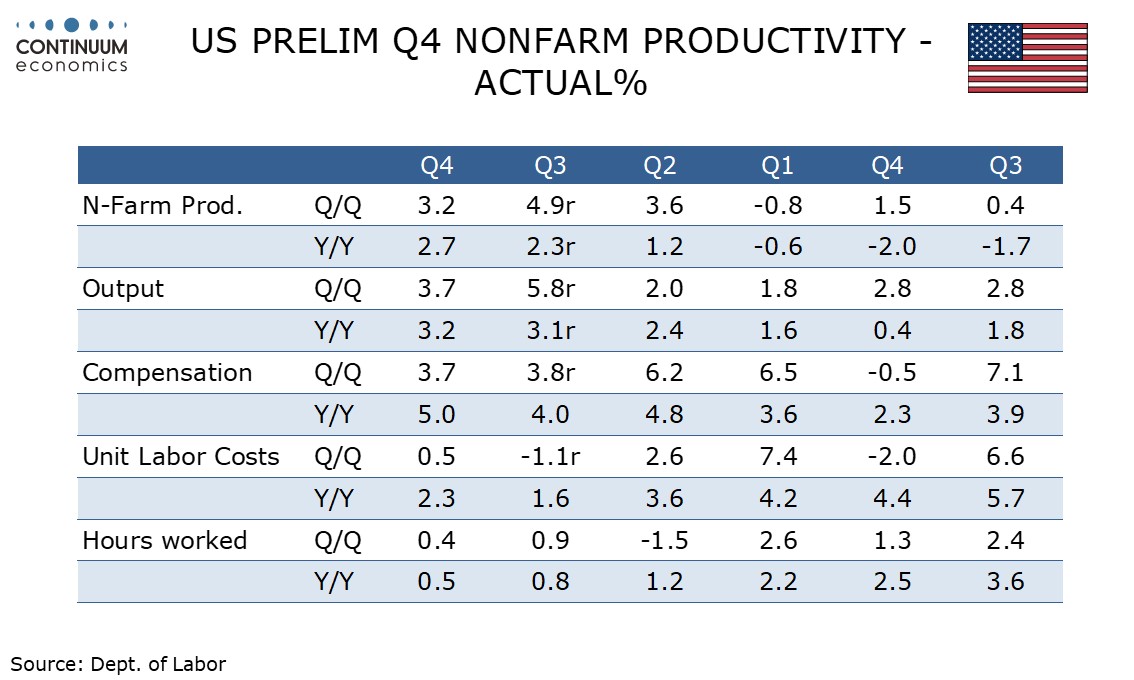

Q4 non-farm productivity saw a stronger than expected 3.2% annualized increase which helped restrain unit labor costs to a weaker than expected 0.5% increase. Productivity was supported by a 3.7% rise in business output as seen in the GDP data with hours worked rising by only 0.4%, less than Q4 non-farm payrolls had implied, explaining the upside productivity surprise.

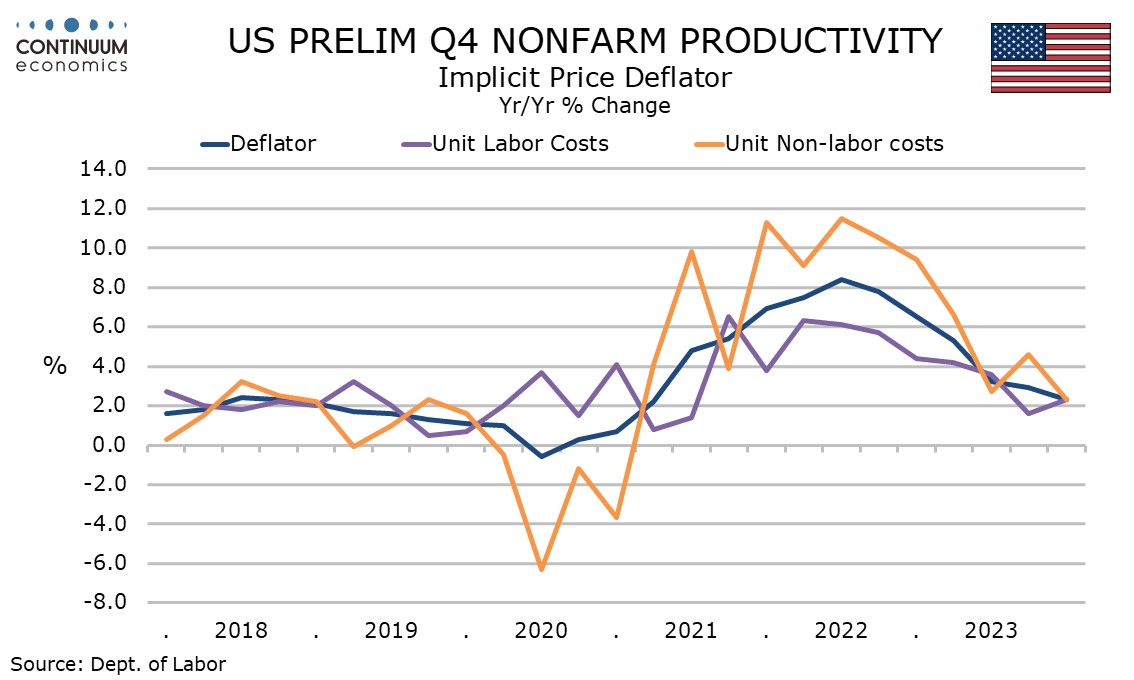

Non-farm compensation rose by a moderate 3.7% which with productivity not far behind led to the downside unit labor cost surprise. Unit non-labor costs rose by 1.3%, leaving the implicit deflator up by only 0.9%. The yr/yr deflator at 2.3% is down from 2.9% in Q3 and well below a Q2 2022 peak of 8.4%, consistent with underlying inflationary pressures falling back towards target.