Published: 2025-04-29T14:42:34.000Z

Preview: Due April 30 - U.S. April ADP Employment - Slightly slower than March, and probably April's payroll

1

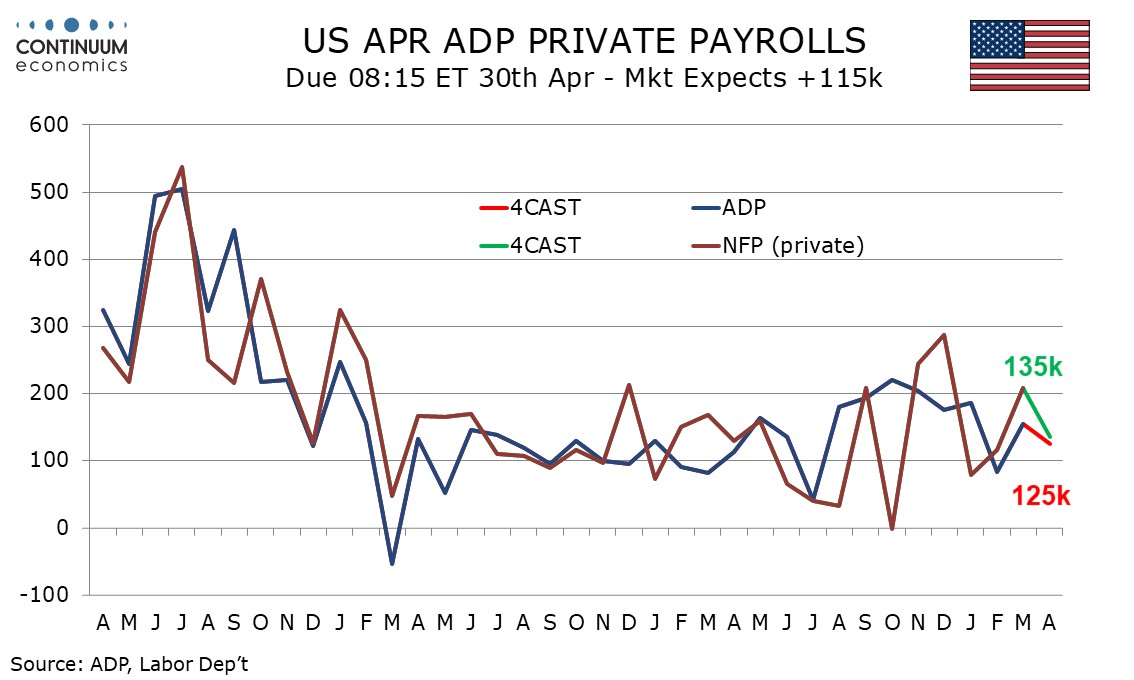

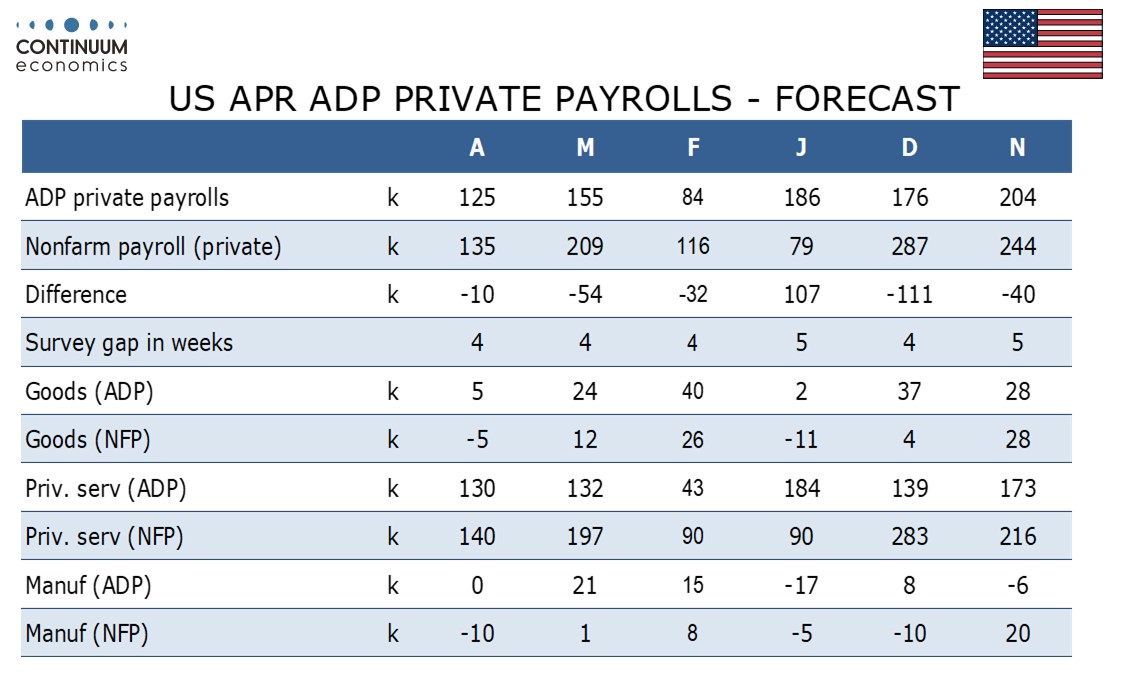

We expect a 125k increase in April’s ADP estimate for private sector employment growth. This would be slower than March’s 155k and slightly below the 135k increase we expect from April’s non-farm payroll. However there is little evidence yet of labor market weakness despite the elevated uncertainty.

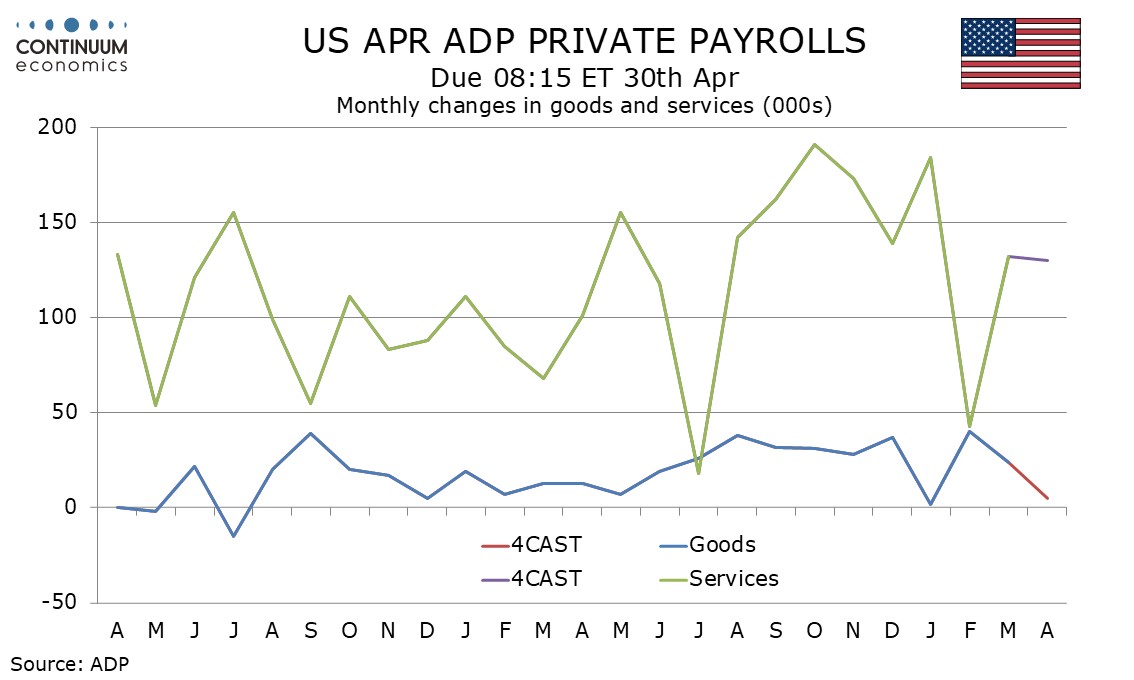

March’s ADP gain picked up from a weak 84k in February but trend appears to be starting to slow. ADP data has had a recent tendency to underperform the non-farm payroll, largely because health care, which has been leading recent non-farm payroll gains, has been less strong in the ADP data.

March’s ADP gain was inflated by gains of 57k in professional and business, 38k in financial and 21k in manufacturing, all of which look difficult to sustain. Slowings in these components may outweigh stronger data from retail, lifted by a late Easter, and health care.

There is little clear evidence of a weakening in the labor market with initial claims still low. The 135k rise we expect from the private sector non-farm payroll would match the Q1 average. We expect overall non-farm payrolls, including government, to rise by 145k.