Canada February Employment - Employment accelerates, wages ease, neither conclusive

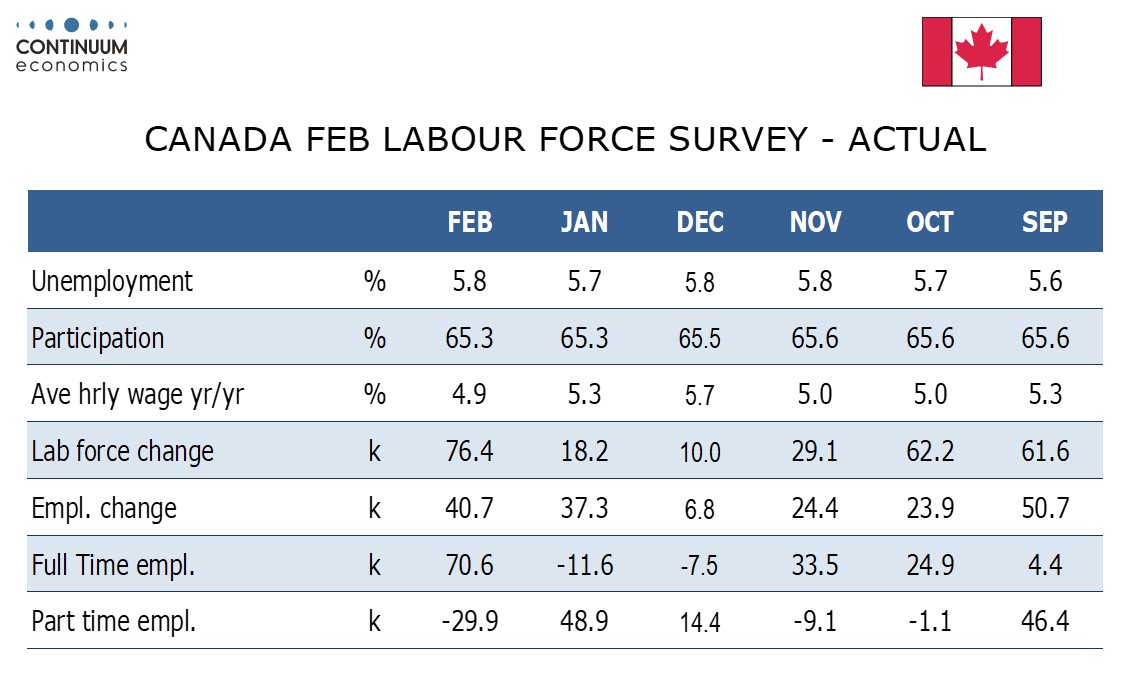

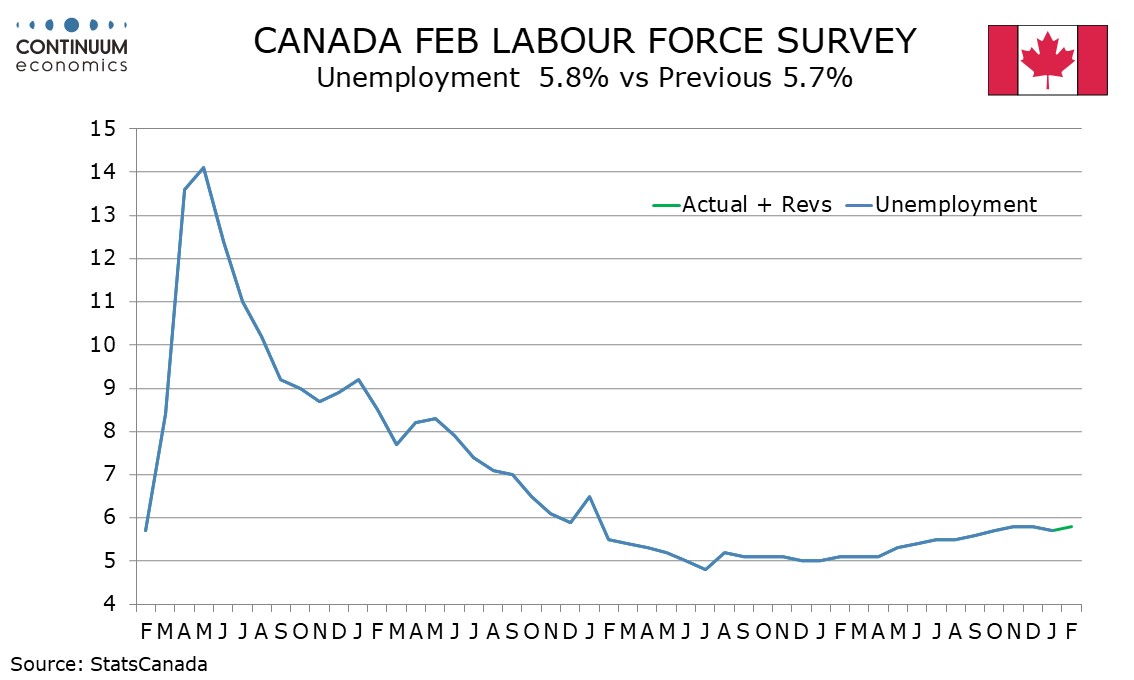

Canada has seen a stronger than expected 40.7k increase in February employment with details on balance but not wholly positive. Unemployment nudged up to 5.8% from 5.7% while wage data showed some slowing, if not yet fully convincing. As in the U.S., the case for easing in Canada is building but there is little pressing need to act.

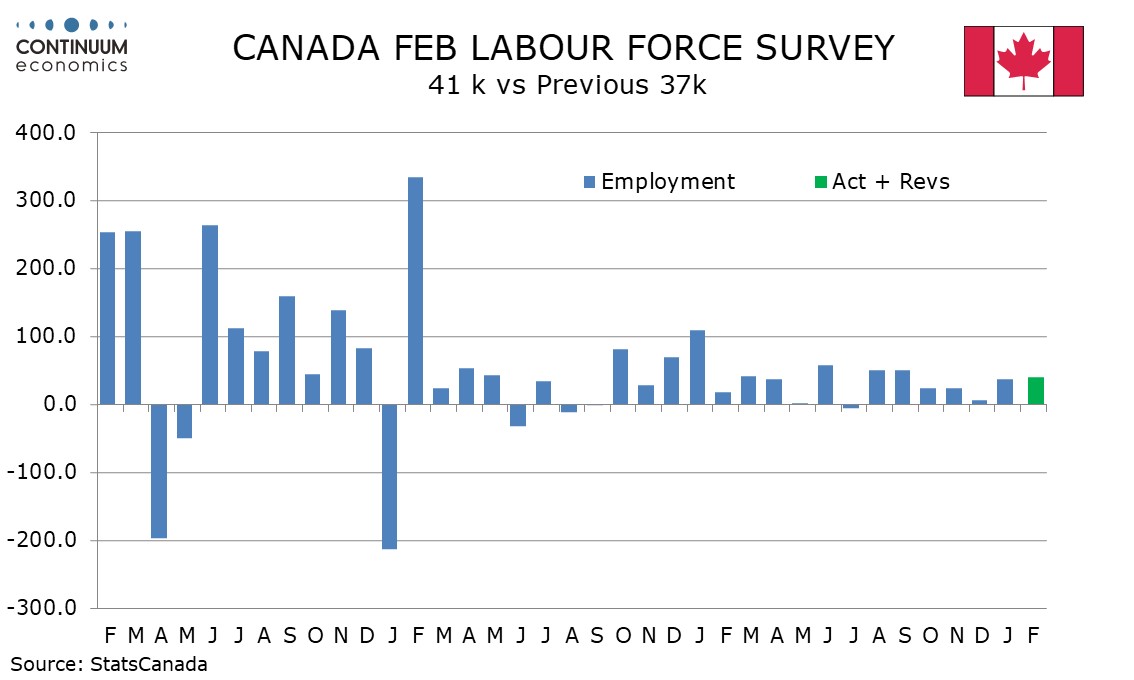

The employment gain follows a healthy January gain of 37.3k and trend is solid, and the February detail is more positive than January’s with full time employment rising by 70.6k after falling by 11.6k in January. Less positive in the detail is that most of the job growth (38.3k) came from self-employment with private sector employment down by 16.4k and public sector employment up by 18.8k. Private sector employment has risen by more than 10k only once in the last eight months.

Goods producing employment fell by 6.3k led by a 13.9k decline in manufacturing while service producing rose by 46.9 led by a 26.2k increase in accommodation and food services, which tends to be low paying work.

Yr/yr growth of 4.9% in hourly wages for permanent employees fell to 4.9% from 5.3%, a second straight fall but not much below the 5.0% seen in October and November. The BoC said this week that there was some sign of slowing in wage pressures. This data supports that view but is not conclusive.

Despite the healthy rise in employment unemployment rose to 5.8% from 5.7% on a strong 76.4k increase in the labor force, reversing a January decline. Unemployment trended higher through 2023 after starting the year at 5.0%. The rate may be stabilizing. If so GDP may be gaining a little momentum frim the below potential pace seen in 2023. Healthy employment growth hints at that but again signals are far from conclusive.