Published: 2024-08-15T15:27:36.000Z

Preview: Due August 16 - U.S. July Housing Starts and Permits - To slip back after multiples-led gains in June

1

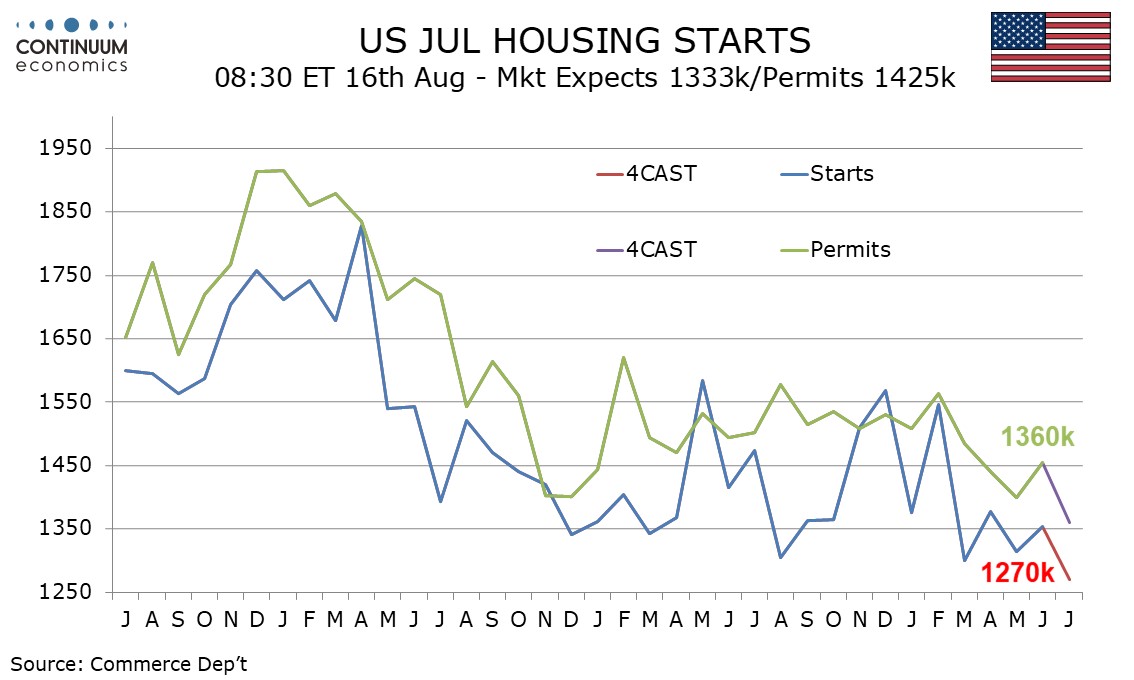

We expect July housing starts to fall by 6.1% to 1270k after a 3.0% increase in June, while permits fall by 6.5% to 1360k after a 3.9% increase in June. June’s gains came fully in the volatile multiples sector.

Home sales have been moving lower in Q2 and this is weighing on the underling housing trends illustrated in single starts and permits. We expect single starts to fall by 2.0% after a 2.2% June decline for a fifth straight fall and single permits to fall by 2.0% after a 1.8% June decline for a sixth straight fall.

In June the volatile multiples sector saw starts up by 19.6% and permits up by 16.3%. We expect July declines of 16.9% and 14.6%, which would put both series marginally below May’s levels.

Non-farm payrolls showed resilience in construction employment but slippage in the construction workweek after a rise in June. Hurricane Beryl is a downside risk in the South but we expect starts to see their biggest declines in the Northeast and Midwest, after strong gains in June.