Preview: Due January 19 - Canada December CPI - Slower even with upward tax distortion

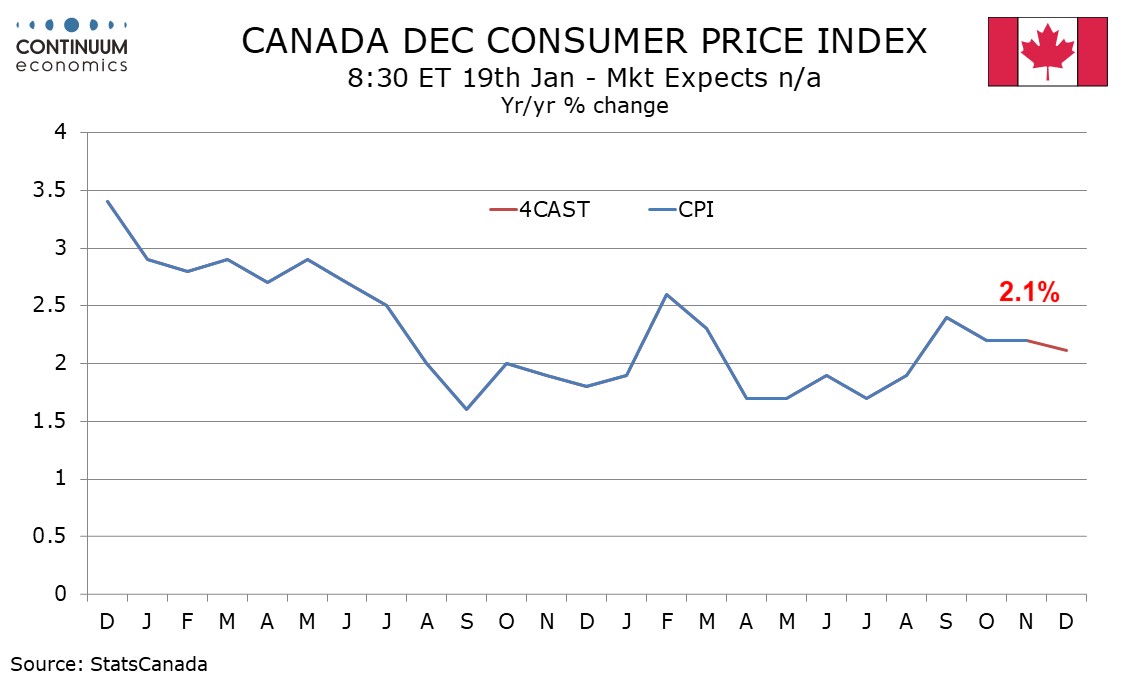

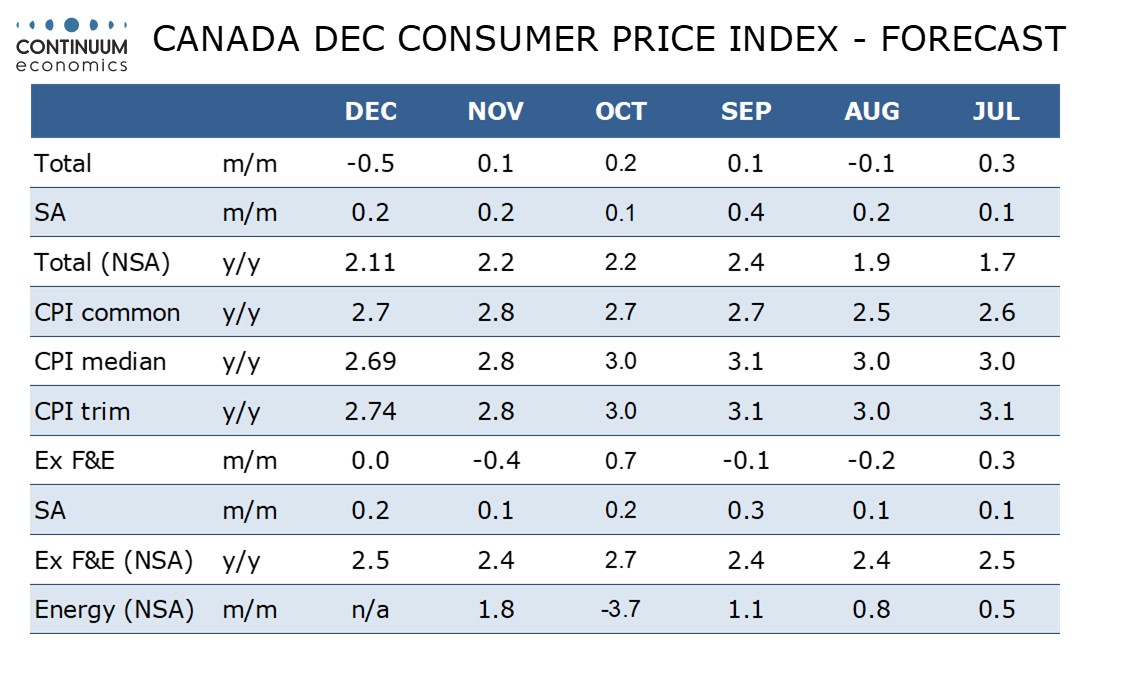

We expect December’s Canadian CPI to slip to 2.1% yr/yr (2.11% before rounding) from 2.2% in both October and November, with each of the three Bank of Canada core rates slipping to 2.7% from 2.8%, leaving the average core rate at its slowest pace since March.

On the month we expect CPI to rise by 0.2% both overall and ex food and energy seasonally adjusted, with the ex food and energy rate slightly stronger than November’s 0.1%. Shelter is likely to be a little stronger than November’s 0.1%, which corrected an above trend 0.6% rise in October. Data before seasonal adjustment is likely to show seasonal weakness, particularly in gasoline, leaving a 0.5% decline on the month overall with the ex food and energy rate unchanged.

Yr/yr data will be somewhat inflated by a sales tax holiday that ran from mid-December in 2024 through mid-February in 2025, and the Bank of Canada has warned this could see inflation pick up. However stronger taxes relative to a year ago need to be balanced by a weaker underlying picture and we expect a marginal slowing on the yr/yr pace to 2.1% after two months at 2.2%, though ex food and energy we expect a yr/yr gain of 2.5%, marginally up from 2.4% in November.

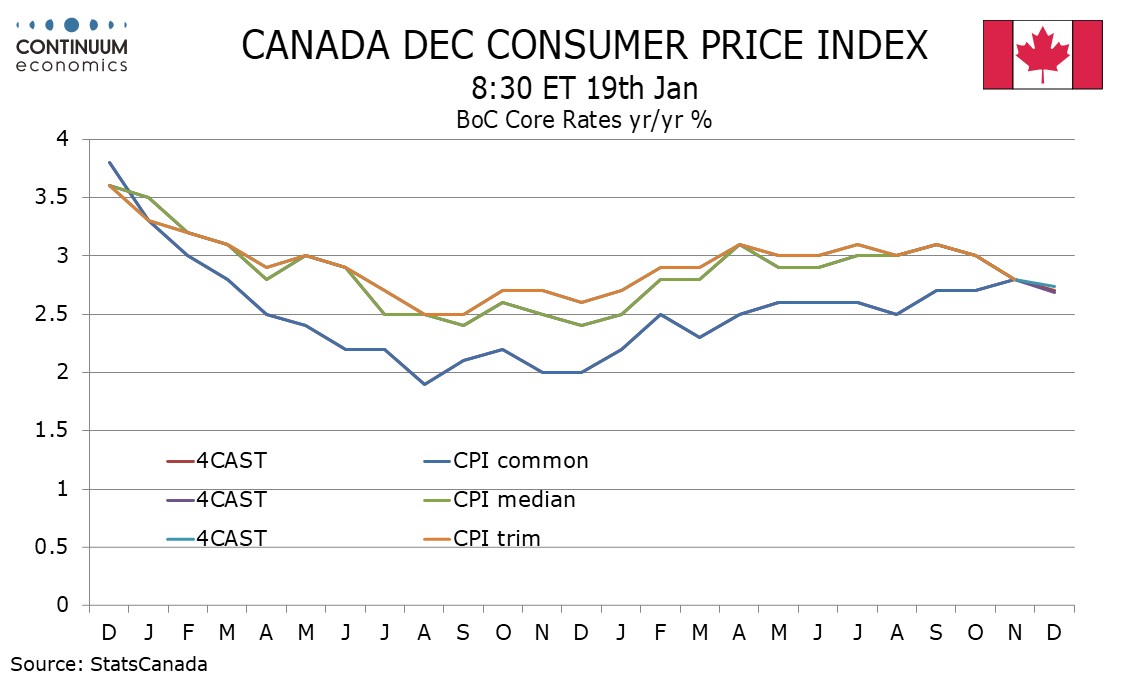

The ex food and energy rate is not one of the BoC’s three core rates and these are likely to be less influenced by tax changes, allowing the slowing underlying pace to be reflected. We expect yr/yr rates of 2.7% from all three, CPI-Common, CPI-Median and CPI-Trim, down from 2.8% in November. Before rounding CPI-Median, at 2.69% from 2.78%, is likely to be a little softer than CPI-Trim, which we expect to slow to 2.74% from 2.84%.