AUD, JPY flows: AUD softer after RBA, JPY stays firm

Dovish RBA cut weakens AUD but support holds. JPY advances as US yields drop

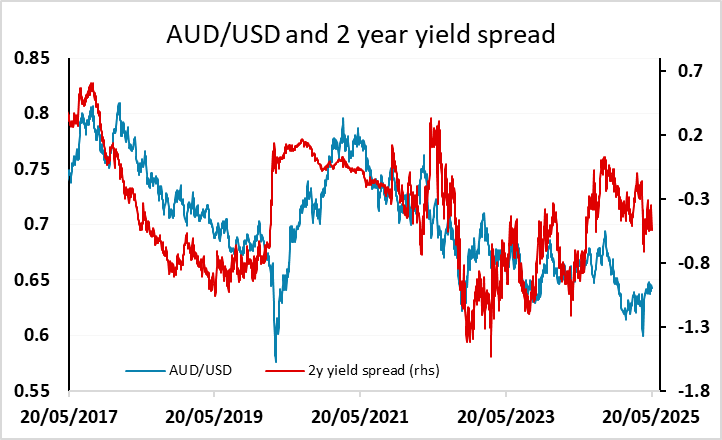

AUD fell back overnight after what was seen as a dovish rate cut from the RBA. They cut 25bps as expected, but admitted a 50bp cut was discussed, though not seen as a serious proposition, and the market has moved from projecting a further 50bps of easing this year to a further 65bps. The AUD fell back around 0.5% after the announcement, but hasn’t really threatened the key support area around 0.6400. The AUD already has substantial support from yield spreads, having underperformed the usual correlation over the last year, so should still hold the support area near 0.6400 as long as general risk sentiment holds up.

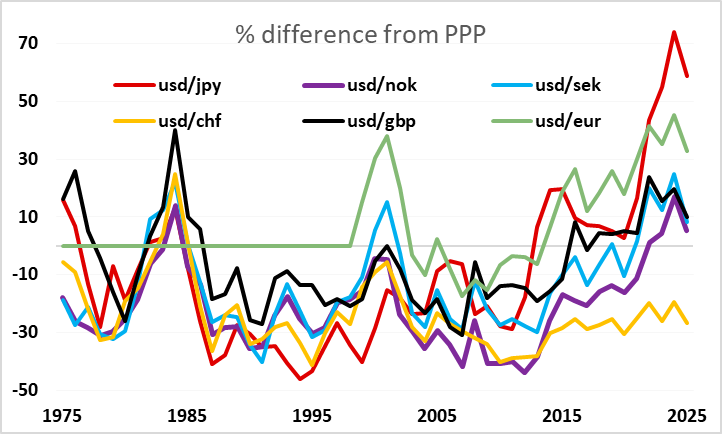

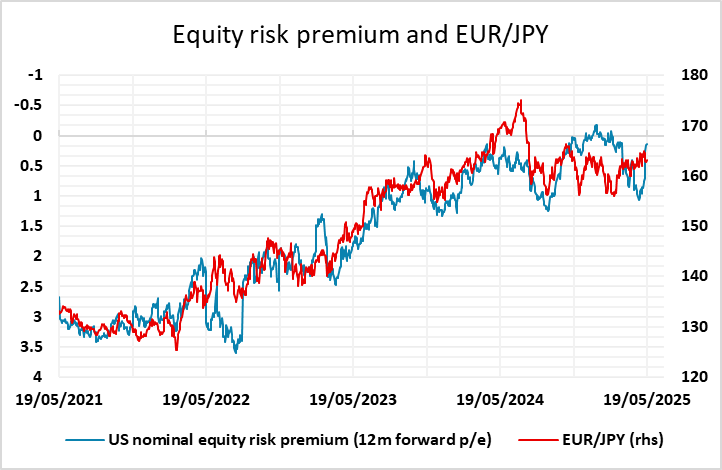

Other than Canadian CPI there isn’t a lot else on the calendar today. Overnight it was noticeable that the rise in US yields seen after the Moody’s downgrade was essentially erased by the end of the US session, and the USD also recovered some ground against the EUR through US trading, but has continued to weaken against the JPY through both the US and Asian session. JPY cross gains have likely been helped by the decline in US yields, which imply a rise in the equity risk premium, but a more significant rise in risk premia is still likely to be required to push the JPY back to levels more consistent with long term fundamentals.