This week's five highlights

Trump Tariffs Bad for The U.S. Worse For Canada

U.S. February Non-Farm Payrolls to be Stronger than January, but slower than November and December

ECB Disinflation Still On Track But Policy now ‘Work in Progress’

Only Moderate Fiscal Stimulus for China

Germany Attempts to Unlock Debt Brake

When Trump announced 25% tariffs on Canada and Mexico in February, we put up a piece outlining the likely economic consequences, which became dated by the end of the day as Mexico and Canada won a one month delay in return for some concessions at the border. We are now recycling that story, with some edits. A Trump climbdown looks less likely this time, though he remains as unpredictable as ever. Canada and Mexico face recessions and the US looks likely to see growth significantly reduced with some acceleration in inflation, making it difficult for the Fed to provide significant support to a slowing economy. For the Bank of Canada however, downside economic risks look set to outweigh upward risks to inflation.

In the United States, the most obvious impact of the tariffs will be higher prices. Full pass through would lift inflation by over 1% but Canadian and Mexican attempts to remain competitive are likely to provide some restraint. What pass through there is will be felt quickly, delivering some strong U.S. monthly inflation data starting in March. This will reduce real disposable income and weigh on consumer spending, and also reduce potential for Fed easing. Recessions in two large neighbors will reduce demand for US exports even without what appears to be a strong desire on the part of Canadian consumers to boycott US-made goods. Still, Canadian retaliation at this point is quite modest and carefully targeted, and even with an escalation scheduled in one month will impact barely a quarter of US exports to Canada.

In our December outlook we expected US GDP to rise by 2.5% in 2025 with each quarter above 2.0%. While it is still too early to say how long the tariffs will persist, GDP growth close to 1.0% would be likely if they do through the year. We expected core PCE prices to rise by 2.4% in 2025. Should the tariffs persist, 3.0% may be a conservative estimate. Tariffs on the EU, which look likely in April, could lift the inflation outlook still further. With China also facing tariffs, a majority of US imports will be impacted.

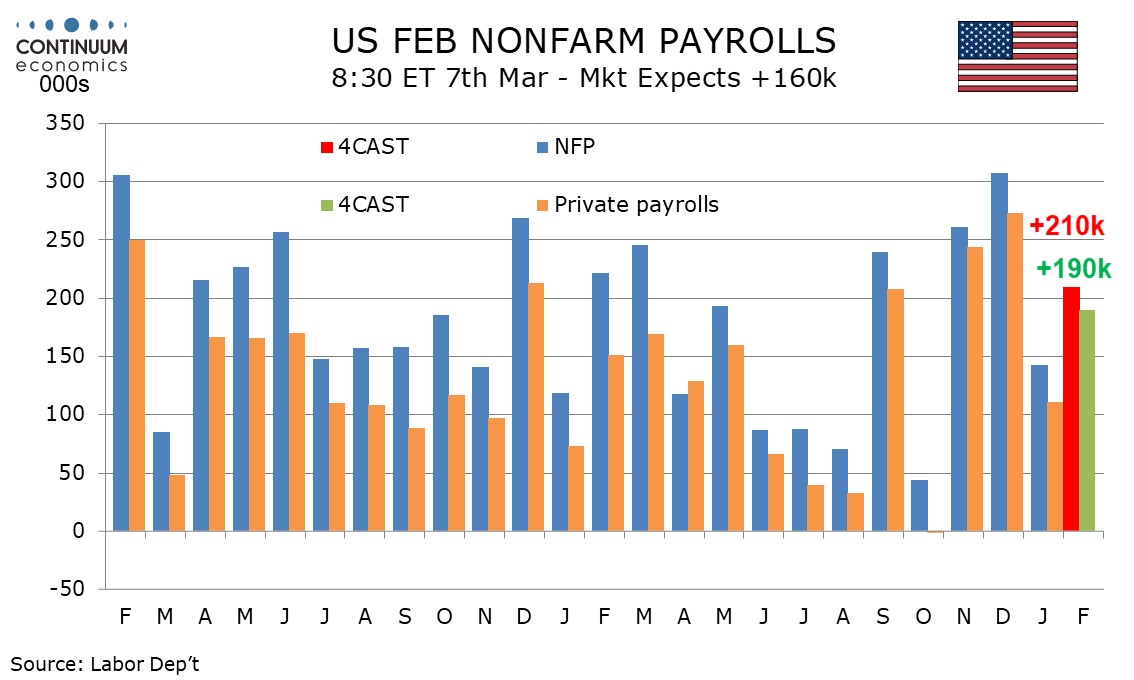

We expect a 210k increase in February’s non-farm payroll, with 190k in the private sector, slightly stronger than in January but slower than in November and December. We expect unemployment to remain at 4.0% and a 0.3% rise in average hourly earnings, following an above trend 0.5% in January. January’s gain of 143k was probably restrained by bad weather, though gains of 307k in December and 261k in November were inflated by a rebound from October’s weak 44k, which was hit by two hurricanes and a strike at Boeing.

Our forecasts for February are slightly slower than January’s 3-month averages of 237k overall and 209k in the private sector, but stronger than the respective 6-month averages of 178k and 145k. This would be consistent with a recent acceleration in labor market momentum peaking, but no significant weakness yet emerging. Initial claims are still low, suggesting underlying labor market strength. Weather in February is likely to be less of a negative than in January, though unusually cold weather persisted. A 20k rise in government payrolls would be on the low side of recent trend as Federal layoffs start to rise, but State and Local government hiring is likely to remain firm. We expect an unchanged unemployment rate of 4.0% with employment growth likely to modestly exceed that of the labor force, but not by enough to reduce the rate before rounding. Lower rates of immigration are likely to restrain labor force growth in the coming months, keeping the unemployment rate low.

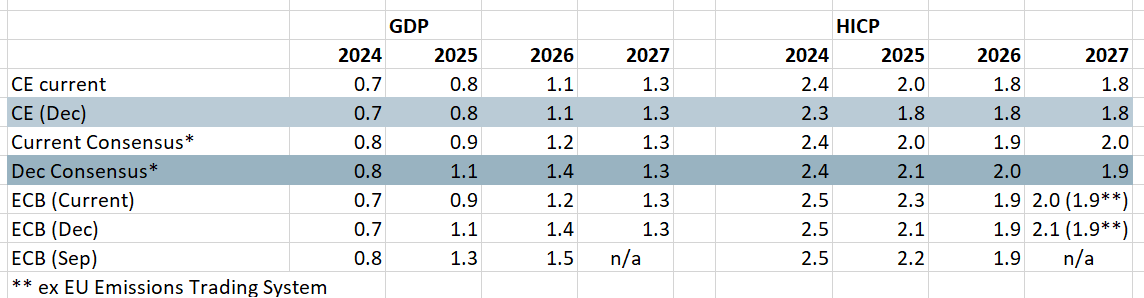

Figure: ECB Shifts Down to Consensus on Growth?

Source: ECB, Bloomberg, CE

Unsurprisingly, the ECB verdict was less important that the rhetoric. A sixth 25 bp discount rate was widely expected – and delivered - to 2.5%, but how wide the door is left open for further cuts may be more opaque. This both reflects gauging the extent of any lingering degree of policy restriction and by the likelihood that even with the updated ECB forecasts with inflation under target from 2026 onwards thereby consistent with policy rates falling to around 2%, those projections now look out of date. The possible fiscal and defence initiatives now emerging for the EZ have to be counterbalanced by opposing and downside risks from US imposed tariffs. Hence why amid what was termed phenomenal uncertainty, ECB policy guidance was far from resounding this time around. Some added clarity should be available by the next (Apr 17) Council meeting but we are less confident that another 25 bp may arrive at that juncture. Given what may be offsetting emerging upside and downside risks but where our perceived result of what being data dependent will bring about, we adhere to the discount rate falling to 2% but it may be later than the mid-year estimate we previously envisaged.

Last time around, the ECB stressed monetary policy remained restrictive albeit with differences on the degree and the likely the debate on this issue may have been more intense this time around. Indeed, while amending the analysis to suggesting ‘monetary policy is becoming meaningfully less restrictive’ is justified, the change in tense by noting becoming rather than remains, probably reflects ECB thinking that policy restriction is better based on an array of factors not one particular policy rate as it reflects just how the transmission mechanism is actually faring. It may also reflect a growing acceptance that even policy rate reductions are taking time to filter through into the rates at which borrowing actually occurs. The transmission mechanism, after all, determines not just the cost of borrowing but bank’s willingness and ability to supply credit. In this regard, perhaps a key factor is the margin that banks lend relative to any policy rate. This margin has narrowed markedly of late (Figure 2), the question being whether banks will seek to rebuild lending margins back to those seen prior to the pandemic, thereby actually acting not only to slow the impact of policy easing but even to offset it.

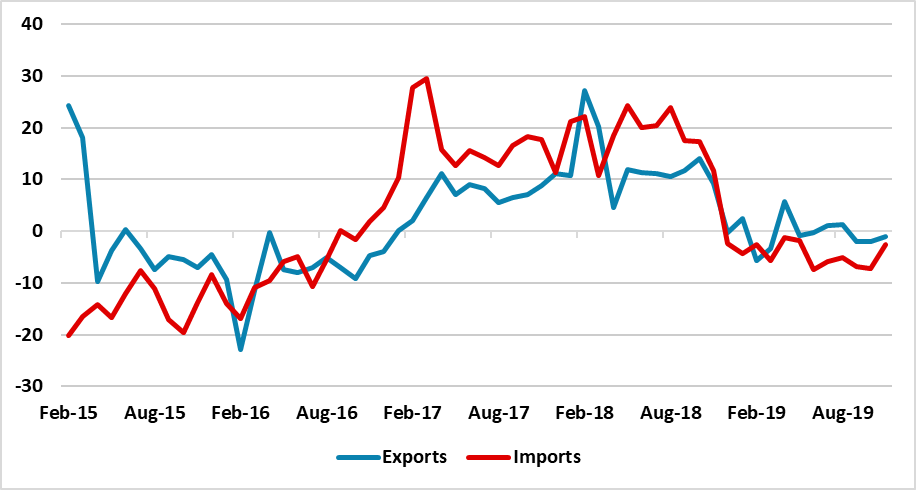

Figure: Export and Imports Values USD (12mth % Change 2MMA)

China announced some fiscal stimulus to help meet the expected 5% GDP target for 2025. Overall, we have not been surprised by the fiscal stimulus measures announced so far from the March NPC, that have been towards the lower end of expectations. However, officials on Thursday have hinted that more could come and we feel that the authorities will likely deliver some more fiscal easing once they have assessed the impact of U.S. tariffs. With the Trump administration having now added 20% to China exports to the U.S., the prospect is that net exports will likely subtract from GDP growth in 2025 – they were hit in 2018 (Figure 1). We maintain the view of 4.5% GDP for 2025.

The fiscal stimulus announced so far is broadly in line with expectations. Key points to note

· Bigger stimulus than 2024. An extra 1.4% of GDP in the budget (around Yuan2trn) is focused on demand stimulus up from 6.6% of GDP in 2024. This will likely include central government infrastructure spending and is the main part of the fiscal stimulus to reach the 2025 goal of 5% real GDP. The authorities also announced a target of 2% for inflation, rather than the previous 3% upper ceiling – given long-term fears over high inflation. Though this could be viewed as a more symmetric target, it is unlikely to be followed by monetary of fiscal policy that seeks to achieve 2% inflation. The inflation target will likely be more a reference and the key target will remain real GDP.

· Yuan500bln for bank recapitalisation. This is destined to boost equity capital/lending in the largest banks still further and make up for restrained credit supply from small and medium-sized banks. This is a positive development, given that M2 is a mere 7% (terrible by China standards). Some boost to lending is likely, but private household and business credit demand also needs to be boosted and less tangible measures are evident. The Yuan500bln is also smaller than the Yuan1trn suggested in the autumn.

· Domestic demand and consumer a focus, but. Emphasis in the statements on domestic demand and consumption to be boosted by income shows that the authorities understand the problems outside the residential property sector. However, the only tangible measure so far is a further Yuan300bln of cash for trade in, with no large-scale cash handouts to households or radical reform of structural safety nets for pensions, unemployment or health. Additionally, the government has so far not added extra fiscal funds to the purchase of complete and uncomplete housing, but last year’s measures are still feeding through to reduce the scale of the negative hit to GDP. Though Thursday press conference talked about a special campaign for consumption, we suspect that any extra measures will be incremental and insufficent. However, housing construction and wealth have not bottomed and this is a headwind for investment and consumption respectively. PBOC Pan on Thursday hinted at more rate cuts, but we feel that this will be modest at 10bps per quarter.

Germany’s likely new Chancellor Friedrich Merz has (and as has been flagged since his election win last week) announced plans to amend the country’s constitutional fiscal restraints, the so-called debt brake and within the confines of the current parliament. Merz said Tuesday evening the motto “whatever it takes” must now apply to the country’s defence which may be separated from the debt brake and reflects Europe’s increasingly alarm by the seeming shifts of the Trump administration in the U.S. toward NATO and Ukraine and with the announcement from Merz to radically increase German defence spending coming in in advance of a summit of the EU’s 27 national leaders in Brussels on Thursday.

The plan is a marked shift in Germany’s traditionally conservative fiscal stance and where the debt brake has been enforced in its constitution in 2009, which limits government borrowing and keeps the structural deficit at 0.35% of GDP.

In detail, the proposal is that defence spending above 1% of GDP be exempted from the restrictions of Germany’s constitutional debt brake. Given that Merz announced the plan on spending alongside the leaders of the Social Democratic Party (SPD), with whom his conservatives are currently in talks to form a governing coalition clearly suggests their cooperation and where the latter suggested a more fundamental reform of the debt brake by year's end to allow for additional spending on infrastructure initiatives. In fact, the aspiration is that the future coalition will introduce another constitutional amendment to set up a EUR 500 bln fund for infrastructure, which would run over 10 years. They are also planning to loosen debt rules for states.

But there are risks not least the likely need to get the Greens to approve the plan before the current parliament stands down and then to get approvals from the new parliament which may be more difficult given that the far right (AfD) and Left (Der Linker) would block a 2/3 majority. NB: The current parliament can be convened until it ends on March 25. Given the plans explicitly implies a boost to the economy as well, it is unclear what will be considered to be defence spending. There is also the question as how the ECB may react, with the lack of details at this juncture meaning that the Council decision tomorrow unlikely to encompass the German initiative, especially in terms of updated forecast. But the possibility is there that the ECB could react to what may be an EU initiative of the boosting defence spending from the current circa-2% of GDP to 3.5% (ie EUR 250 bln per year) by amending its QT plans – although any decision on these issues may be too early at this juncture.