Preview: Due March 3 - U.S. February ISM Manufacturing - Staying positive

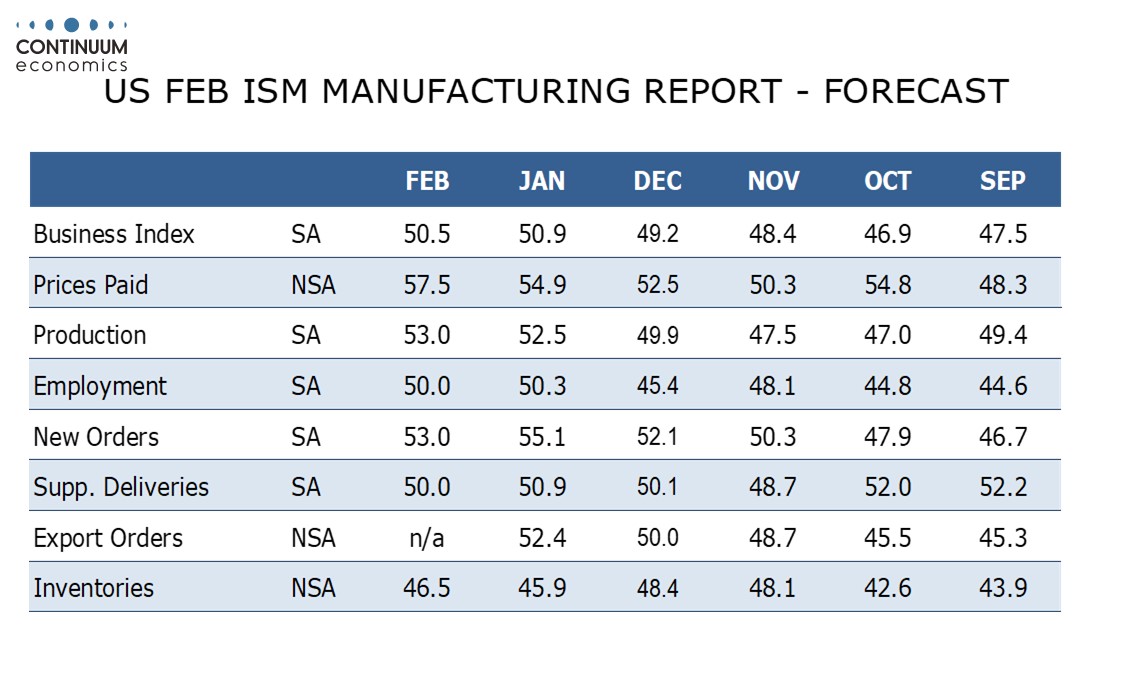

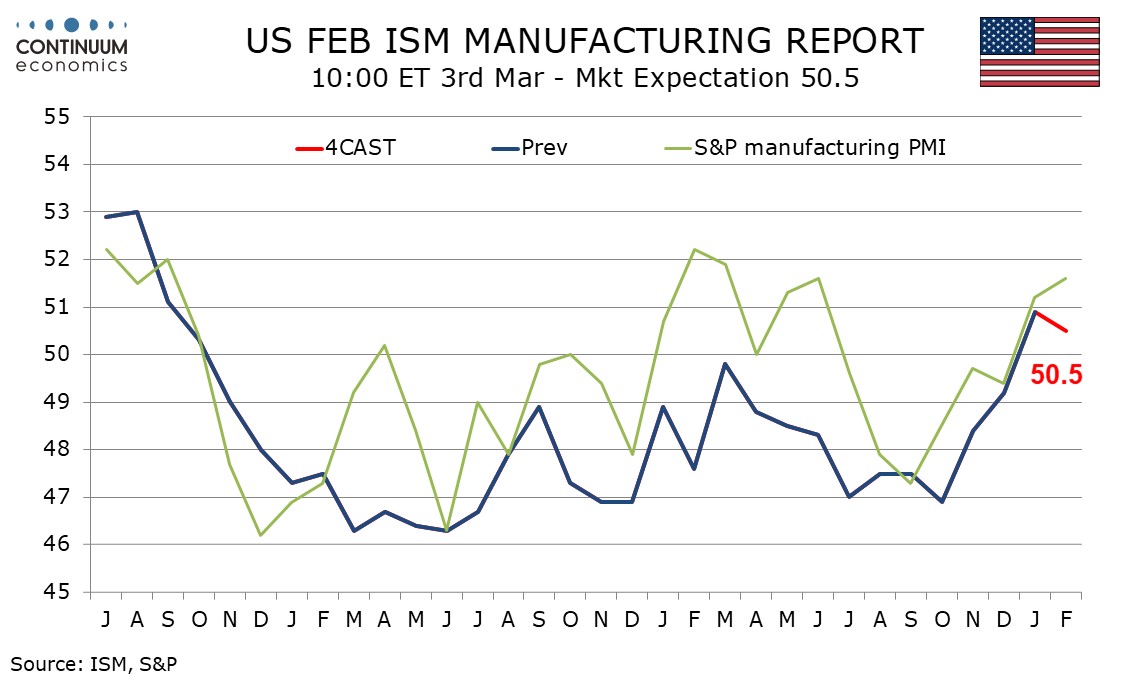

We expect a February 1SM manufacturing index of 50.5. slightly below January’s 50.9, but sustaining January’s move above the neutral 50 which was the first since October 2022 (after March 2024 was revised down to 49.8 from 50.3 with January’s annual revisions),

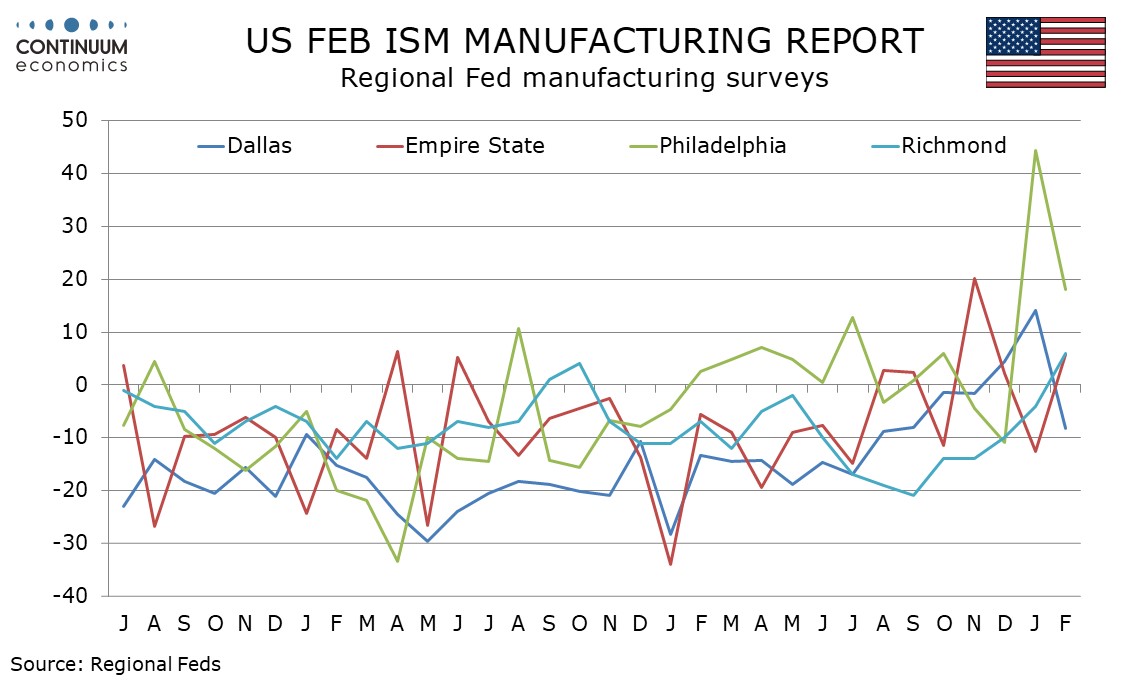

Signals from other surveys are mixed but on balance positive. The S and P manufacturing PMI extended a recent upturn and Empire State and Richmond Fed data improved. A slowing in the Philly Fed was from an exceptionally strong January, but the Dallas Fed report did see a significant slide.

January data saw new orders give a particularly positive signal in rising to 55.1. We expect a correction to 53.0 but with production also at 53.0, up from January’s 52.5. We expect employment and deliveries to slip to a neutral 50.0 from slightly positive January readings, while inventories correct up to 46.5 from 45.9, completing the breakdown of the composite.

Prices paid do not contribute to the composite but we expect an increase to 57.5, which would be the highest since April 2024, from 54.9. Price signals are positive in most regional surveys, probably influenced by tariffs.