JPY, SEK, NOK flows: JPY strong, SEK little affected by weak GDP

JPY gains as BoJ tightening anticipated. SEK resilient after weak GDP but scope for NOK/SEK gains

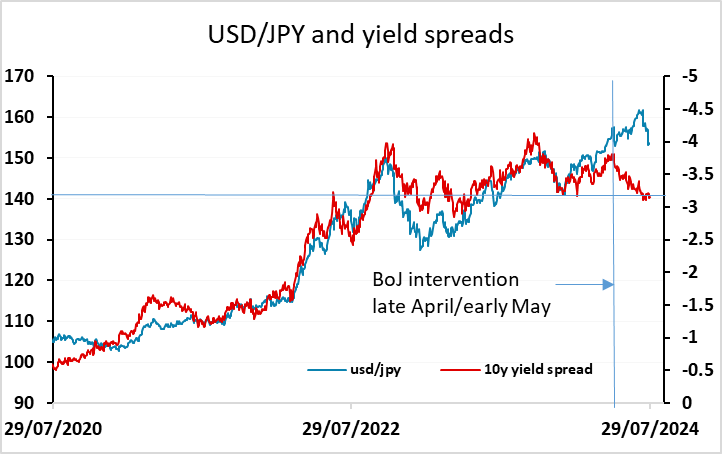

The overnight session saw renewed JPY strength after some early weakness, as markets focused on the potential for a BoJ rate hike at the Wednesday meeting. We still see this as being in the balance, but favour a delay until September, while the market is pricing a hike as a better than 60% chance. With equity markets performing better overnight, the JPY gains we have seen overnight could see some reversal this morning, and we may see a larger JPY dip if the BJ leave rates unchanged on Wednesday. We still think this will represent a good medium and long term JPY buying opportunity, but it could be a choppy week.

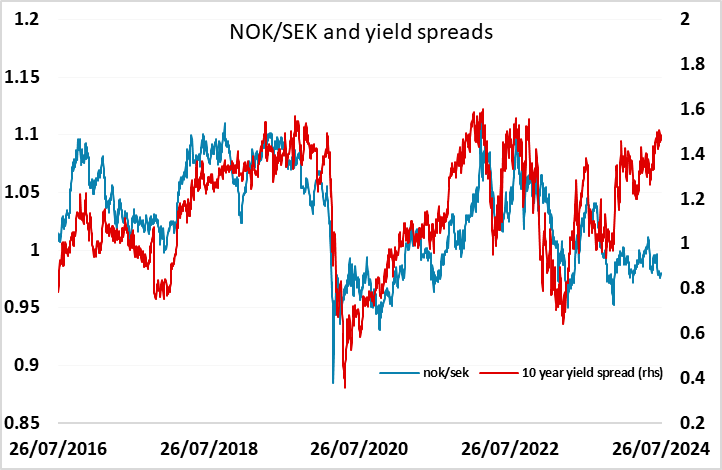

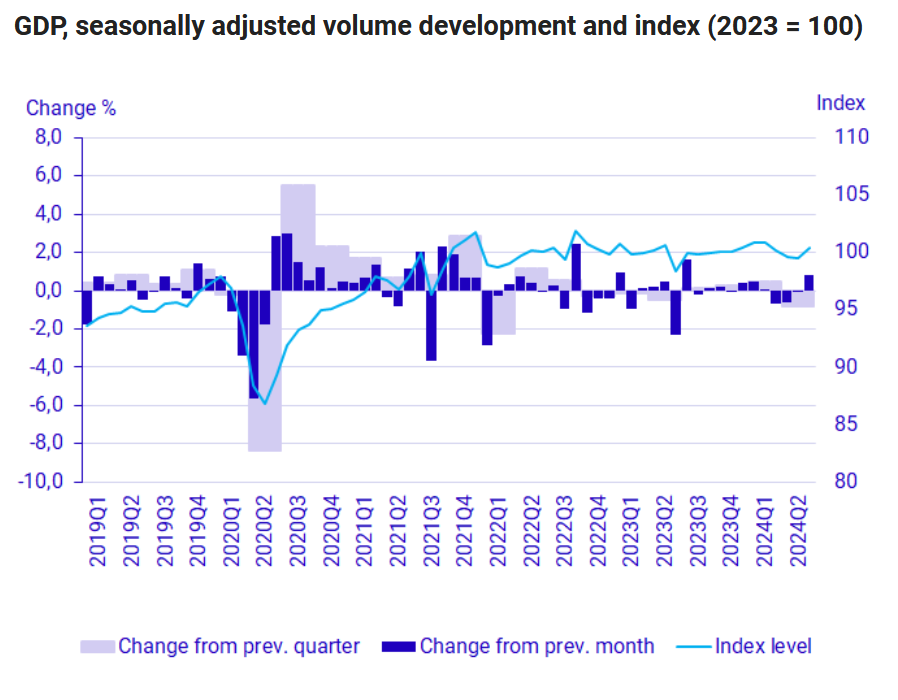

This morning has seen Swedish Q2 GDP data released, and it has come in on the weak side of expectations, with a 0.8% q/q decline against the market expectation of a 0.4% decline. This follows a 0.7% gain in Q1, so is to some extent driven by seasonal factors, and the SEK reaction has been mild. Nevertheless, we see scope for the NOK in particular to recover against the SEK helped by the better risk tone as well as the better Swedish data.