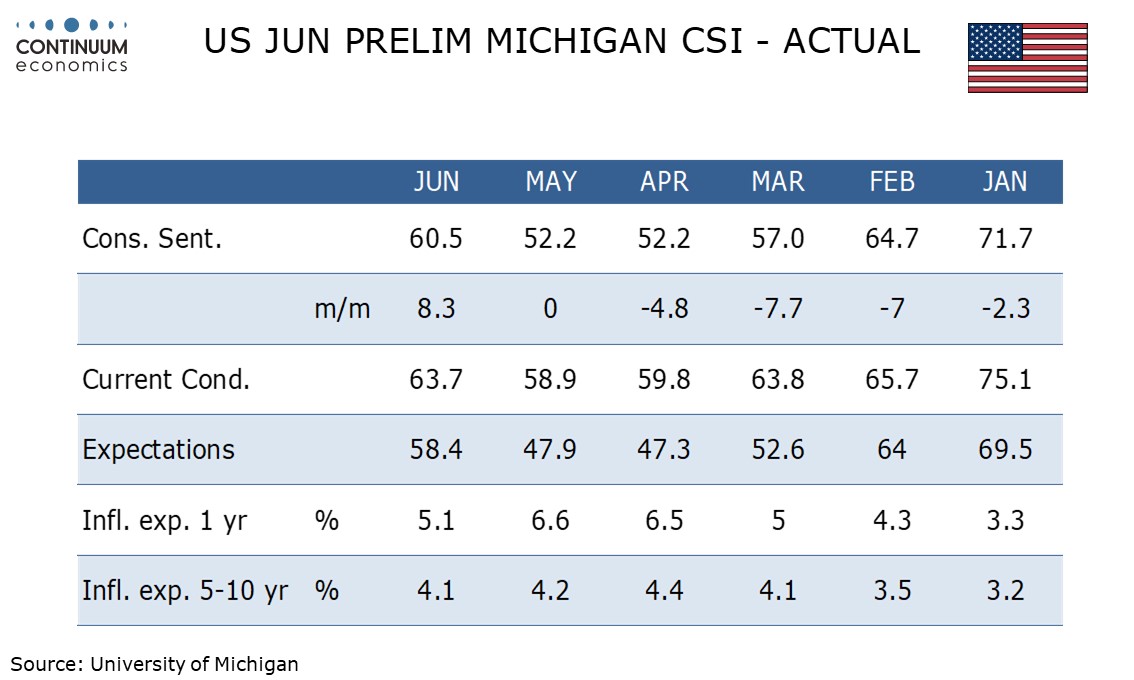

U.S. June Preliminary Michigan CSI - Back to levels seen before the reciprocal tariff announcement

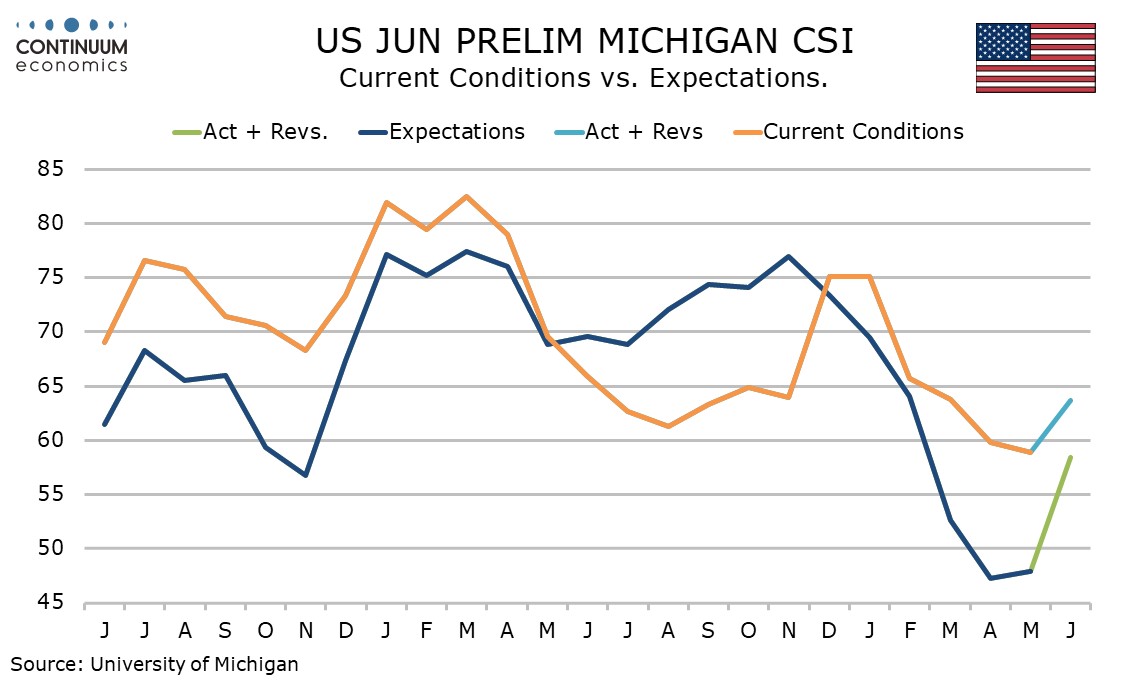

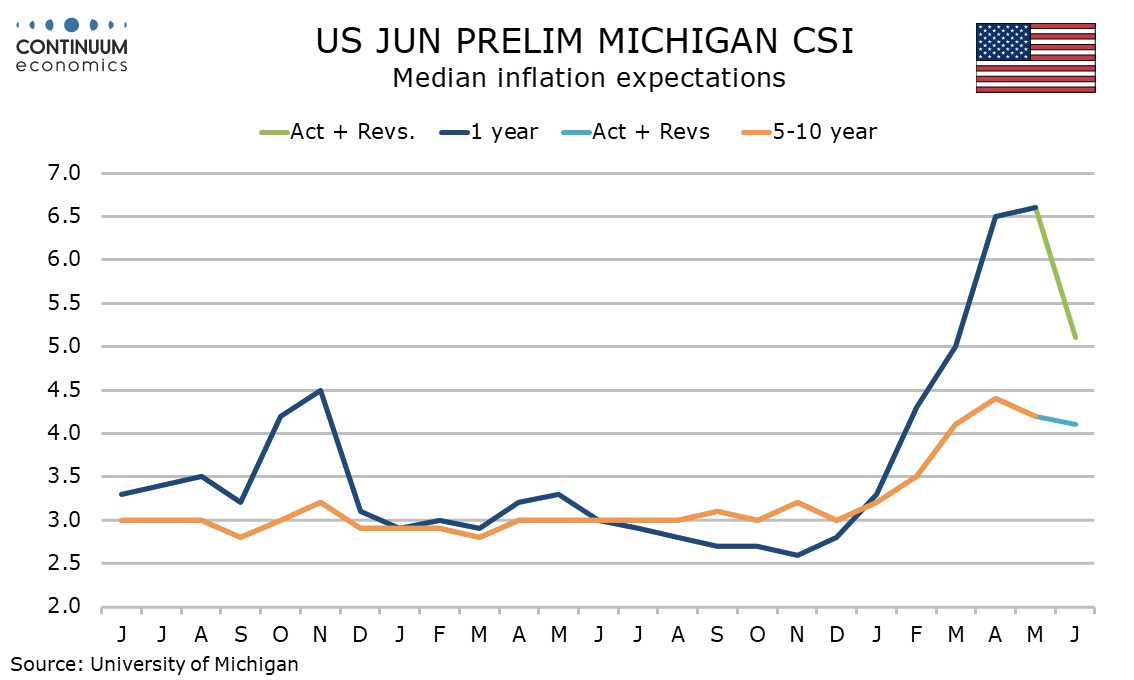

June’s preliminary Michigan CSI has seen a significant bounce to 60.5 from 52.2, putting the index to its highest since February assisted by reduced tariffs against China. The one-year inflation view has fallen to 5.1% from 6.6% though the 5-10 year view at 4.1% is down only marginally from 4.2%.

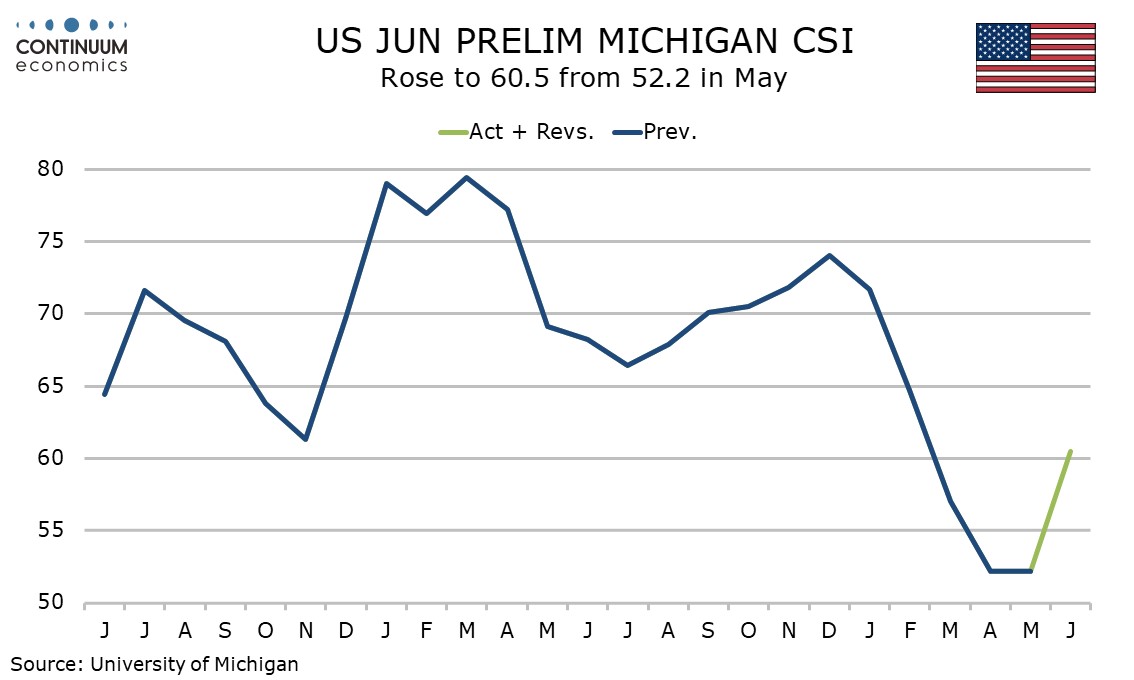

An actual lack of large price rises in the April and May CPIs may also have come as a relief to many. Detail shows expectations up 10.5 points to 58.4 and current conditions up 4.8 points to 63.7, both at their highest since February.

Current conditions, which bounced after the election but then fell on inflationary worries are now fairly close to pre-election levels. Expectations, despite the sharp June bounce, are still well below pre-election levels.

Inflation expectations are back near March levels, just before the reciprocal tariff announcement. The 5-10 year view has seen four straight months above 4.0%, something not seen since the early 1990s.

Details by political party show stronger sentiment from Republicans, Democrats and independents, but the rise in current conditions was led by Republicans and the rise in expectations was led by Democrats, though the latter are still very pessimistic even if less so.