JPY flows: Sharp JPY decline looks excessive

JPY has reversed yesterday's gains but decline looks excessive

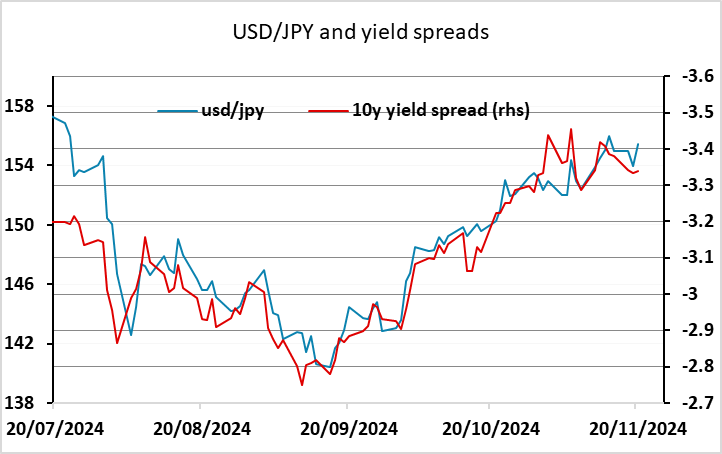

USD/JPY has reversed sharply higher overnight following yesterday’s dip on the comments from Putin around the Russian nuclear threat. The decline was a little excessive based on the move in yields, but the recovery is even more so., There may be some impact here from cross trades, with GBP strength this morning possibly leading to some unwinding of short GBP/JPY positions. However, even on the basis of the correlation of the last few months, USD/JPY looks overdone at current levels, especially given yesterday’s comments from Finance minister Kato calling JPY moves “rapid and one-sided” and saying he was watching them with the “utmost sense of urgency”. Levels near 156 look likely to be a good selling area for medium and long term players.