GBP flows: GBP lower after mixed labour market data

EUR/GBP gains 20 pips after labour market data, but earnings growth remains too high for comfort

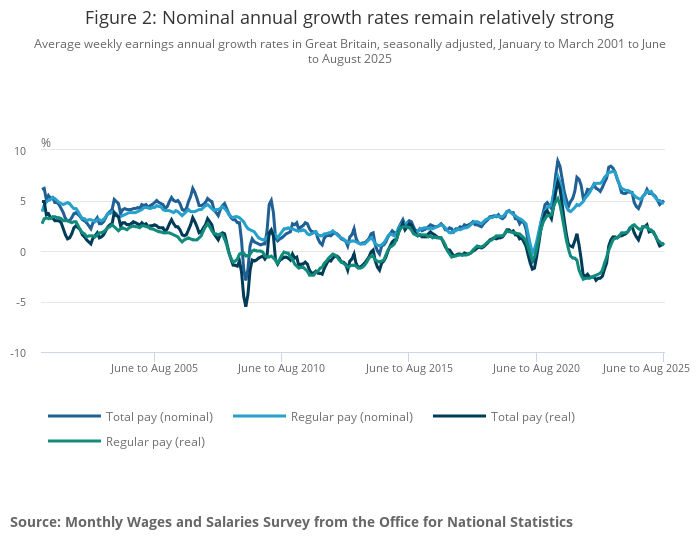

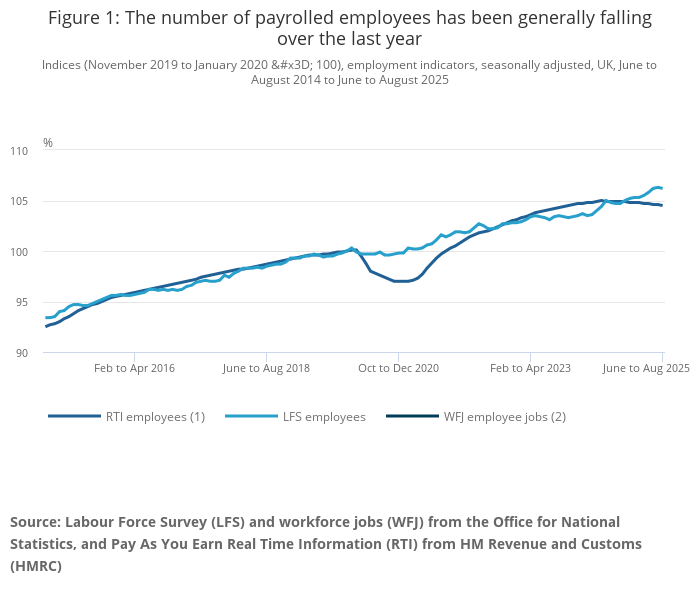

GBP has moved lower after the UK labour market data, although the data is probably best described as mixed. Total average earnings growth was actually stronger than expected in the 3 months to August at 5.0% y/y, although excluding bonuses it was in line with consensus at 4.7% y/y, down slightly from 4.8% in July. However, the more up to date (but provisional) HMRC data showed a weakening in payrolled earnings growth in September to 5.5% y/y. Payrolled employment growth remained modestly negative in the HMRC data, with a 10k decline in September following an 8k decline in August, although the ONS data still showed a 91k increase in employment in the 3 months to August. However, the unemployment rate rose to 4.8% and the economic activity rate dropped due to an increase in labour supply.

All in all the data doesn’t significantly change perceptions of the UK labour market. There is still evidence of weakening employment, and while the trend in earnings growth is slightly lower, it is still too high for the BoE MPC to be looking to cut rates in the near future. The decline in GBP in response to the data looks a little overdone, but suggests the market is prioritising the deteriorating employment picture, which is likely to lead to weakening earnings growth in the future. We do still think there is scope for earlier UK rate cuts than the market is pricing in (the next rate cut is not fully priced until April next year) so we favour the GBP downside medium term. However, the market seems unlikely to price in significantly faster rate cuts before the end November Budget unless we see a significant general global weakening in risk assets. The modest decline in equities overnight, reflecting continued concern over the US/China tariff situation, has no doubt helped the GBP decline this morning, but the year’s high at 0.8763 in EUR/GBP should not be in immediate danger.