USD, JPY flows: JPY surges again on China retaliation

China has announced retaliatory tariffs of 34% triggering general sharp losses in equities and a shift out of riskier currencies to the JPY and CHF

We are seeing another leg down in global equities as China responds to Trump’s tariff increases by imposing its own 34% tariffs. Europe has been particularly badly hit, with European equities this time leading the way, but the renewed equity rout has triggered a new bout of USD selling against the JPY and CHF, while EUR/USD has also edged up after losing a big figure earlier in the European morning. In contrast to yesterday, the riskier currencies are falling further against the USD, with AUD/USD testing the lows of the year. The concern now is that we will see further escalation in the trade war, with Europe and others also announcing retaliation. There has been an even more substantial decline in yields, with the market now pricing in 100bps of Fed cuts by the October meeting.

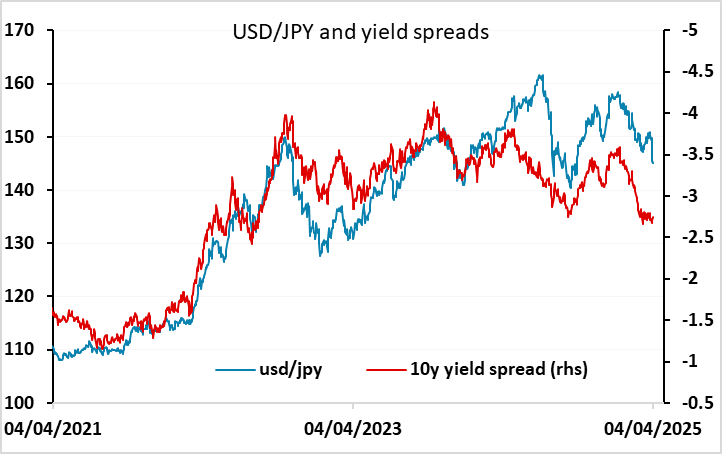

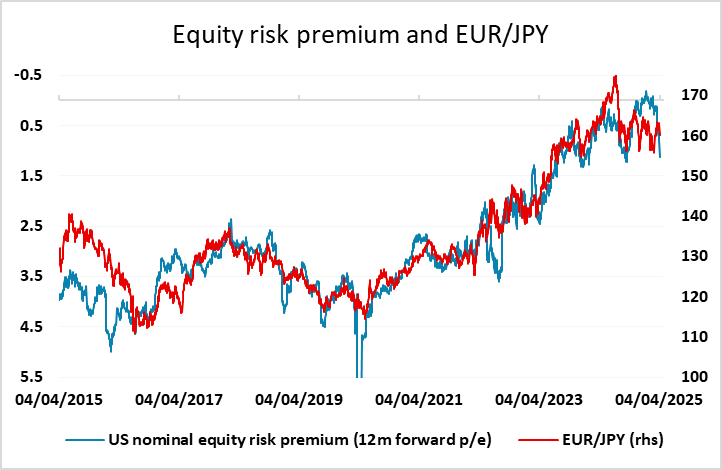

USD/JPY could still have further to decline, with yield spreads pointing to at least 140. EUR/JPY is also under pressure, with rising equity risk premia typically translating into EUR/JPY losses. The big worry is that the US market is still expensive by historic standards, despite the latest sell off, with the equity risk premium still well below the levels seen before the pandemic, and with the US growth numbers looking weak, it’s hard to see what stops the sell off. A strong employment report might help in the short term, but the main hope is that the market rout leads to Trump moderating his stance.