U.S. April Housing Starts and Permits - Single family slippage suggests trend starting to slip

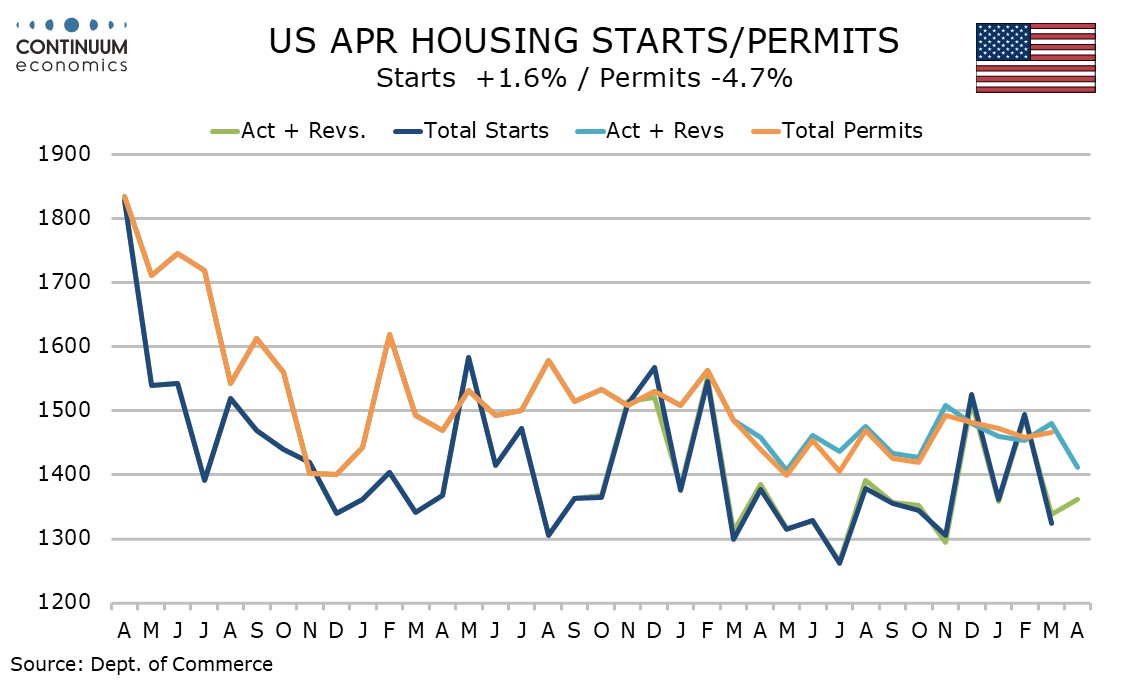

April housing starts are in line with expectations, up 1.6% to 1361k, but permits are weaker than expected, down 4.7% to 1412k. With the starts rise fully due to the volatile multiples sector and the permits fall broad based this is a weaker than expected report.

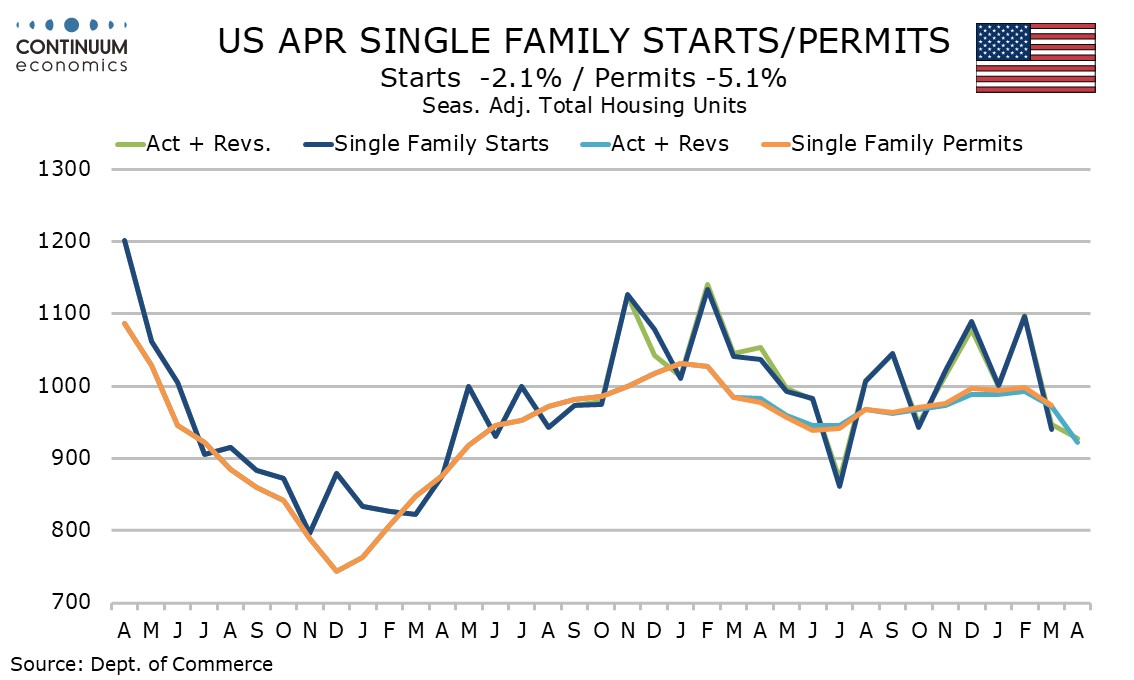

Single starts fell by 2.1% and single permits fell by 5.1%, in each case a second straight fall. Two straight declines in single starts is nothing unusual, but the April fall in single permits is unusual sharp and a sign that trend is starting to weaken.

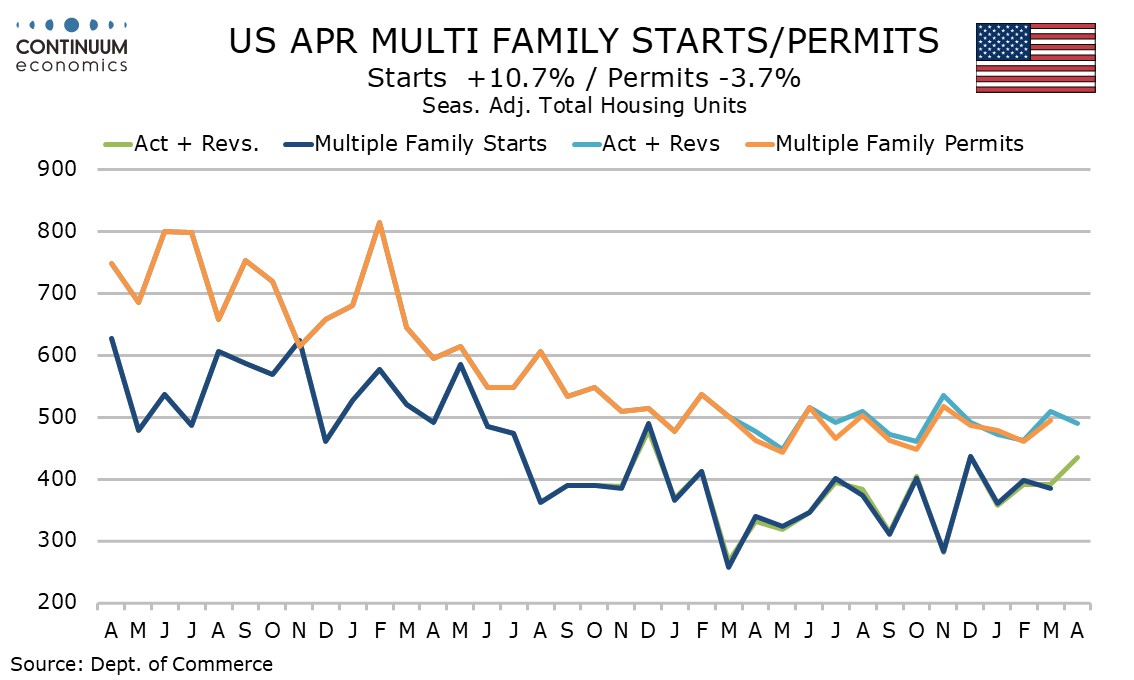

Multiple starts rose by 10.7% after a flat March and have not fallen since January. Multiple permits fell by 3.7% after a 10.2% increase in March. There is little sign that trend in multiples is weakening.

Still, this on balance a weak report and suggests strength in March new home sales is unlikely to be sustained. May’s NAHB homebuilders’ index saw a significant dip. The outlook, as is the case for the economy generally, remains highly uncertain, but with significant Fed easing likely only in the economy slows sharply, risks in housing appear to be on the downside.