Published: 2025-03-19T12:49:53.000Z

Preview: Due March 20 - U.S. February Existing Home Sales - Pending home sales suggest slippage

1

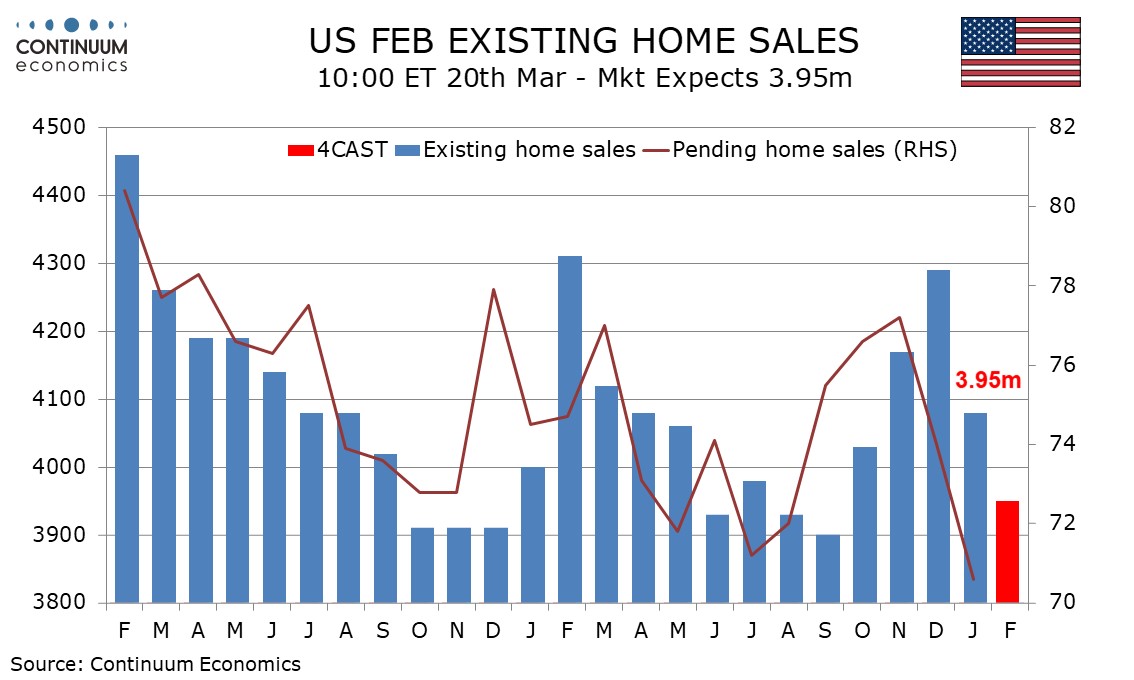

We expect February existing home sales to fall by 3.2% to 3.95m, which would be the lowest since September. Survey evidence, particularly pending home sales, suggest a weak number but it is notable that February in both 2023 and 2024 saw strong gains.

January pending home sales, designed to predict existing home sales, fell to a record low, and other surveys including those from the NAHB and MBA have seen some slippage as Fed easing expectations fade.

The strength in February data from 2023, and 2024, up 9.3% and 7.6% respectively, does suggest risk of a seasonal adjustment problem in the data, but two data points is not conclusive. February 2022 saw a steep 9.8% decline.

We expect the median price to see a 0.5% increase on the month, but this would see yr/yr growth slipping to 3.9% from 4.8%.