USD, JPY, EUR flows: JPY weakness continues as US data stays solid

JPY stays weak as equities hit new highs

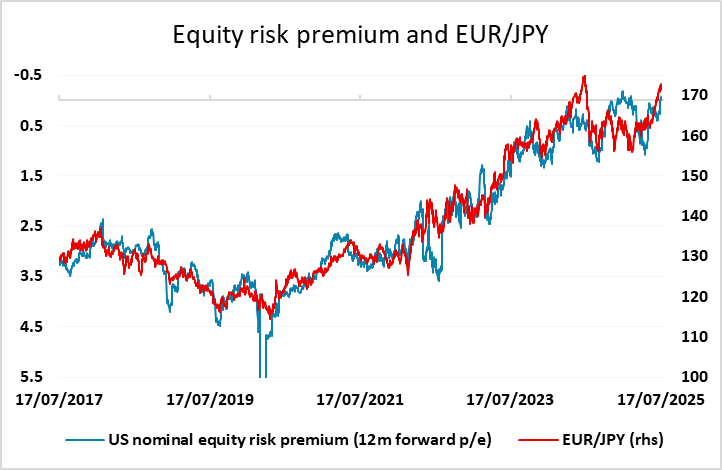

Friday’s calendar looks thin, with just US housing starts and the University of Michigan confidence survey on the data front, and a couple of Bundesbank speakers this morning. Overnight we have seen more strength in equity markets, with S&P 500 futures hitting yet another all time high, and this has translated into renewed general JPY weakness, with USD/JPY and JPY crosses closing in on Wednesday’s highs.

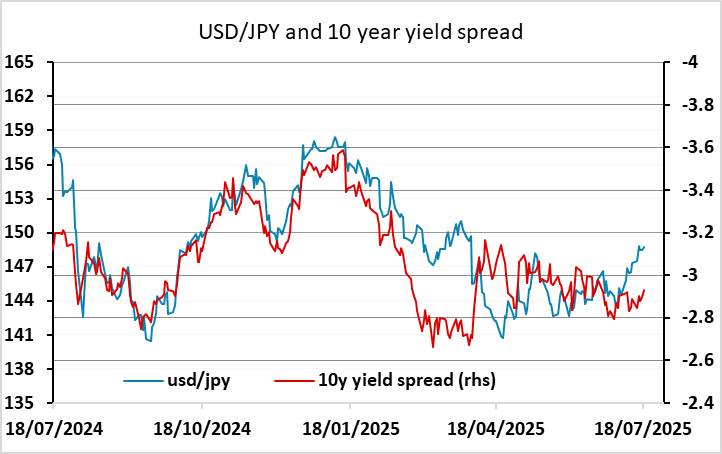

Japanese national CPI data came in slightly below consensus, and this has helped Japanese yields edge a little lower, perhaps also helping to undermine the JPY, although inflation remains at levels that would justify BoJ tightening if the BoJ felt confident about the economic outlook post-tariffs. USD/JPY continues to trade above the level suggested by yield spreads, with JPY crosses still supported by the extreme low levels of risk premia, although even on this basis the JPY looks a little on the low side. The solid US data this week has helped maintain the positive risk tone, and until or unless the market shows some concern about the tariff deadline on August 1st, it will remain hard to oppose JPY weakness and general mild USD strength. Even so, this is now the eighth consecutive week of EUR/JPY gains (if we close above 172.32), a run that is very rare, and there may be some paring of positions into the weekend.