Published: 2025-03-24T12:09:30.000Z

Preview: Due March 25 - U.S. February New Home Sales - Trend has no clear direction

3

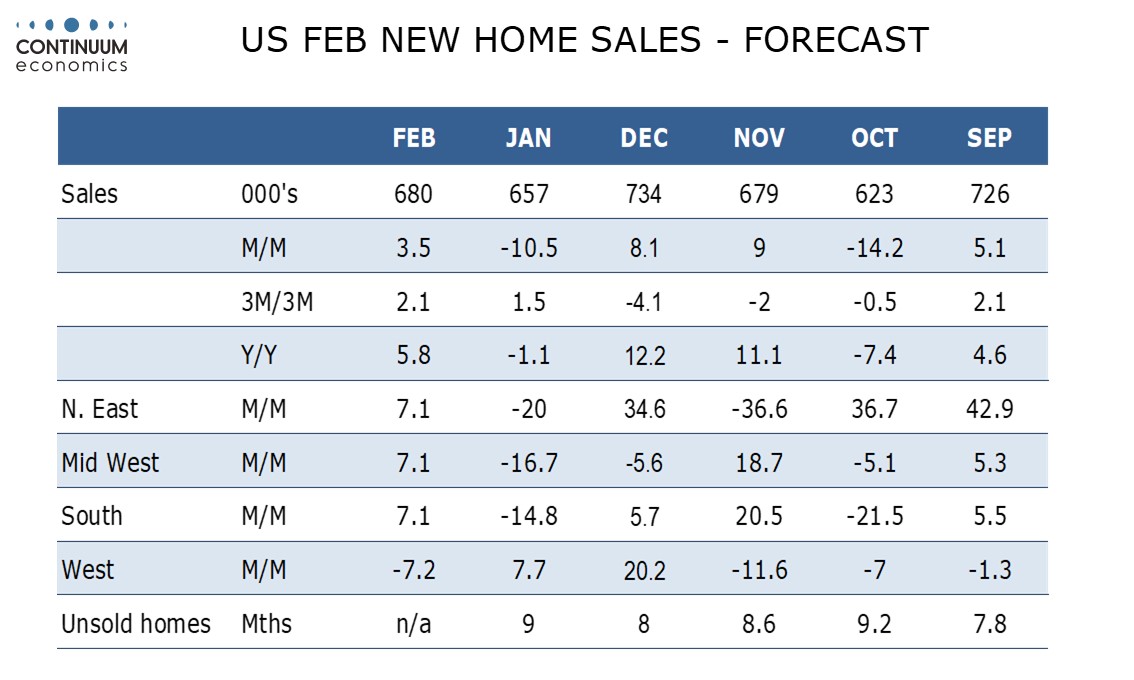

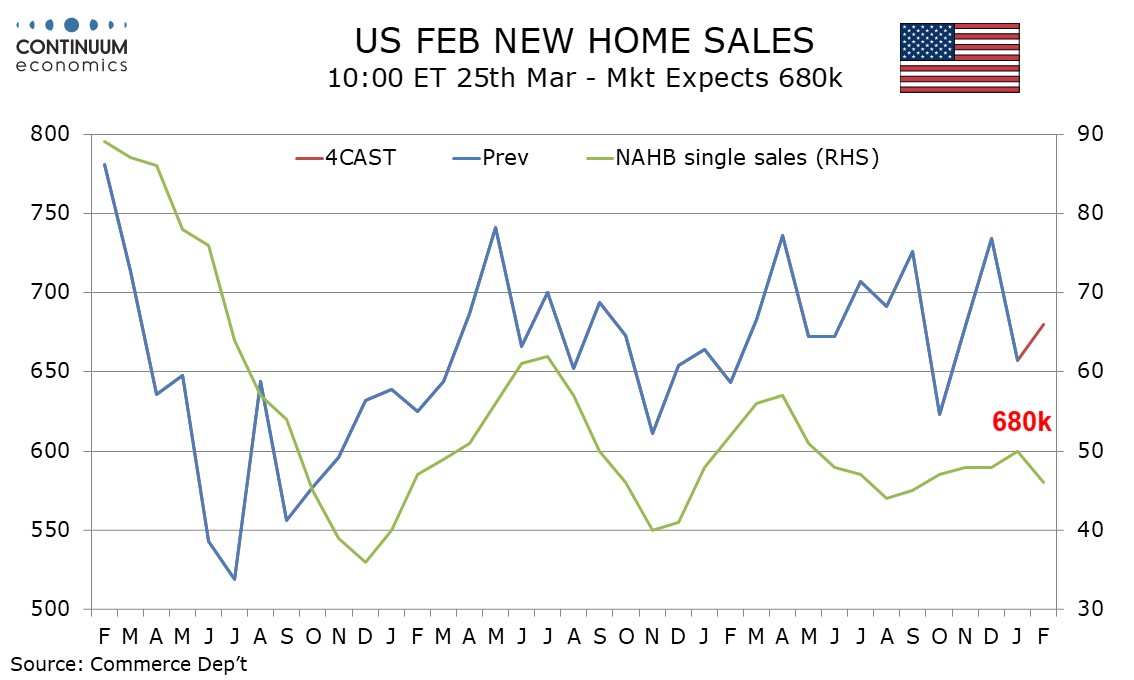

We expect a February new home sales level of 680k, which would be a 3.5% increase if January’s 10.5% decline to 657k is unrevised. While January’s decline was probably in part due to bad weather a full reversal is unlikely, with December’s 734k level significantly above trend.

Survey evidence from the NAHB, for March in particular, suggests housing demand is losing momentum as expectations for Fed easing fade, though more recent falls in mortgage rates could provide some support going forward. The underlying new home sales picture still has no clear direction.

After stronger data in December January and February, we expect the median price to fall by 3.0% in February while average prices, which saw little change in January, remain unchanged. This would see yr/yr median prices slow to 2.9% from 3.7% while average prices rise by 0.1% yr/yr after a 3.4% decline in January.