EUR flows: EUR gains after French election

EUR up after RN wins a slightly smaller than expected victory, but period of deadlock remains the most likely outcome.

The EUR has gained after the first round of the French election produced a slightly smaller victory for the right wing RN party than had been expected, although the results were not materially different from the polls. RN gained 33%, the left alliance 28%, and Macron’s centrist coalition 20%. The final result is still uncertain as the second round of voting on July 7 will determine the make-up of parliament, and the results of this will depend on how many candidates who finished in third place or lower drop out in the constituencies where there was no overall majority for one party. Most parties are guiding their candidates to drop out if they finished third or worse, and this will tend to prevent an RN majority. The most likely eventual result is still that there is no effective parliamentary majority achievable for any coalition. This could mean a period in which there is little prospect of any significant policy action, so measures to reduce the deficit seem unlikely to be achieved in the next year.

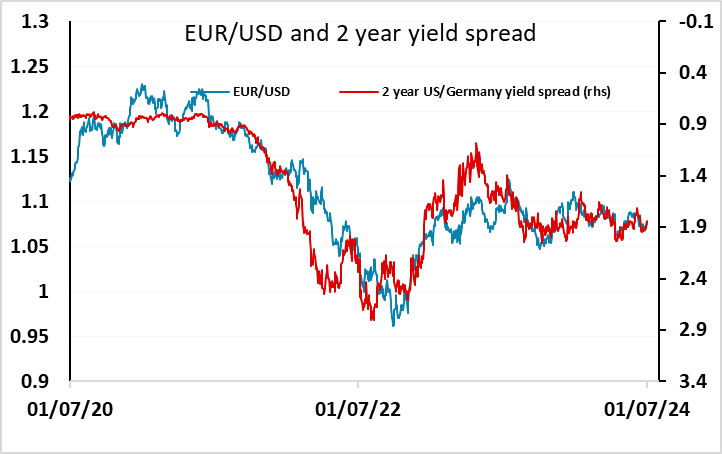

EUR gains look to be based more on relief that there is unlikely to be a majority for RN than any real optimism about the prospects of an eventual effective French government coming out of the election. The EUR had fallen back after the elections were called, so this may represent some sort of unwinding of short positions based on political risk. But there is still little reason for optimism, and EUR/USD continues to move closely with front end yield spreads, which have moved little, so we would doubt there is scope for sustained gains beyond 1.08 unless we see increased expectations of Fed easing later in the year.