USD, CHF, EUR, NOK flows: USD weakness may be overdone, CHF strength looks excessive

Better risk tone should mean CHF comes under pressure

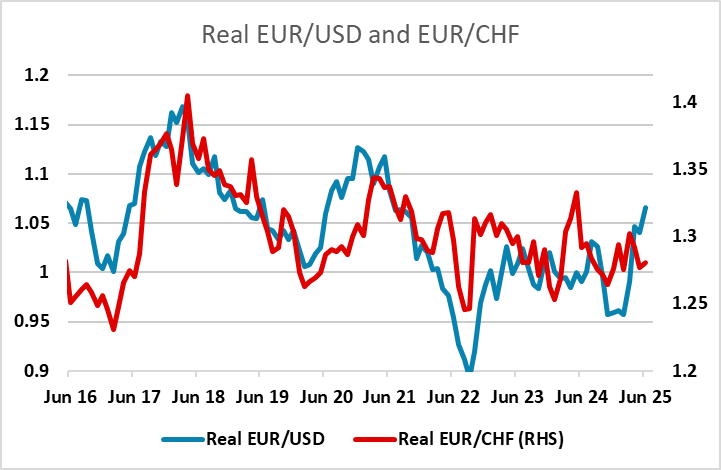

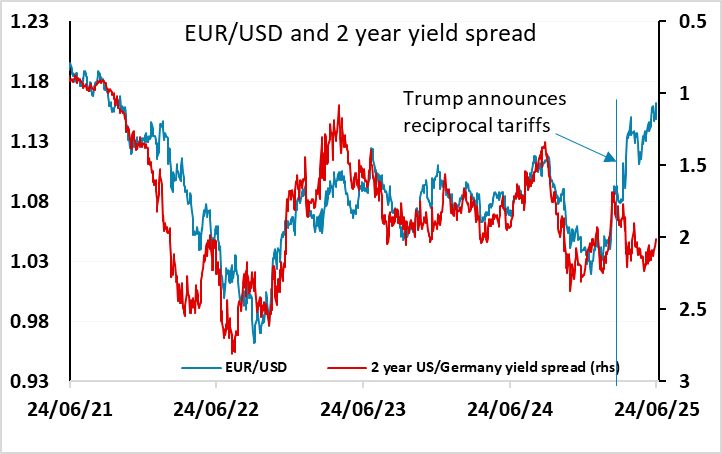

A quiet Wednesday calendar suggests that the focus will remain on geopolitics, although this may be a fading factor if Iran and Israel stick to the ceasefire. A combination of easing Middle East tension and lower US yields in the last couple of days have meant the USD has come under some pressure, with EUR/USD making new 4 year highs and USD/CHF hitting its lowest level since the 2015 spike lower when the SNB removed their support from EUR/CHF. Lower US yields have been helped by some dovish comments from Waller and Bowman, but Powell still sounds quite neutral and with the market now fully pricing a September rate cut the risks may be that there is some reversal of recent yield declines if Powell maintains this neutral stance when he talks this afternoon (although his comments are unlikely to differ much from yesterday’s). The equity market is benefiting from the lower US yield structure and the decline in Middle East tension (and the resultant decline in the oil price), but still looks inflated with the S&P500 testing close to the all time high of 6147 seen in February. If tariffs come back into focus, we could see some downward pressure return, but for now the mild risk positive tone looks like continuing. If so, the riskier currencies could benefit, while the safe havens – particularly the CHF which has strongly outperformed in recent weeks – could come under some pressure. The NOK fell back sharply on risk aversion and has subsequently suffered from a weaker oil price, but ought now to have scope to rally.