U.S. June Philly Fed - Details mostly weak

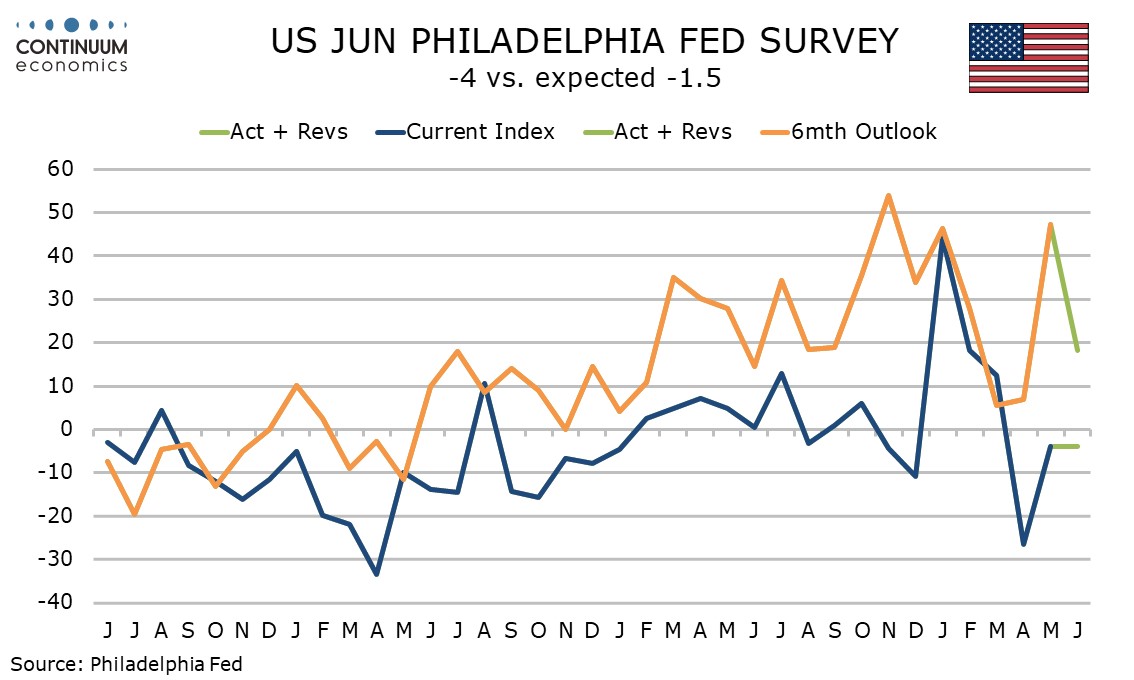

June’s Philly Fed manufacturing index of -4.0 is unchanged from May and weaker than expected. The details are generally soft, with 6-month expectations slowing to 18.3 from May’s very strong 47.2, though the 6-month view is still stronger than seen in March and April.

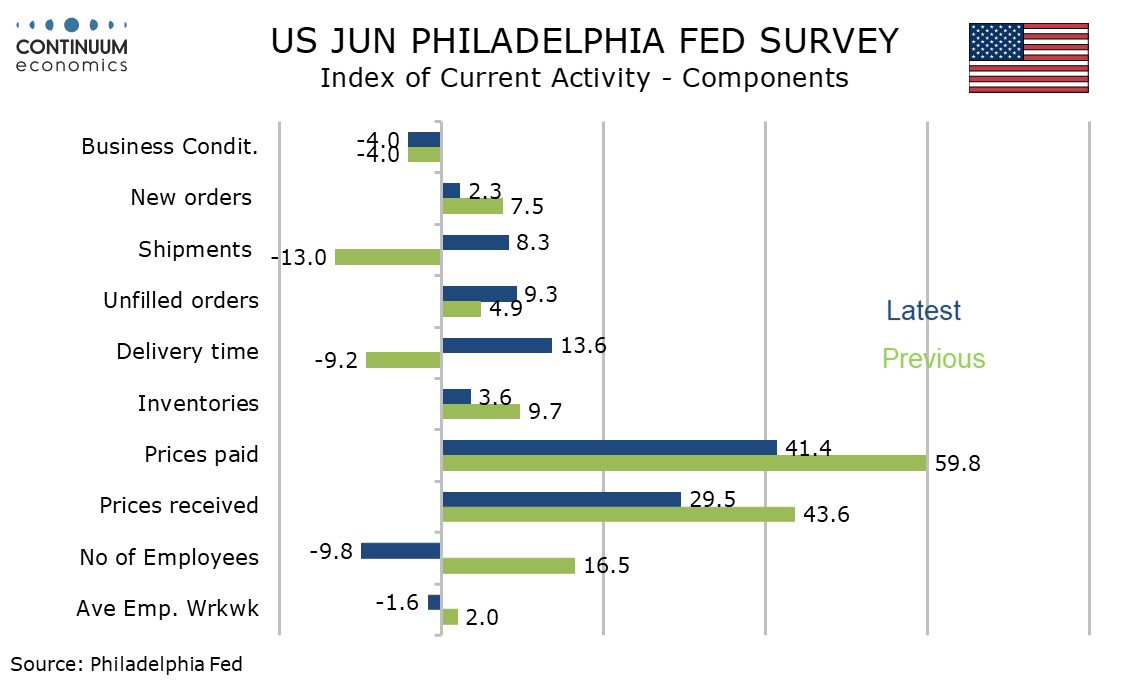

The current month details are generally softer, in particular employment which plunged to -9.8 from a positive 16.5 in May, while new orders slowed to 2.3 from 7.5.

Prices paid at 41.4 from 59.8 are the slowest since February while prices received at 29.5 from 43.6 are the slowest since January.

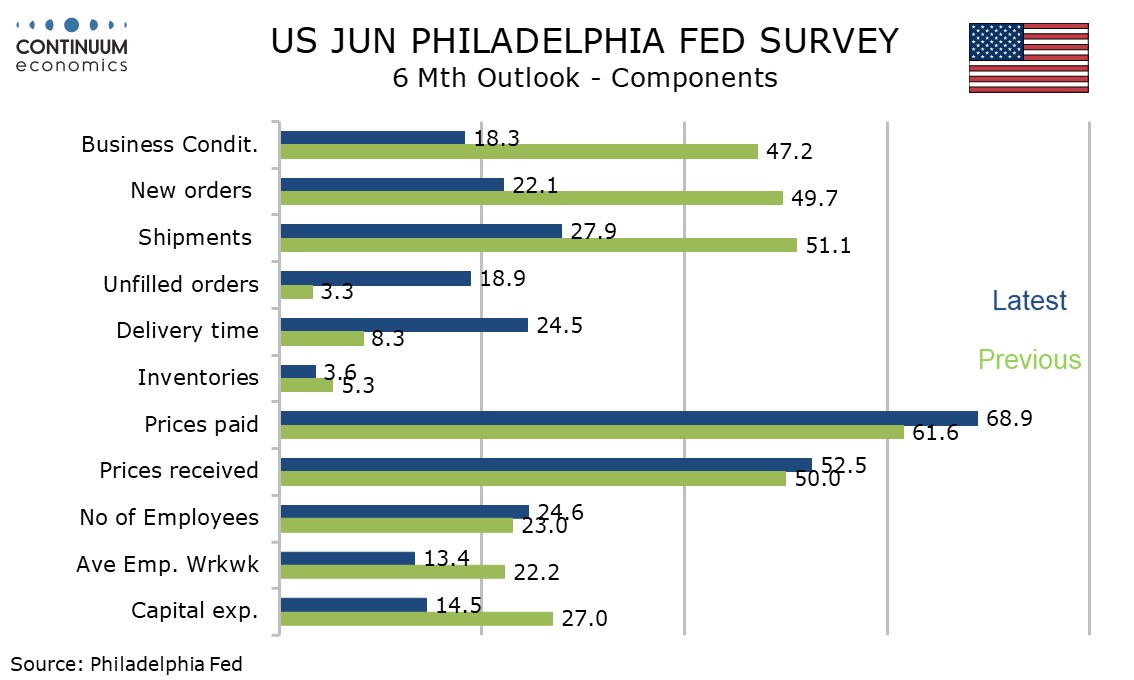

6-month expectations however showed employment remaining firm at 24.6 from 23.0 while 6-month prices paid at 68.9 from 61.6 are the highest since January 2022. 6-montb prices received at 52.5 are up from May’s 50.0 but still well below April’s 67.7.