This week's five highlights

Geopolitical Tension Flares Up

U.S. CPI Beats Estimate

And Rocks the USD

Tokyo CPI and Labor Cash Earning Disappoint JPY Hawks

UK GDP Still Moving Sideways

Geopolitical conflict once again seize the headline again as the U.S. and UK launched airstrikes against Houthi targets in Yemen while Australia, the Netherlands, Bahrain, and Canada supported. Dozens of targets including training and drone storage facilities were stroke with the U.S. and UK launching with fighter jets and submarine. Soon after the airstrike report, the United States Embassy in Iraq was also reported to be bombed, looking like a tit for tat retaliation. With the U.S. entering, it seems inevitable geopolitical tension will flare up. The U.S. has been restraining to launch military action in the Middle East since the beginning of Israel-Palestine conflict to avoid further escalation. But the latest attacks on commercial vessel in the Red Sea seems to be forced the U.S. hands to maintain a smooth voyage. Hopefully we will not see another escalation of conflict but there is no doubt risk sentiment will be on their toes over the weekend.

The U.S. December CPi has came in higher than expected with headline at 3.4% y/y vs 3.2% expected and core CPI at 3.9% y/y vs 3.8% expected. The headline inflation rebounded from November's 3.1% but core slipped from 4% in November. The report itself is showing still hot inflation, especially with core measures like service ex rent of shelter steadily grow at 0.6% m/m. As a knee jerk response, USD is immediately driven higher along with Treasury Yields as market expects less easing from the Fed.

However, the tide soon turns with Treasury Yields led the fall with market pricing for rate cut returning to pre-CPI level. After the fog of war on pace of rate cut dissipates, the market seems to focusing on the real inflationary dynamics and subsequent economics development, which is lower inflation and growth, both weakens the USD.

On the chart, we could see the DXY extend consolidation around congestion resistance at 102.50. Intraday studies are improving and the daily Tension Indicator is rising, highlighting potential for a later break towards strong resistance within 103.00/20. However, daily stochastics are overbought, suggesting any immediate tests could give way to further consolidation. A close above the 103.20 Fibonacci retracement, however, will confirm completion of the short-term consolidation pattern and extend late-December gains towards stronger resistance at 104.00. Meanwhile, support remains at 102.00. A close beneath here, if seen, would add weight to sentiment and open up 101.50, where fresh buying interest is expected to appear.

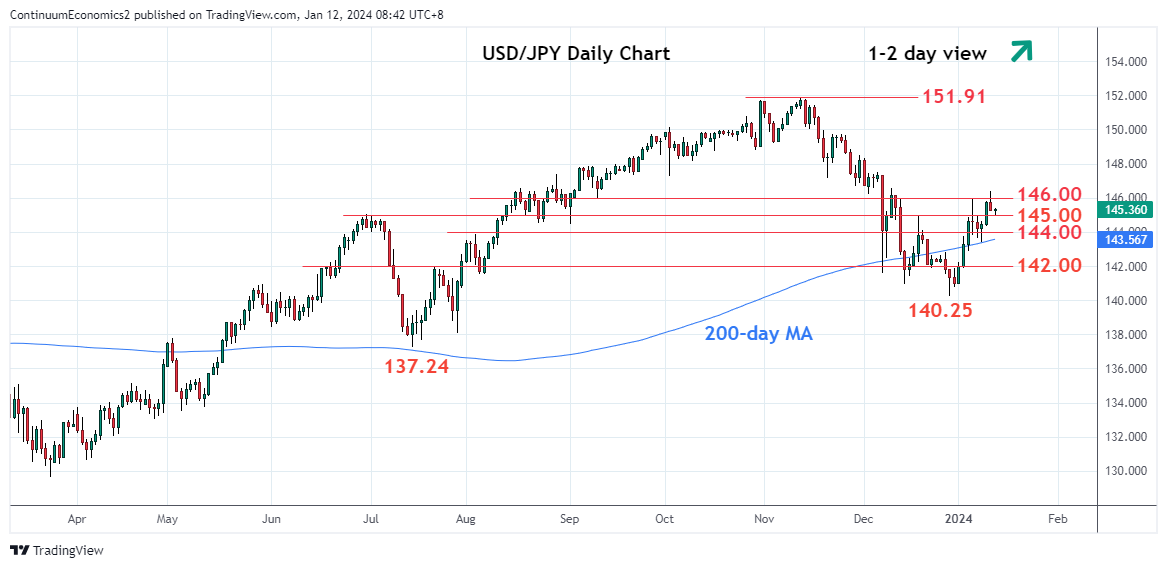

Tokyo CPI this week showed further moderation in inflation of all three metrics, headline, ex fresh food and ex fresh food and energy. It seems to suggest the path of moderation in Japanese inflation is aligning with our forecast of headline and less fresh food drifting closer to 2% while less fresh food and energy being stubborn. However, the magnitude of wage growth has missed estimate significantly within the headline figure. As a metric that is being closely watched by the BoJ in determining their next step of monetary policy, such slack in wage inflation is not encouraging for the BoJ to exit ultra-loose policy soon and supports their decision in waiting for the spring wage negotiation for confirmation. In a very short run, it will be JPY negative.

On the chart, USD/JPY shows little follow-through on break of the 146.00/146.10 resistance as prices unwind the overbought intraday studies. However, further gains not ruled though the daily studies are now overbought as well and suggest gains likely to struggle to clear strong resistance at the 146.60/147.15 area. Meanwhile, support is raised to the 145.00 congestion and this extend to the 144.00 level. This area now seen protecting the downside and only failure here will weaken and return focus to the downside and see slippage back to the 143.42/142.85 support.

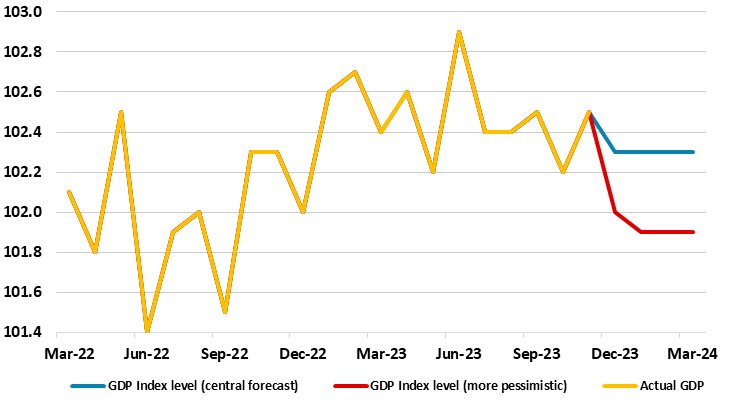

Figure: UK GDP Still Volatile but With Downside Risks…

Coming in higher than expected, and probably boosted by less poor weather and a correction back in imports, GDP rose by 0.3% m/m in the November data, a result that meant that the surprise drop of the previous month was exactly reversed (Figure). Regardless, there may be some fresh fall in the looming December numbers, (albeit with some upside risks posed by some survey data, this flagged by what we think will be a fresh drop in retail sales, a result that still suggest a small contraction in Q4 GDP and thus a recession will have occurred given a second successive drop. Regardless, a better description of the economic backdrop is one of the economy moving sideways.

As for the economic outlook, the backdrop is looking softer still. Recent GDP sectorial updates suggest a much weaker growth picture for Q2 and Q3 last year, meaning that the 2023 average rate may be no higher than 0.2%, less than half the now out-of-date consensus and with this downgrade threatening an outright contraction for this year: we now see a 0.1% drop.

GDP is estimated to have fallen by 0.2% in the three months to November 2023, compared with the three months to August 2023. Monthly GDP is estimated to have grown by 0.3% m/m in November 2023, following an unrevised fall of 0.3% in October 2023. Services output grew by 0.4% in November 2023 and was the main contributor to the monthly growth in GDP; this follows a fall of 0.1% in October 2023 (revised up from a 0.2% fall in our previous publication). Production output grew by 0.3% in November 2023, following a fall of 1.3% in October (revised down from a 0.8% fall in our previous publication). The construction sector fell by 0.2% in November 2023 after a fall of 0.4% in October 2023 (revised up from a 0.5% fall in our previous publication). Admittedly, weather patterns have helped accentuate swings in monthly GDP numbers of late but where the essential trend remains flat and where domestic demand weakness is still being masked by softness in imports. But elsewhere the allegedly less-weak housing market is an impact via the fall in transactions.