Published: 2025-11-10T13:52:15.000Z

Preview: Due November 20 - U.S. October Existing Home Sales - Responding to lower mortgage rates

3

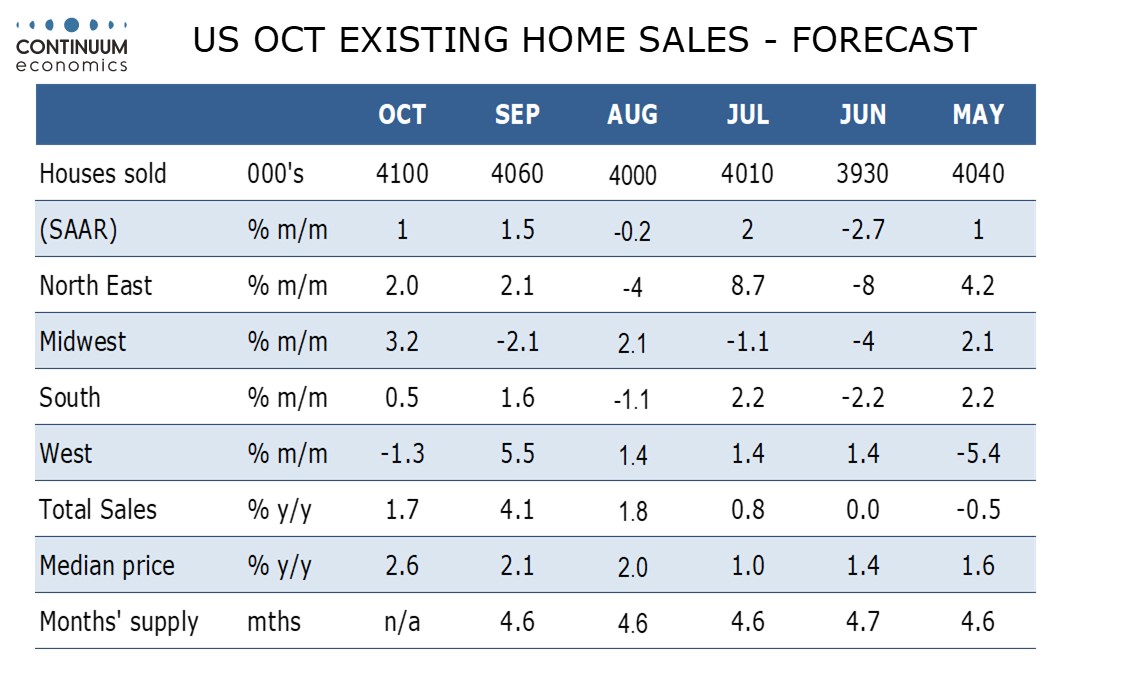

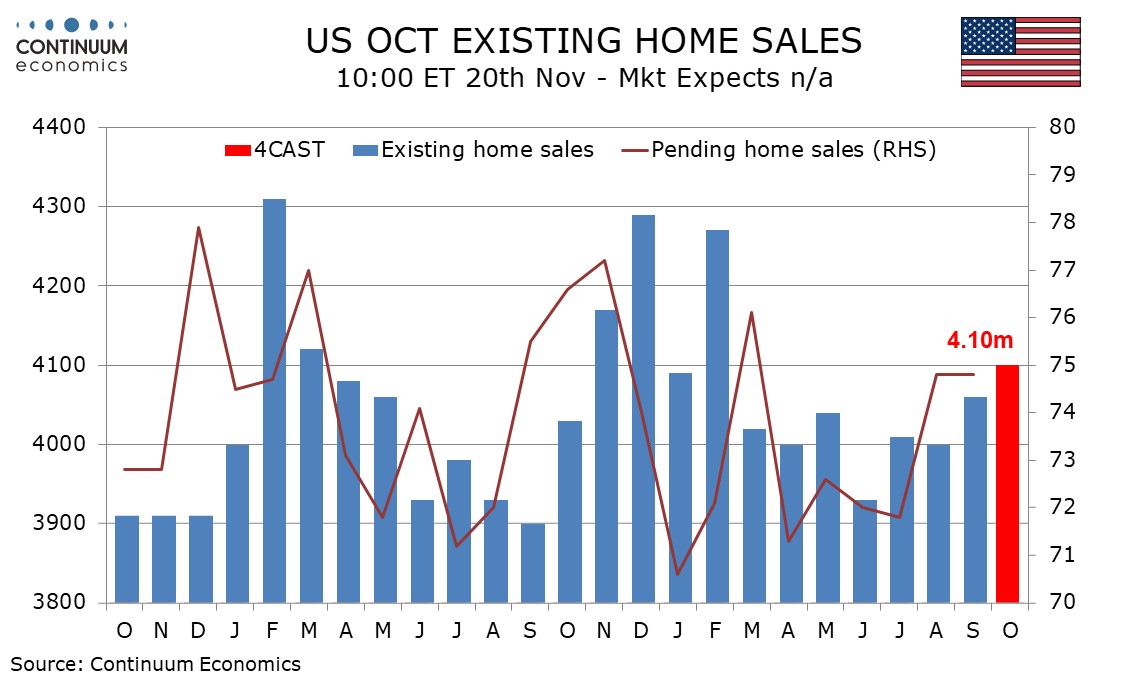

We expect October existing home sales to increase by 1.0% to 4.10m, extending a 1,.5% rise in September to reach the highest level since February, as the housing market gets support from lower mortgage rates as Fed easing resumes.

Pending home sales, designed to predict existing home sales, were unchanged in September but sustained a 4.5% increase seen in August. MBA weekly house purchase indices corrected lower in October after rising in September but the NAHB homebuilders’ index gained momentum in October. On balance housing sector signals are positive.

We expect October’s sales increase to be led by the Midwest, which was the only region to fall in September, with only the West, which led September’s increase, declining. We expect a 0.5% increase in the median price, which would lift yr/yr growth to 2.6% from 2.1%, extending the move off a recent low of 1.0% seen in July.