This week's five highlights

U.S. December CPI A modest comfort to the Fed

U.S. December Retail Sales still solid

USD/JPY Capped by Potential BoJ Hike

UK GDP Continued Weakness Evident

China Hits 5% for 2024 but Still Imbalanced

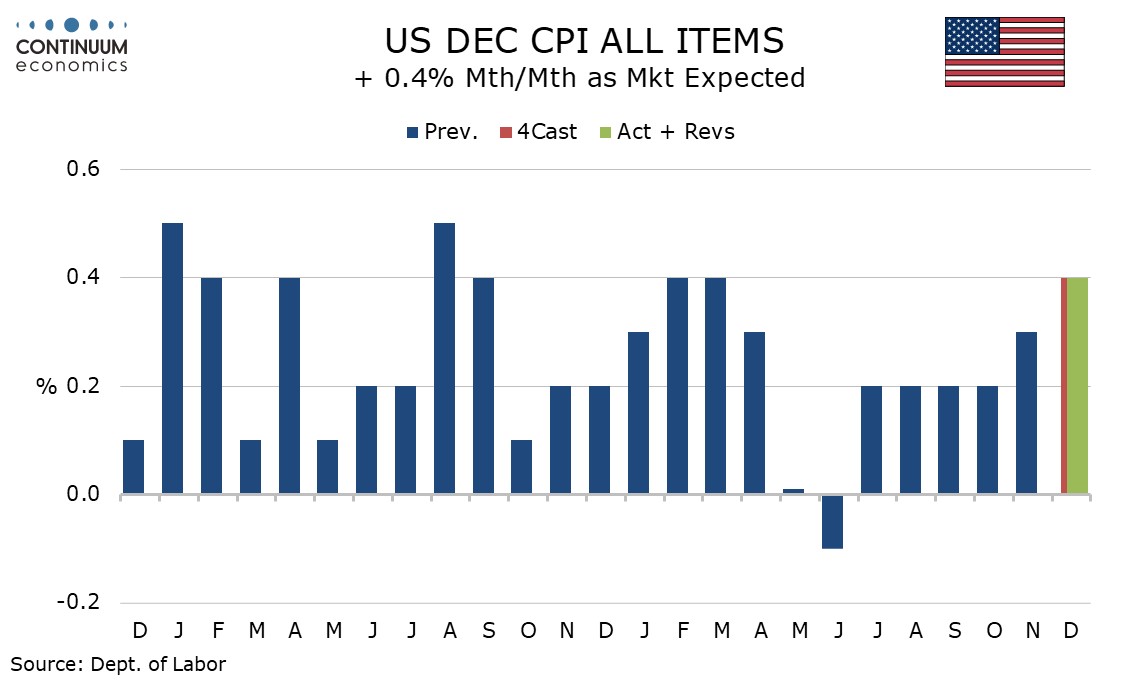

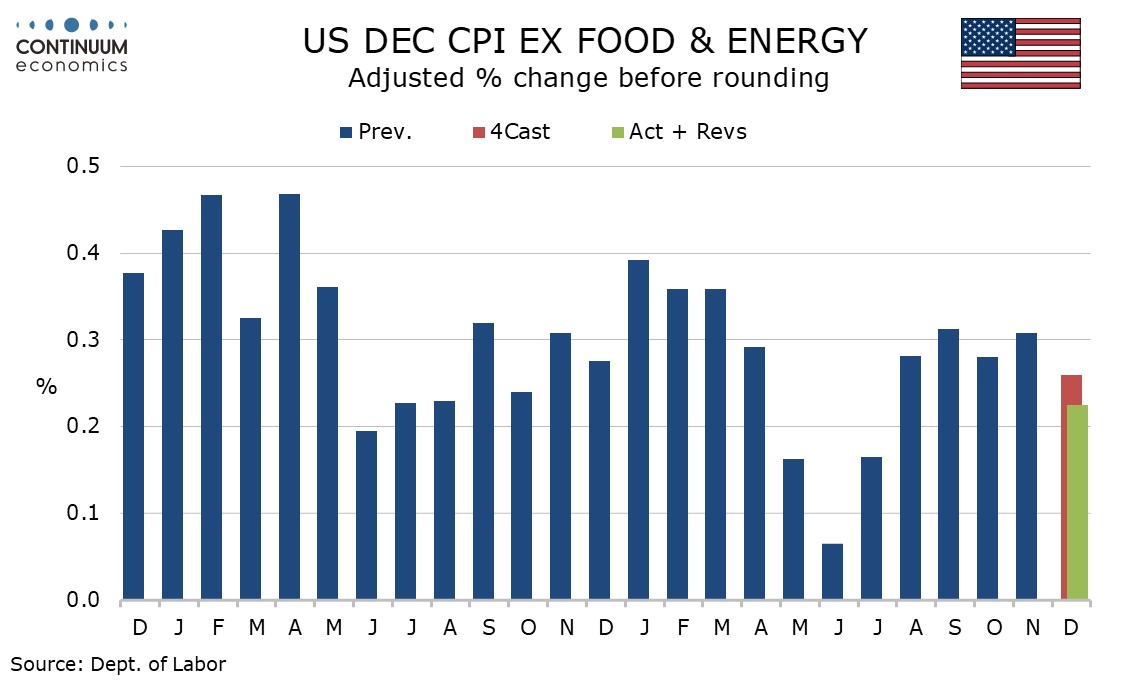

While December’s headline CPI is in line with expectations with a 0.4% increase, the core rate ex food and energy is subdued at 0.2% following four straight gains of 0.3%, and a downside surprise is quite comfortable with the gain before rounding being 0.225%. Price data did however pick up in January's Empire State survey.

Services less energy rose by 0.3% for a third straight month. Air fares saw a strong month with a rise of 3.9% but auto services have lost their previously strong momentum, with overall transport services up by 0.5%. Owners’ equivalent rent rose by 0.3% after a 0.2% November gain which corrected a 0.4% rise in October but housing was restrained by a 1.0% decline in lodging away from home. Yr/yr core CPI slipped to 3.2% after three straight months at 3.3%, but remains ahead of overall CPI, which at 2.9% from 2.7% saw a third straight acceleration from a recent low of 2.4% seen in September.

After four straight months of modest disappointment the December core CPI will be a modest comfort to the Fed but after the strong non-farm payroll is unlikely to put a January easing on the agenda. Early 2025 data will be crucial going forward. If the strength of early 2024 is not matched, yr/yr data will fall.

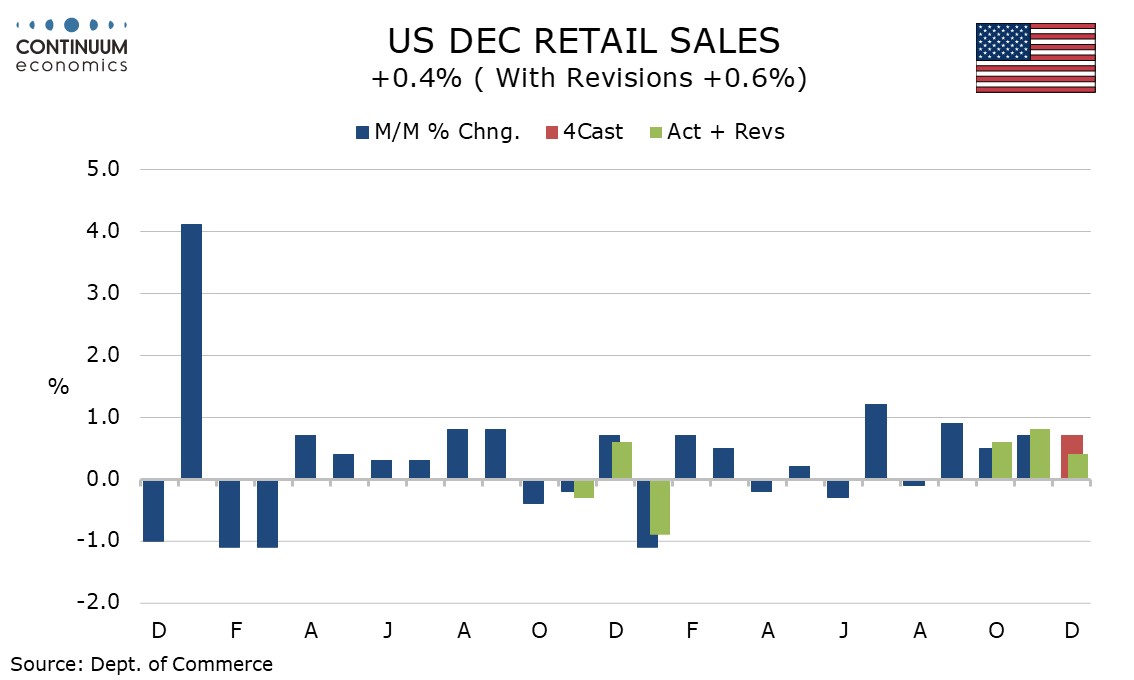

December retail sales with a 0.4% increase overall and ex auto, 0.3% ex autos and gasoline, are on the weak side of expectations but maintain respectable momentum, particularly in the control group which contributes to GDP, which rose by 0.7%. A strikingly strong January Philly Fed manufacturing index of 44.3, up from -10.9 in December, has also been released.

The main restraint on retail sales was building materials, where a 2.0% fall could be a hint that rising bond yields are starting to hit housing. Strength was seen in furniture, up by 2.3%,while clothing and gasoline each rose by 1.5%, the latter supported by prices. Food rebounded from a November decline with a rise of 0.8% but sales at eating and drinking places fell by 0.3%. Despite the modest disappointment in December, Q4 saw a strong rise of 1.8% (not annualized), the strongest since Q1 2023. Ex autos a 1.1% increase matched that of Q3 while ex autos and gasoline at 1.2%, while down from 1.5% in Q3, was still solid.

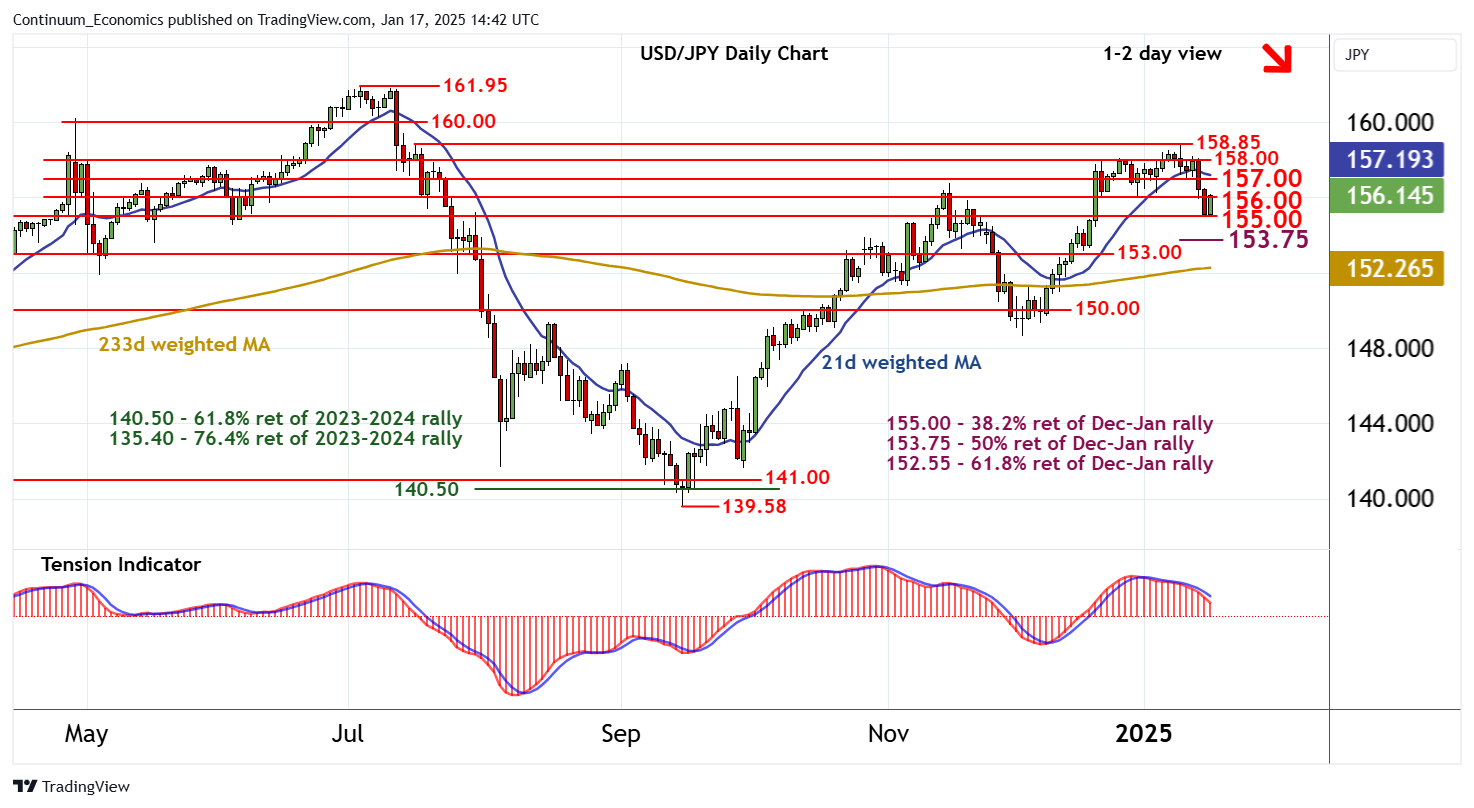

Market expectations on a January BoH hike ramped up this week as BoJ's Ueda releases supportive remarks. While he has been indifferent on his rhetoric, a slight change in wordings on wage growth has sparked speculation in the market. Not to mention the latest November headline wage reached 3% y/y. However, given the BoJ's record, one must be cautious in believing how hawkish they really are.

On the chart, consolidation is giving way to a fresh test higher, with prices currently pressuring congestion resistance at 156.00. Rising intraday studies highlight room for a test above here. But daily readings continue to track lower and overbought weekly stochastics are unwinding, highlighting potential for renewed selling interest towards further congestion around 157.00. Following cautious trade, fresh losses are looked for. A close below 155.00 will add weight to sentiment and extend January losses initially towards the 153.75 Fibonacci retracement.

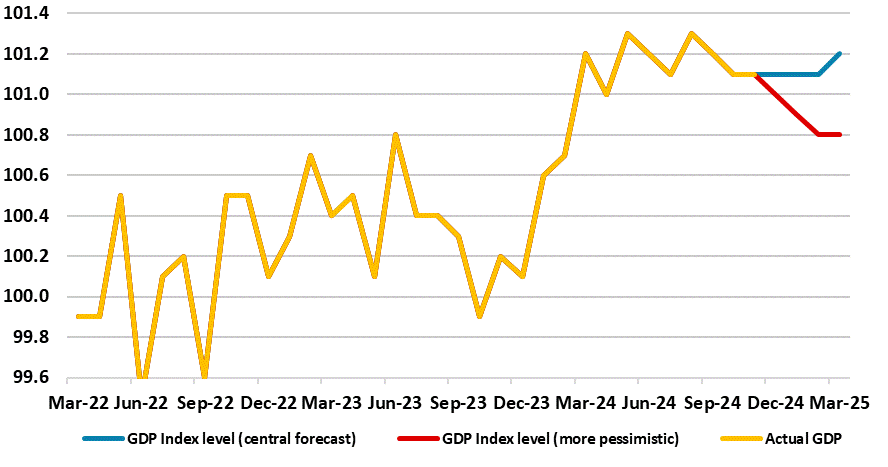

Figure : Momentum Ebbing – Amid Continued Downside Risks?

The latest set of GDP data add to already-growing questions about the UK’s economy’s apparent solidity, if not strength, as seen in sizeable q/q gains in the first two quarters of the year. As we envisaged, November saw a bare almost-0.1% m/m rise, this came after October saw a second successive m/m drop of 0.1%, all below expectations, this adding to what have now been only three positive outcomes in the last eight months of data a period in which the economy has ‘shrunk’ a cumulative 0.1%. This backdrop included evidence that the economy actually fell again in terms of private sector activity in November. Thus the 0.1% m/m rise for November must be seen in that weak and pared –back context and the likelihood remains that Q4 2024 may have seen a small q/q contraction, ie even weaker than the BoE’s recent downgrade to zero. With momentum into early 2025 also ebbing, it is clear that many on the MPC are concerned about activity weakness!

This all the more notable as it suggests a weaker trend that dates back prior to the election of the new government let alone its October Budget and its mixed policy measures. Although most evident in a further drop in manufacturing, the data do also suggest weaker services of late. While monthly real gross domestic product is estimated to have grown by 0.1% in November 2024 largely because of modest rebound in services in which the latter output grew by 0.1% in November 2024, after falling by 0.1% in October 2024 (revised down from no growth in our last release), but it showed no growth in the three months to November 2024. Otherwise, production output fell by 0.4% in November 2024, following an unrevised fall of 0.6% in October 2024; production fell by 0.7% in the three months to November 2024, driven by a decline in manufacturing. Construction output grew by 0.4% in November 2024, following a fall of 0.3% in October 2024 (revised up from a fall of 0.4% in our last release); construction also grew by 0.2% in the three months to November 2024. But the whole economy was boosted by the public sector – again!

Figure: Retail Sales Yr/Yr (%)

Though China hit the 2024 GDP growth target of 5.0%, monthly data shows the economy unbalanced. Industrial production/exports and state investment support the economy, with residential property investment negative and consumption sluggish. With monetary policy ineffective, we see Yuan3-5trn fiscal policy stimulus arriving from the March NPC and stick with our 4.5% GDP forecast until we see specific details of the package.

China’s economy remains unbalanced, despite hitting 5.0% GDP growth in 2024 – Yr/Yr at 5.4% in Q4. The December data shows a better than expected industrial production at 6.2% Yr/Yr with a 0.6% jump on the month. High tech manufacturing led the way and is consistent with the strong export picture seen recently. However, December retail sales was only marginally better than expected at 3.7%, with a mere 0.1% rise on the month. The breakdown also shows underlying weakness, with the post COVID boom in restaurants now finished with a slow 2.7% Yr/Yr. Headline retail sales was boosted by the trade in for household appliances, which was 39% Yr/Yr.

Investment also remains imbalanced with residential property investment at -10.6% YTD Yr/Yr. Fixed investment was a slow 3.2% Yr/Yr, with the private sector seeing 0.1% Yr/Yr decline. The latter sluggish private company investment also bodes badly for new jobs, given that the private sector traditionally generates the most employment change.

2025 will likely be harder, as we outlined in the December Outlook (here). Net exports positive contribution will likely become more neutral, as we see the Trump administration threat of tariffs turning into reality at 30% average by mid-year. This will hurt export growth directly to the U.S., especially as exports have recently been front loaded to avoid extra tariffs. With residential investment still likely to be a drag on GDP, plus sluggish consumption, only production and central/local/SOE investment is driving the economy.