This week's five highlights

Surprising Ukraine Incursion in Russia

RBNZ Begin Cutting

U.S. July Core CPI below 0.2% before rounding for a third straight month

UK Inflation Up on Energy But Services Resilience Diminishes

Soft Start to Q3 for China

After Russia executed strong counteroffensive operations in the western regions of Ukraine this summer, aiming to seize more territory before the U.S. presidential elections, Ukraine made a surprise attack in return and conducted a cross-border offensive inside Russia's western Kursk region on August 6. Following the incursion, Russia evacuated part of Kursk and Belgorod regions. Despite the exact aims of the operation remain unclear, it appears this operation has aimed to boost Ukrainian morale, push Russia to draw some of its forces away from Ukraine, and force Russia to the defensive positions. We foresee it is unlikely that Russia will allow Ukrainian forces to go too far, as we expect a strong Russian response in the next days in Kursk region, which will likely slow down the pace of some of the Russian operations in Ukraine. Russia will probably fire missiles and execute more drone attacks into Ukraine territory while the use of tactical nuclear weapons remains unlikely for now. We still think the fate of the war will be determined by the U.S. presidential elections in November as Putin continues to hope that Trump is reelected as U.S. president, splits western support and leading to a probable Russia-friendly peace deal with current territories, likely in 2025, while the impacts of the incursion could moderately change the game.

Ukraine conducted a cross-border offensive inside Russia's western Kursk region on August 6, and penetrated more than 30 kilometres (km) past the Ukraine-Russia border. Fighting was said to be taking place in three villages between 11 and 18 km from the border – Ivashkovskoye, Malaya Loknya and Olgovka. Following the incursion, Russia’s domestic security agency imposed a counter-terrorism regime on Kursk and two neighbouring oblasts, Bryansk and Belgorod, giving the authorities sweeping powers to lock down an area and impose controls on communications.

President Zelensky confirmed on August 10 that they started a cross-border offensive into Russia, and top Ukrainian commander Syrskyi mentioned the same day that “Ukraine is proving that it can really bring justice and guarantees exactly the kind of pressure that is needed – pressure on the aggressor.”

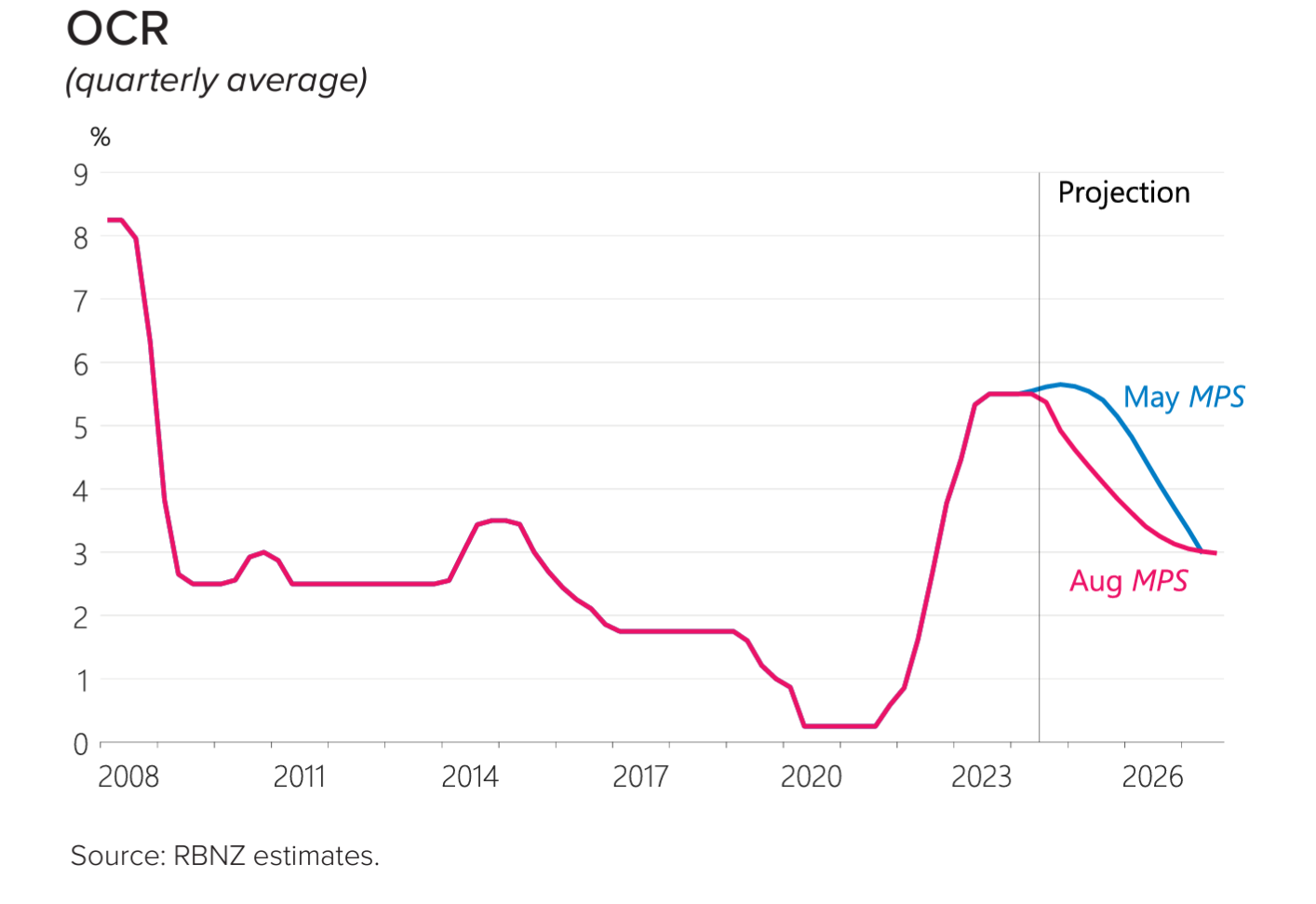

The RBNZ cut its cash rate by 25bp to 5.25% in the August meeting with significant revision in their forecast and expects inflation to return to three percent in September 2024. Some key takeaways:

Policy Change: "New Zealand’s annual consumer price inflation is returning to within the Monetary Policy Committee’s 1 to 3 percent target band." The RBNZ reinforce their view that inflation will continue to tread lower after Q2 CPI came in lower than forecast at 3.3%, shaking off the hot labor report in Q2. They cited "Surveyed inflation expectations, firms’ pricing behaviour, headline inflation, and a variety of core inflation measures" are all aligning with their forecast, which was revised significantly.

Forecast revision: The RBNZ has made significant revision to almost all forecast. The OCR forecast has been revised lower to 4.92% in December 2024 from 5.65% and at 3.85% in December 2025 from 5.14%. The OCR path shows continuous easing until year end 2026 at 3% terminal rate. Q2 2024 CPI has been revised lower to sub-two percent from three percent.

Forward Guidance Change: The forward guidance is changed to "The pace of further easing will depend on the Committee’s confidence that pricing behaviour remain consistent with a low inflation environment, and that inflation expectations are anchored around the 2 percent target." from "The Committee agreed that monetary policy will need to remain restrictive. The extent of this restraint will be tempered over time consistent with the expected decline in inflation pressures." The RBNZ is signalling they have exited tightening and entered into the easing cycle. Given the current OCR path, it looks like the RBNZ is expecting to cut rate by 2.25% till 2026, which is almost one every meeting.

The August meeting is a turning point for the RBNZ as they entered the easing cycle. The inflation picture seems to be cooling rapidly in the recent months and prompted the RBNZ to ease earlier than expected. However, the labor market remains red hot and could be a speed bump for RBNZ's smooth cutting plan.

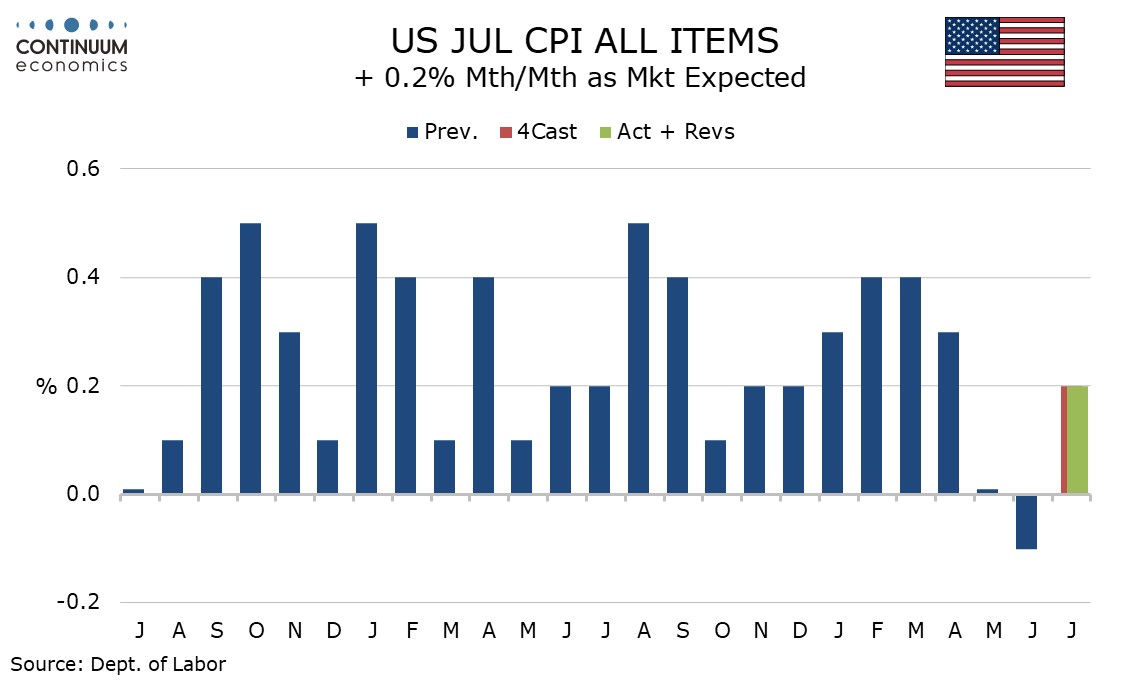

July CPI is consistent with inflationary pressures continuing to ease towards target with gains of 0.2% overall and ex food and energy as expected, but before rounding the gains were only 0.155% and 0.165% respectively. Shelter inflation persists, with a 0.4% rise accounting for nearly 90% of the overall gain, with owner’s equivalent rent at 0.362%, up from 0.276% in June, though still softer than the gains of February through May that were all rounded down to 0.4%, suggesting trend even here is easing. Commodities less food and energy at -0.3% were below trend, with used autos at -2.3% showing a particularly sharp decline and apparel also weak at -0.4%. Energy and gasoline were both unchanged after two straight dips while food showed a subdued gain of 0.2%. Services less energy saw a 0.3% increase, up from 0.1% in June and 0.2% in May, supported by shelter with services less rent of shelter unchanged. There were some other areas of strength. A 0.4% gain in transportation services saw a 1.2% rise in autos insurance outweighing a 1.6% decline in air fares. Recreation services at 0.4% were also above trend, largely on what looks like a one-time 7.6% bounce in subscription and rental of video and video games. On the downside, medical care services saw an unusual decline of 0.3%.

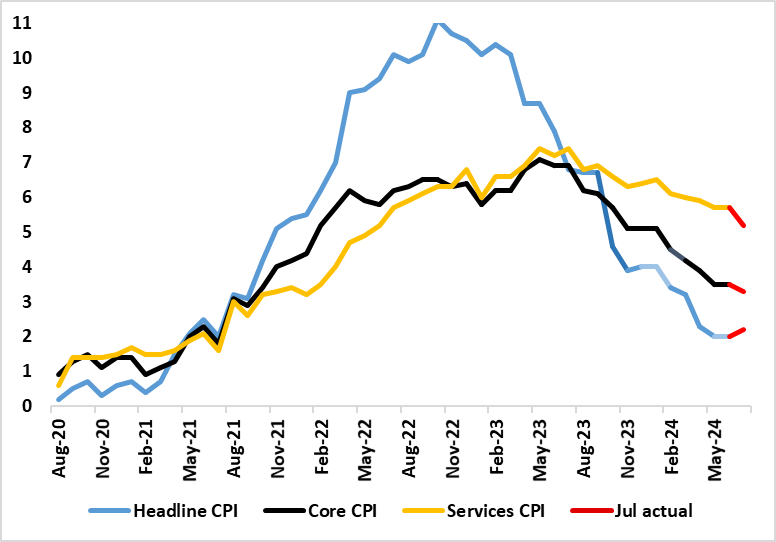

Figure: Headline and Core Inflation Diverge as Services Drop

The July CPI is notable for a clear fall in services inflation, one driven by a fall in restaurant/hotel inflation, this often seen as a bellwether indicator of price persistence. Indeed, services inflation fell 0.5 ppt to 5.2%, a two-year low and well below the BoE projection. Even so, due to energy related base effects (related to the Ofgem price cap changes), the overall CPI headline rate rose to 2.2% in July from 2.0%, this projection being a notch below the consensus and a further notch under BoE thinking. Even so, the core still fell to 3.3% (Figure), the lowest in almost three years and adjusted m/m data suggest a clear slowing short-term price dynamics. Regardless, this underlines that headline CPI inflation having dropped back to the 2% target in May (for the first time in just over three years) and stayed there in June was important but far from definitive. Indeed, apparent service sector resilience has been troubling the BoE (certainly the hawks) and will continue to do so, but probably less discernibly given these numbers as they do put a further rate cut on the table for the Sep 19 BoE verdict, much depending on the August CPI due the day before that decision.

This makes any assessment using shorter-term adjusted measures are the more compelling. In this regard we, note that the July data did see fresh softer price dynamics on this basis both for services and the core (Figure 2).

As for details, the largest upward contribution to the monthly change in CPI annual rates came from housing and household services where prices of gas and electricity fell by less than they did last year; the largest downward contribution came from restaurants and hotels, where prices of hotels fell this year having risen last year. Core CPI (excluding energy, food, alcohol and tobacco) rose by 3.3% in the 12 months to July 2024, down from 3.5% in June; the CPI goods annual rate rose from negative 1.4% to negative 0.6%, while the CPI services annual rate fell from 5.7% to 5.2%. Prices for restaurants and hotels fell by 0.4% between June and July this year, compared with a rise of 0.9% a year ago. The annual rate rose by 4.9% in the year to July 2024, down from 6.3% in the year to June. The slower annual rate was almost entirely because of the price of hotels, which saw a monthly fall of 6.4% compared with a rise of 8.2% a year ago.

Headline CPI inflation stayed at 2.0% in the June numbers and with a stable core rate of 3.5%, but with services failing to ease by remaining at 5.7% (Figure 1) and thus some 0.6 ppt above then-BoE thinking. Thus, the data alone did not give a green light to the rate cut this month and explains the strong dissent to this actual easing. However, the narrow MPC majority were instead more swayed by the thrust of inflation news that has evolved of late and by the August Monetary Policy Report continuing to point to a clear inflation undershoot ahead even after readopting an upward risks bias. These July CPI data very much accentuate this disinflation thrust and may make the narrow majority who voted for the cut vindicated.

Overall, the July data is consistent with our forecast of a weaker H2 and we still look for 4.7% GDP growth for 2024. The data is also consistent with our forecast of 4.0% in 2025 GDP growth. Consumption behavior could stall further and cause more of a drag than we anticipate and we now see a 30% probability that 2025 growth could be below 4%.

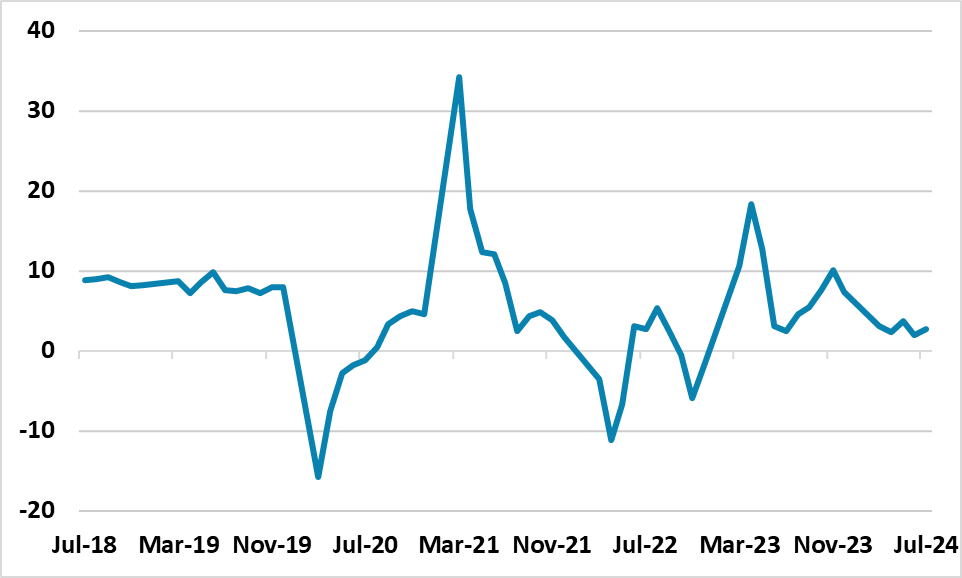

The July economic numbers from China make disappointing reading. The output side of the economy disappointed versus expectations, with industrial production at 5.1% Yr/Yr (unchanged on the month). Though high tech manufacturing held up well, other areas were soft. This is not a surprise given the weakness in retail sales in H1 2024. Meanwhile, fixed investment slowed to 3.6% YTD Yr/Yr, with the breakdown pointing to slowing state investment – though this could be weather related and the Yuan 1trn central government expenditure program should kick in over the course of H2.

Retail sales was marginally better than expected at 2.7% Yr/Yr, helped by summer travel. Even so, the breakdown suggests that the trend remains soft, with furniture and households weak and luxury goods soft. Households are suffering from a hit to wealth from the house downturn, with the NBS reporting that existing home prices are down -8.8% Yr/Yr – questions have been raised whether this fully captures the decline in transacted prices. Additionally, employment growth in the private sector has been weak, due to restrained sentiment among private businesses and flat business investment. This saps income growth and hence consumption prospects.

Overall, the data is consistent with our forecast of a weaker H2 and we still look for 4.7% for 2024. The data is also consistent with our forecast of 4.0% in 2025 GDP growth. Though some further easing will be evident this is likely to be incremental in nature. We look for a 25bps cut in the RRR rate in September and 10bps in key policy rates in October (the PBOC is moving from the MLF rate to the 7 day reverse repo rate for more control – the August MLF decision has been delayed until Aug 26). However, downside risks exist to our baseline forecasts, if the consumer slowdown is greater than expected. Retail sales trends are already soft by China standards given the structural headwinds from property, slowing employment growth and population aging. It can be argued that China is showing signs of a major hangover from the residential property bust and staling of private employment, which some says as echoes of Japan balance sheet recession in the 1990’s. Consumption behavior could stall further and cause more of a drag than we anticipate and we now see a 30% probability that 2025 growth could be below 4% -- most likely in the 3-4% region, which would feel like a recession by China’s standards!