This week's five highlights

U.S. CPI Stronger than Estimated

Tone of March FOMC Minutes is Not Hawkish but Recent Speakers' Rhetoric Suggest Otherwise

And see USD/JPY Rose To Another High

RBNZ Kept Rates on Hold

UK GDP Shows Less Fragile Recovery

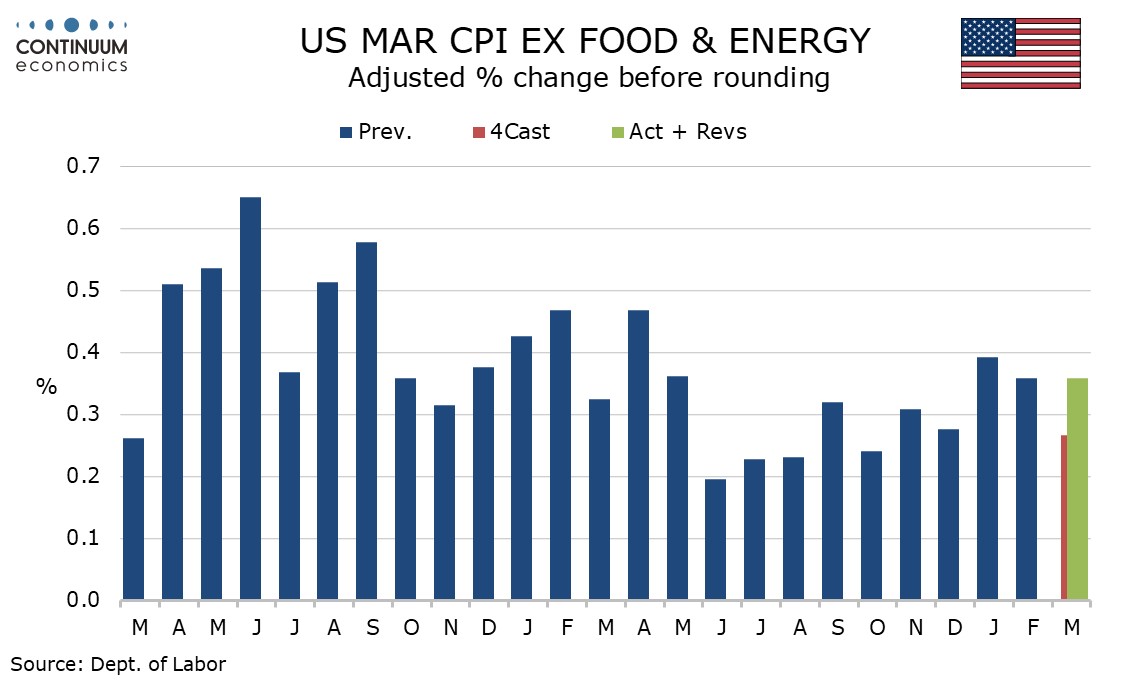

March CPI has shown a third straight disappointing month at 0.4% overall and ex food and energy, and this suggests that with the economy’s strength persisting, inflation has not yet been defeated, despite the encouraging data seen through the second half of 2023. Still, the market surprise was not dramatic, with the core rate at 0.359% before rounding, the third straight month to be rounded up to 0.4%. Overall CPI was only marginally stronger than the core, up 0.378% before rounding. Food was subdued with a 0.1% increase but energy rose by 1.1%, led by a 1.7% increase in gasoline.

Commodities less food and energy were weak with a decline of 0.2%, used autos resuming a downtrend with a 1.1% decline after a correction higher in February, though apparel saw second straight strong month with a rise of 0.7%. Services less energy services rose by 0.5% for a second straight month. This outperformed gains of 0.4% in shelter and owners’ equivalent rent. Medical care services rose by 0.6%. Transportation services were particularly strong at 1.5% despite a marginal dip in air fares led by sharp gains in motor vehicle insurance and motor vehicle repair. Other personal services rose by 0.8%. Yr/yr core CPI is unchanged at 3.8% while the headline nudged up to 3.5% from 3.2%.

FOMC minutes from March show little sign of disagreement and the tone is not hawkish, with participants expecting both inflation and the economy to slow, and there being a clear majority view that the pace of balance sheet reduction should soon be trimmed. Optimism on inflation is however cautious which the strong CPI outcome for March is likely to have dented.

Participants noted that they continued to expect that inflation would return to 2% over the medium term. They observed that significant progress had been made over the past year even though January and February data had been firmer than expected. Some noted that those gains had been relatively broad based and should not be seen as aberrations. However a few noted that residual seasonality could have impacted the readings. Some unevenness was anticipated as inflation returned to target though it was noted that recent data had not increased their confidence of a return to target, and March data will have caused further doubts. Participants also expected economic growth to slow from 2023’s strong pace and assessed that labor demand and supply were coming into better balance.

All agreed it was appropriate to leave policy unchanged at the meeting and almost all agreed it would be appropriate to ease at some point this year if the economy evolved as expected, though they wanted greater confidence on inflation returning to target before easing. They noted the risks of easing too late and too soon, with incoming data seen as important for assessing the latter risk. On policy the message is of a consensus looking towards easing despite recent disappointing data but the consensus having some vulnerability to further strong data, which has materialized in March’s CPI release.

Before discussing the economy and when to ease, the minutes address the pace of balance sheet reduction, which suggests that the conclusions here are unlikely to be vulnerable to the CPI disappointment. After reviewing lessons from 2017-2019, participants broadly assessed a cautious approach to further runoff was appropriate with the vast majority favoring slowing the pace of runoff fairly soon. This did not mean that the balance sheet would ultimately shrink by less than it would otherwise. Participants generally favored reducing the monthly pace of runoff by roughly half from that seen currently. Participants generally preferred to maintain the existing cap on agency MBS and adjust that on USTs.

The hotter than expected CPI and subsequent Fed speakers have led to market participants anticipating later or less easing from the Fed this year. USD and U.S. Treasury Yields jumped with the JPY being another victim. USD/JPY has been hovering at high after BoJ's policy shift. Japanese Finance ministers had been trying to verbally support JPY with threats of intervention but remain fruitless. The last leg of USD saw USD/JPY refresh historic high to above the 153 figure with little sign of stopping. Despite yield differentials may narrow in a medium run, it looks like the likely path is further north in a short run untill BoJ intervenes.

On the chart, the anticipated break above the 152.75 multi-year Fibonacci retracement has reached a fresh (34 year) high at 153.25, where unwinding overbought intraday studies are prompting short-term reactions. Daily studies have ticked higher and broader weekly charts are positive, highlighting room for further USD- and JPY-driven gains in the coming sessions. A break above 153.25 will open up 154.00. However, the next significant resistance is at the 155.80 high of June 1990. Meanwhile, support remains at 152.00. A close beneath here, if seen, will turn sentiment neutral and put prices into congestion supported at 151.00.

RBNZ kept rates unchanged at 5.5% and suggest OCR to stay restrictive for a sustained period of time. The key to the April meeting from the RBNZ is that while they do not see a significant revision towards medium term CPI and OCR, they are forecasting the Q1 CPI to spike due to transitory factors. This statement could be read as a pre-emptive measure to deal with market participant's reaction towards higher CPI. In the February OCR forecast, it is suggested they maybe a cut by the end of 2024 and the April statement is suggesting the cut may not materialize if inflation is not returning along forecast.

- CPI Will Spike in Q1: "The Committee noted that recent monthly Selected Price Indices (SPI) imply some upside risk to the March 2024 quarter Consumers Price Index (CPI)." RBNZ is being per-emptive here to tell the market CPI will spike in Q1 from preliminary data but only due to volatile factors.

- Signal Restrictive Rates Stays: "The Committee agreed that interest rates need to remain at a restrictive level for a sustained period to ensure annual consumer price inflation returns to the 1 to 3 percent target range." The forward guidance from RBNZ suggested that the need for OCR to remain at current level at least for the calendar year, signalling the one rate cut that was presented in the February OCR forecast may not happen .

However, we still believe there will unlikely be more upward revision in the coming meeting as the RBNZ has made it clear the higher Q1 headline inflation is transitory and current restrictive rates are sufficient to see CPI returning to target range.

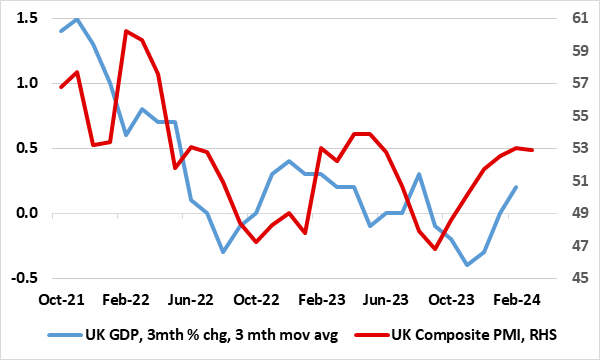

Figure 1: Tentative Recovery – Output Recovering?

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly much better with GDP growth only modestly positive. Admittedly, coming in as largely expected, and despite industrial action, GDP rose by 0.1% m/m in February accentuating the upgraded 0.3% bounce in January data, a result that nevertheless is nothing more than a continuation of the monthly swings seen of late, which means that y/y growth is still negative. Admittedly, unseasonable weather may have played a part in hampering February activity, most notably in construction and it is noteworthy that the 3 mth rate tuned positive in February for the first time since last summer. Regardless, the modest added momentum so far in Q1 suggests that the quarter may see GDP growth of 0.3%, higher than BoE thinking and fully reversing the slide seen in Q4 last year.

This, alongside some better business survey readings (Figure 1), may be something that the BoE hawks use as a rationale to argue for no near-term rate cut, even though this may add to effective debt servicing costs facing consumers. More notably, unless this early-year momentum builds, the economy is still likely to grow this year by no more than 0.3% q/q, a result that chimes with existing BoE thinking, which is being shaped more by price and costs developments not real activity. As for details, GDP is estimated to have grown by 0.2% in the three months to February 2024, compared with the three months to November 2023. Services output was the main contributor, with a growth of 0.2% in this period, while production output rose by 0.7% and construction fell by 1.0%. Perhaps the most striking feature was the large and broad based rise in manufacturing. Indeed, overall production output is estimated to have grown by 0.7% in the three months to February 2024 compared with the three months to November 2023. This was driven by a 1.1% m/m rise in manufacturing output. Electricity, gas steam and air conditioning supply also contributed positively, with a 1.2% growth in this period, while there were falls of 2.0% in water supply, sewerage, waste management, and 2.5% in mining and quarrying.