USD, CAD, JPY flows:Tariff uncertainty persists, JPY has potential for big rally

Tariffs on Canada, Mexico and China are due to be imposed tomorrow but now look likely to be les than the threatened 25%. However, USD/CAD still looks biased higher if the tariff increase is significant. USD/JPY looks very out of line with yield spreads and could see a sharp move lower.

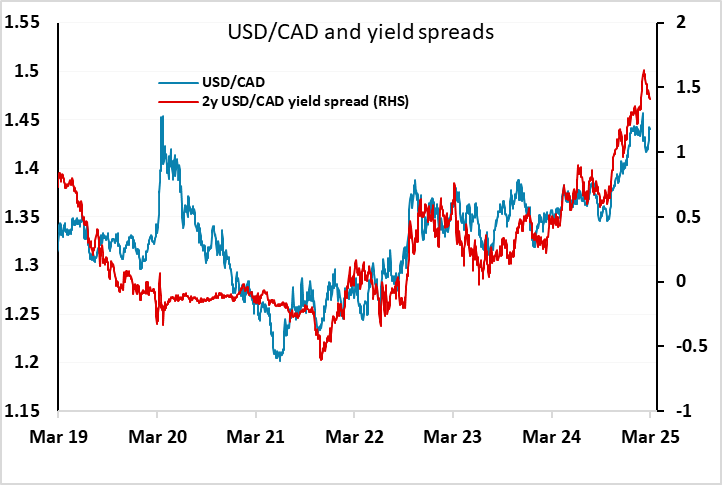

The focus at the beginning of the week will be whether and to what extent Trump imposes tariffs on Canada, Mexico and China. Trump’s commerce secretary, Howard Lutnick, said on Sunday that US tariffs on Canada and Mexico will go into effect on Tuesday, but the president would determine whether to stick with the planned 25% level. This suggests Trump may not impose the full threatened 25% tariffs on all goods from Mexico and non-energy imports from Canada, but even a more modest increase could have a significant negative impact on the Canadian economy. USD/CAD isn’t much changed from Fridays close, and remains at levels that suggests the market isn’t really expecting a major tariff increase, as current USD/CAD levels are slightly below levels consistent with current yield spreads. USD/CAD risks may therefore still be to the upside, but if tariffs are delayed again or imposed at less than 10% USD/CAD may edge lower.

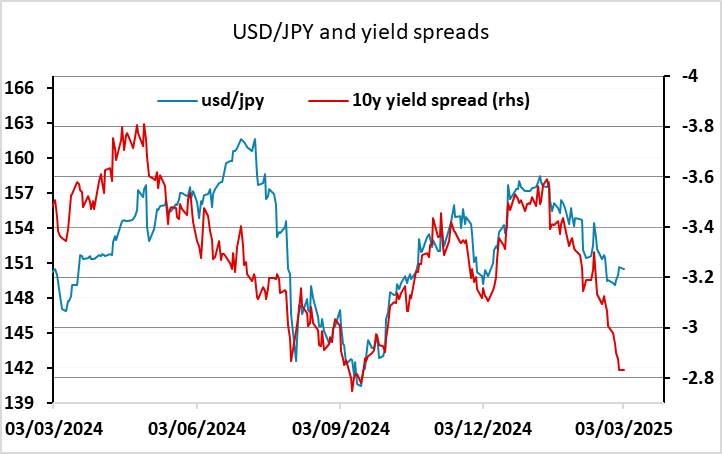

Otherwise, the USD’s strength at the end of last week looks overdone, particularly against the JPY, with yield spreads suggesting potential for a substantial USD/JPY decline. USD gains may have been partly due to end of month flow, and if so we may see much of last week’s gains reversed early this week. However, uncertainty around the tariff issue could preclude much movement today. If tariffs are imposed, the JPY seems likely to benefit from the negative equity response, while if they are not we could see more general USD losses Either way, USD/JPY upside looks very limited and there is potential for a big move lower if concern about recent softer US data persists.