EUR flows: EUR stays steady despite strong GDP

Eurozone GDP beating consensus, suggesting upside risks for EUR

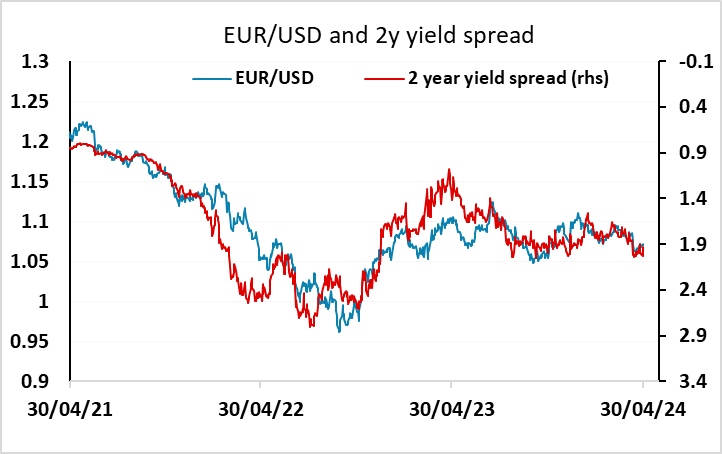

Eurozone GDP now clearly coming in stronger than expected after beats from France, Spain and Germany, but EUR/USD unimpressed and holding close to 1.07. The CPI data has also been on the firm side, with the French numbers this morning slightly higher than consensus on an HICP basis, as were the German numbers yesterday. But short end EUR yields have been essentially unmoved, with the ECB still priced as around a 70% chance to ease in June. As long as 2 year yields remain little changed, EUR/USD is likely to be similarly stable.

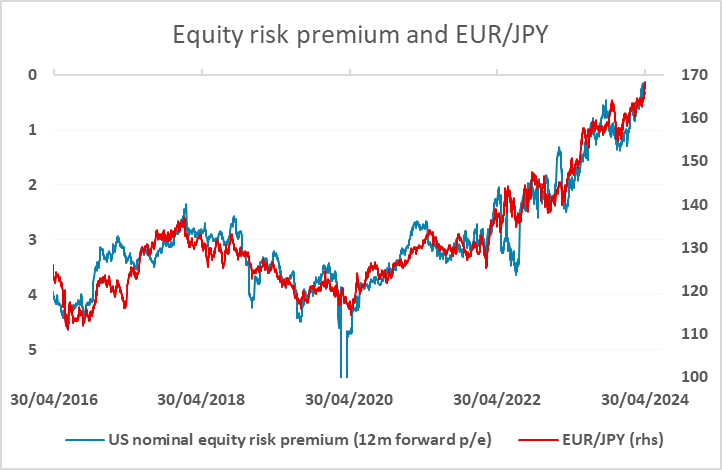

But we do start to see greater risks on the upside now. Part of this comes through the JPY. EUR/JPY remains closely correlated with equity risk premia, which support current EUR/JPY levels. Even though this correlation has little fundamental justification, it remains hard to oppose. But USD/JPY upside looks very limited now, both because of BoJ intervention and because the yield spread correlation doesn’t support current levels.

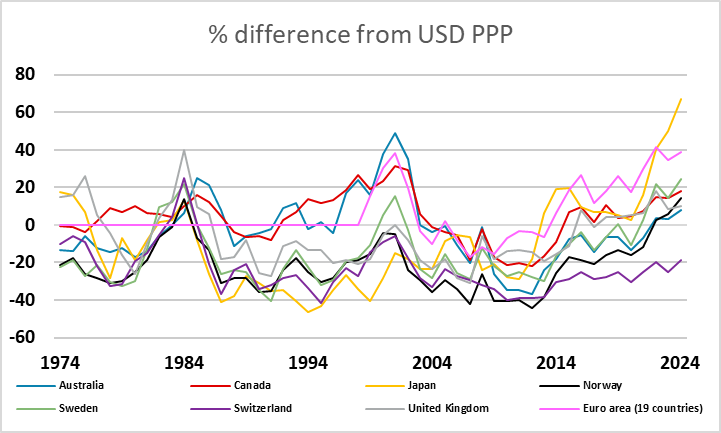

So there may now be scope for the EUR and the JPY to both rise against the USD. This would be more likely if the recent relative improvement in the Eurozone PMIs translated into relative GDP performance. The Q1 data now looks likely to show the Eurozone not far behind the US, and if the Eurozone continues to improve into Q2, this could allow a more significant EUR rise. For now the focus on tomorrow’s FOMC limits the scope for USD losses, but any less than hawkish indication from Powell could trigger some USD weakness. It should be remembered that not only is the JPY is at record weak levels, the EUR is also very weak form a long term perspective, and the USD is likely to fall substantially against both in the medium to long term.