GBP flows: GBP marginally weaker after MPC leaves rates unchanged

BoE decision contains few surprises, but risks remain to the GBP downside

EUR/GBP initially dipped slightly in response to the BoE MPC announcement, but has since moved higher, although there are few real surprises in the statement. The 7-2 vote, with 2 votes for a cut, was slightly more dovish than expected as the consensus was for an 8-1 split. As expected, the MPC voted to reduce QT to £70bn in the coming year, against £100bn before, with one dissent in each direction. The staff forecast for Q3 GDP was raised slightly to 0.4% from 0.3%, but inflation is still expected to peak at 4% in September.

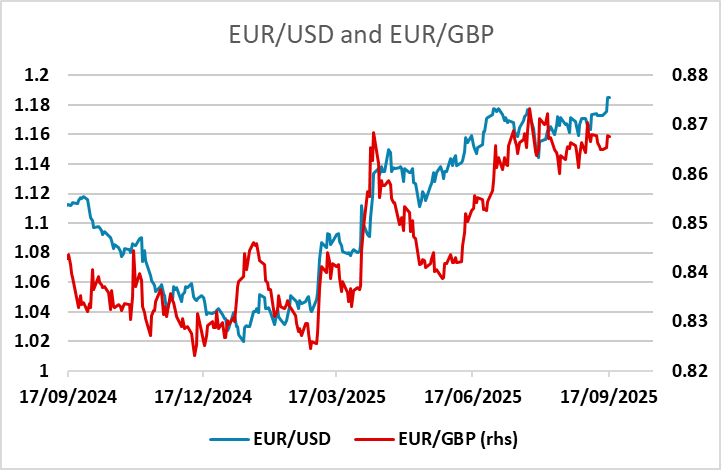

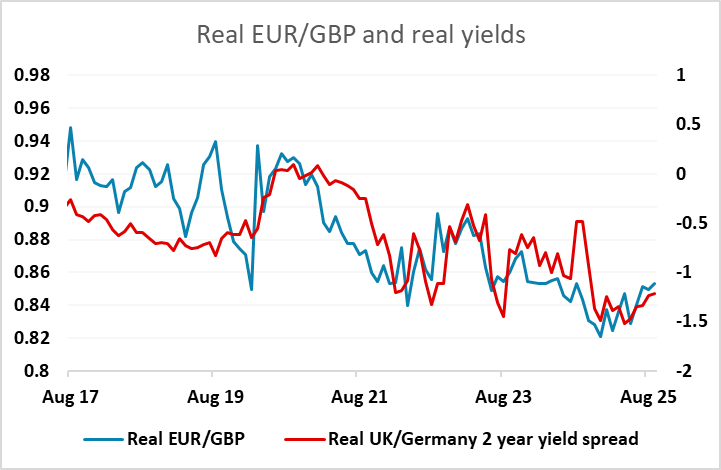

All in all the stance remains cautious, still talking about a “gradual and careful” withdrawal of monetary policy restraint. Even so, with a rate cut not fully priced in until April next year, and a clear bias to ease, the risks remain towards lower rather than high UK yields, and consequently to the upside for EUR/GBP. Longer term, we would still expect some convergence of real yields with the Eurozone, and this would suggest significant gains in EUR/GBP. Shorter term, the rise in EUR/USD we have seen in the last couple of weeks also suggests EUR/GBP upside risks.