GBP, EUR flows: GBP softer after borrowing data

GBP edges lower after higher than expected PSNB. EUR rally fades after Trump tariff threat

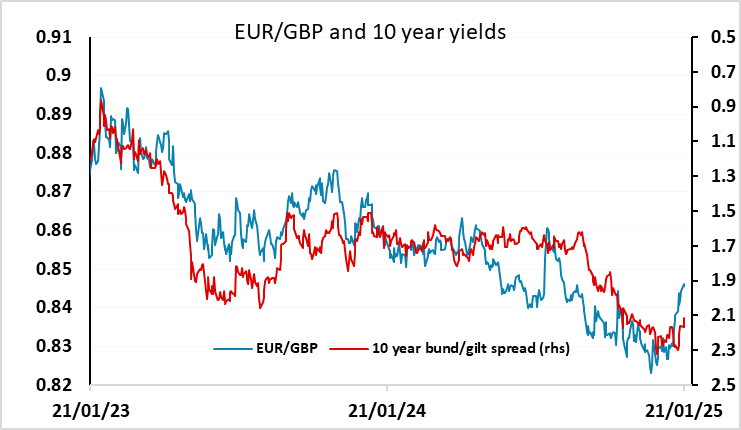

GBP has fallen slightly after the UK public sector net borrowing numbers showed December borrowing £3.6bn higher than expected at £17.8bn. These are volatile numbers and the PSNCR was slightly below last December’s number, so we wouldn’t conclude anything significant from the data at this stage. But UK public borrowing is set to rise over the next year, and all the more so if growth doesn’t improve, so the picture for GBP remains negative with further deterioration in the public finances likely unless the BoE cuts rates more aggressively. Both scenarios are GBP negative, so we look for a move above 0.85 in EUR/GBP after the February 6 BoE meeting if not before.

Elsewhere it has been a fairly quiet overnight session, but Trump is floating the idea of a 10% tariff in the EU which may take the edge off the more positive EUR tone seen yesterday. Even so, this is quite a modest move and most likely a negotiating position rather than a defined policy, so at this stage we wouldn’t expect any major reaction. Yield spreads still suggests some mild EUR upside risk.