JPY, AUD flows: JPY and AUD firmer in quiet conditions

JPY reocvers some ground, AUD extends gains but hard to see major moves in quiet markets

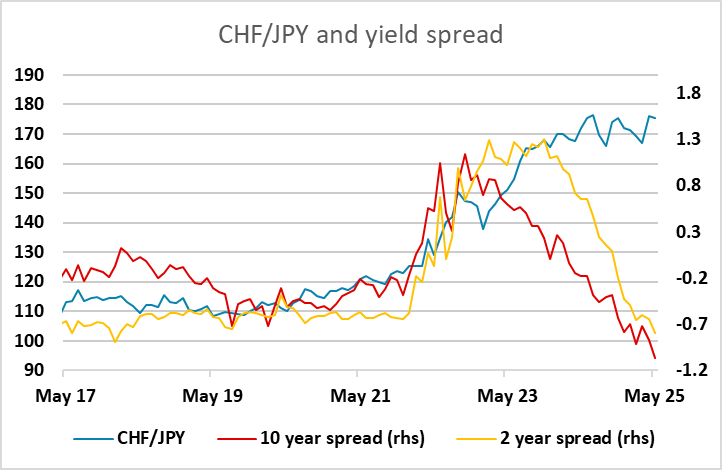

A quiet calendar on Wednesday limits the scope for volatility. The JPY has been firmer overnight, although without any specific trigger. Certainly, we would see current levels as likely to prove close to a JPY bottom on a longer-term basis, so as momentum fades longer term players may see these as attractive JPY buying levels. However, as long as risk appetite remains positive, it is unlikely the JPY will advance far on a broad front. But we do see a lot of value in CHF/JPY, which remains close to all time highs while yield spreads have oved in the JPYs favour.

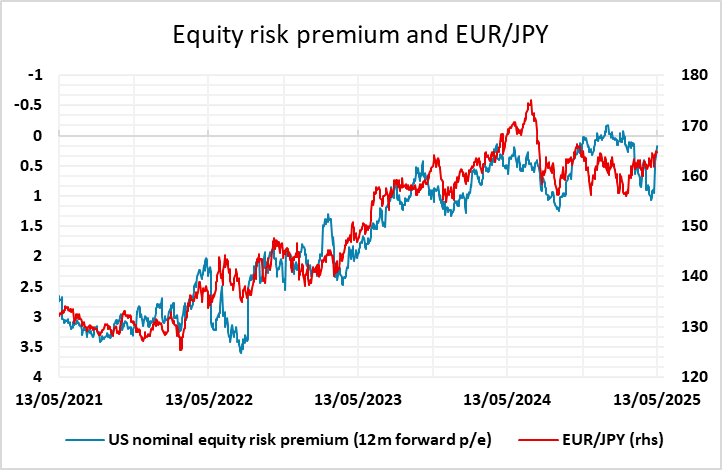

The AUD has also managed some gains in the last 24 hours, helped by the solid tone to equities, while the overnight Australian data showing a firmer than expected wage and price index may also restrict expectations of RBA easing. But the underlying driver is still likely to be risk sentiment, so we would be a little wary of assuming AUD gains will extend across the board as the S&P looks fully valued close to 6000.