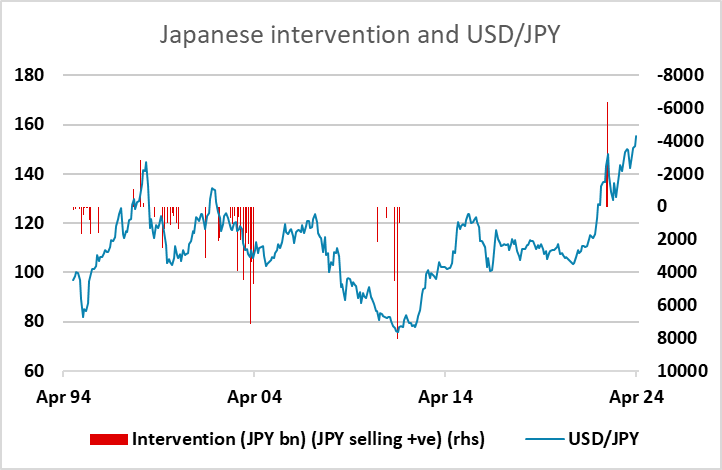

JPY flows: Sharp JPY rally might be intervention

USD/JPY fell 170 pips in a few minutes, suggesting potential intervention, but this is unconfirmed. If this is intervention more is likely to be required if JPY weakness is to be stopped, but some stability may now be seen until the US opens.

USD/JPY fell 170 pips in 3 minutes at 9 am London, in a move that looked like it might be due to official action from the Japanese authorities. But there is no confirmation from Japan’s Ministry of Finance, and USD/JP has quickly recovered 145 pips to stand only 35 pips below the highs. Intervention would be no surprise given the JPY weakness since the BoJ meeting, especially since the JPY’s decline isn’t really supported by any movement in Japanese yields or yield spreads. But if this is official intervention, further action will be required if the BoJ is to halt JPY declines, with the market unlikely to give up the trend easily. Nevertheless, given the extreme weakness of the JPY and the historic success of the BoJ in intervening at extremes, traders are likely to be wary of holding short JPY positions at these levels, and we may see some near term stabilisation.