GBP flows: GBP lower after MPC votes 6-3 for no change in policy rate

BoE leaves rates unchanged but deputy governor Ramsden joins the established doves in voting for a rate cut. Nevertheless statement still suggetss rate cuts will be gradual, and GBP has already fallen significantly in the last week

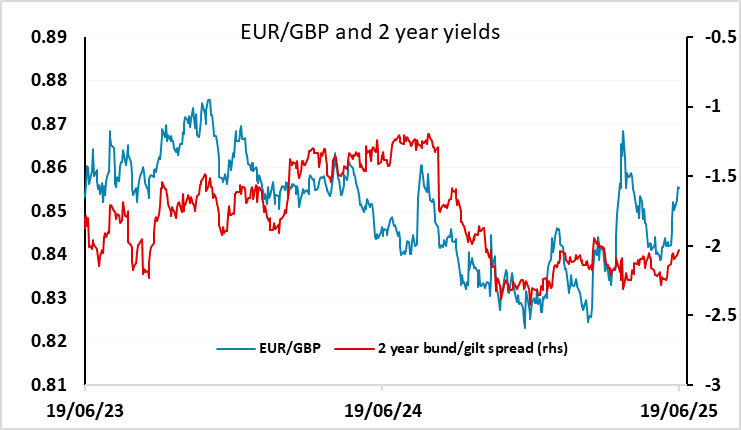

GBP has fallen back after the BoE voted 6-3 for no change in rates, with deputy governor Ramsden joining the established doves Dhingra and Taylor in voting for a cut. The market consensus was for a 7-2 split, so the extra vote suggests a more dovish bias than expected. However, the statement is not particularly dovish, with the Bank saying policy will need to remain restrictive and rate cuts would remain “gradual and careful”, while also saying they thought the tariff shock would be smaller than first estimated. With EUR/GBP already having risen fairly significantly since last week’s weak labour market data, we doubt there will be an extended response to the vote split. Although EUR/GBP will now be well supported above 0.85, and should retain a mildly firm tone, it will be hard to extend gains beyond 0.86.