This week's five highlights

U.S. Dollar Under Trump

Trump’s Policies and U.S. Equities

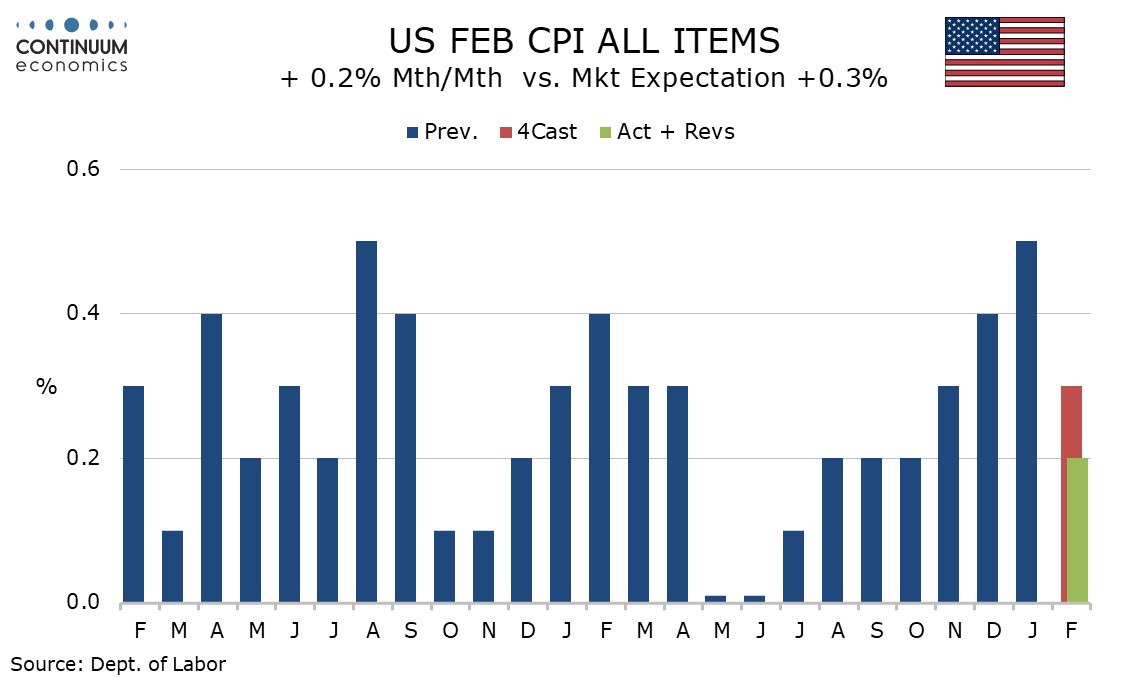

U.S. February CPI Renewed progress, but threatened by tariffs

Bank of Canada Another Cut

PBOC Slow Cuts with 5% Nominal GDP

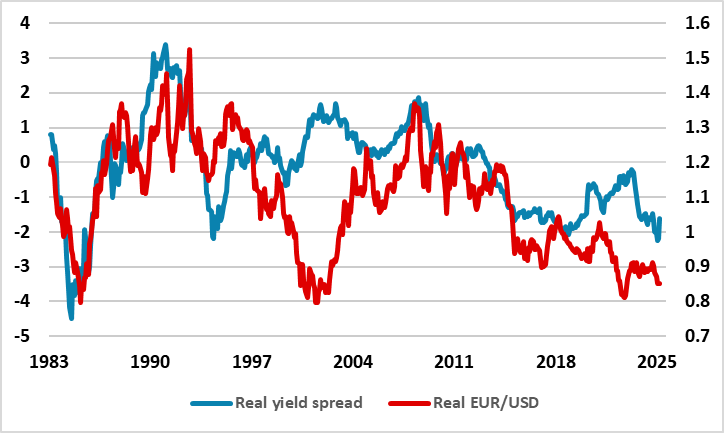

Figure: Real EUR/USD (RHS) and Real 10yr U.S.-Germany Government Bond Spread (LHS)

The Trump administration could decide to more broadly talk the USD down or less likely try to reach a cooperative Mar A Lago accord with big DM and EM countries. A more cohesive alternative is a forced currency deal for countries to appreciate their currencies to avoid more tariffs and withdrawal of U.S. military security guarantees. Worst case alternative would force foreign central banks to swap short-dated U.S. Treasuries into 100yr bonds i.e. a debt reprofiling that is a partial debt default with toxic consequences. The most likely approach is more complaints that certain currencies are too weak and some USD jawboning. Trump hates multilateral approaches and loves a bilateral focus.

Key points to note:

· Your currency is too weak. Trump this week has said of Japan and China that you cannot continue to reduce and break down your currency and that it is unfair to the U.S. Trump then noted that the U.S. response will be higher tariffs. This is targeted bilateral pressure that Trump loves and is designed to get other countries to raise the value of their currencies against the USD. The JPY is seeing a recovery and we actually see a move to 135 this year on further BOJ hikes; Fed easing; rate spreads and the U.S. losing the perception of exceptionalism. For USDCNY, we see a move to 7.45 given already large interest rate differentials (here), but unlike 2018 China is not undertaking noticeable depreciation despite 20% extra tariffs from the U.S. – China will not be keen on a Yuan appreciation however. The Euro (EUR) could get similar verbal intervention from Trump at some stage.

· Talking the USD down and more Fed rate cuts. A broader approach is to say that the value of the USD is currently too high (true) but that the U.S. still believes in stable inflation for a “strong” USD. The U.S. has done this in the past, with the most well known being the 1985 Plaza accord (Trump later bought and sold the hotel). In 2003, U.S. Treasury secretary Snow jawboning led to a USD decline (here), when the USD was overvalued compared to interest rate differentials – see Figure 1 for EUR/USD. The USD currently looks overvalued relative to real interest rate differentials of select DM currencies (JPY and EUR). Trump or Bessant jawboning the USD would have some impact in hurting the USD initially. However, in general, FX policy is hard to enact effectively independent of monetary policy. The Plaza and Louvre accords which affected the value of the USD in 1985 and 1987 respectively saw the USD decline and then stabilize because monetary policy was in part focused on FX policy. In a world of inflation targeting by central banks it will be hard to get FX policy to work in this way. However, when FX values are deviating from fundamental relationships with value and yield spreads, intervention (verbal or actual) can have an impact in bringing currencies back into line. In 2025, much depends on what the Fed is doing relative to other central banks, which at the moment is only really narrowing rate differentials versus Japan. A U.S. hard landing would see aggressive Fed easing and associated USD decline, but that depends on economic data. One associated issue to watch for is Trump pressuring the Fed to cut rates if the equity market says see a 10% peak to trough decline like 2018. This would hurt the USD initially, though the Fed would be reluctant to become politicised.

· Cooperative Mar A Lago accord. Steve Miran the president’s CEA advisor has pushed this idea (here) in various forms. One form is a cooperative Mar A Lago accord like the Plaza accord. The problem is that as well as FX intervention this could require reducing interest rate differentials e.g. Fed cutting and ECB hiking! Additionally, big EM currencies are also now important unlike 1985. It is unlikely that India, China and South Africa push to appreciate their currencies versus the USD or hike rates to help lower the value of the USD. Countries outside the U.S. are also not in a cooperative spirit with actual tariffs against Canada/Mexico/China, steel and aluminium from March 12 and more product and reciprocal tariffs from April. Finally, Trump hates multilateral approaches and loves a bilateral focus.

· Forced Mar A Lago deal. One other idea floating around the Trump administration is that the U.S. forces a deal with threats. Appreciate your currency or else face more tariffs and withdrawal of U.S. security guarantees. Do as the U.S. wants and you face less tariff threat and continued U.S. military protection. Japan/S Korea and Taiwan would be very fearful of losing the U.S. military security guarantee and feel pressured. However, European countries have already decided that the Trump administration cannot be trusted with Europe defence and hence the huge effort to boost Europe defence spending in the last few weeks. How this cohesive approach would work with big EM countries is unclear e.g. India/S Africa/Brazil. It would led private investors to fear more toxic solutions (see below) and this could backfire on U.S. financial markets.

· Swapping your U.S. Treasuries into 100yr bonds or charging a withdrawal fee. Two other ideas floated by Miran are swapping foreign central bank holdings into 100yr Treasuries or perpetual bonds or charging a withdrawal fee (e.g. for coupon payments). The former if forced would a debt reprofiling, which the UK effectively did in 1932 after World War 1 or Greece did after the 2010 crisis. This is technically a partial debt default, which would see private holders around the world dump U.S. Treasuries; surge U.S. nominal and real yields and cause a U.S. equity market crash/U.S. recession. If voluntary it would led to dumping of Treasuries and a surge in U.S. bond yields! The 2 idea of charging a withdrawal fee to foreign holders is also toxic to overseas holders and would led to sharp reduction in overseas holdings of U.S. Treasuries. These ideas are a disaster for a large debtor country that depends on foreign holders. The U.S. net international investment position is estimated by the IMF ESR to be 70% of GDP in 2023 – a high level already (Figure 2). You do not want to upset your creditors.

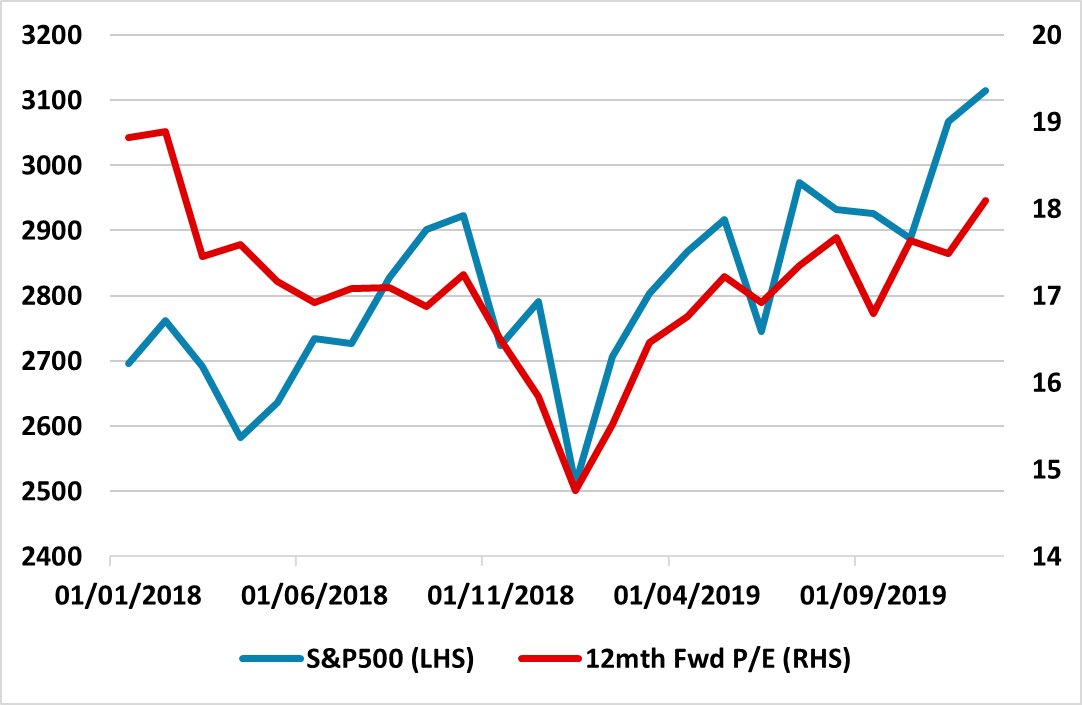

Figure: S&P500 2018-19

Models would suggest that the current and prospective direct tariff impact should slow GDP growth to a 1.5% pace, which should see slow Fed easing in 2025 given the boost to inflation. However, the policy uncertainty means that business and consumer behaviour could see a large adverse hit that keeps the equity market worried about the harder landing scenario. We see scope for the selloff to extend through the spring to 5200 on the S&P500, as Trump introduces new product and reciprocal tariffs from April. We now look for 5700 by end 2025.

The U.S. equity market is not happy with the Trump administration implementation of tariff policy. Adjustment is occurring to market participants thinking. Some tariffs are now expected to be permanent (for tax revenue purposes and to shift production back to the U.S.) plus some potentially temporary (to get trade concessions). With more product tariffs expected at 25% in April and reciprocal tariffs, the breadth and pace are wider than 2018 when it largely focused on China after the initial steel and aluminum tariffs. Additionally, policy uncertainty has increased, with a more chaotic process of late announcements and delays than in 2018. Moreover, the success of any production switch to the U.S. will vary, as some products have no or limited U.S. supply currently. This likely means higher prices, less demand in the U.S., delayed investment and softer GDP. Finally, Trump decision to have a trade war with multiple countries at the same time risks demand for U.S. exports being hit, with a backlash in Canada and against Tesla in Europe.

February CPI is softer than expected with gains of 0.2% both overall and ex food and energy, with the ex food and energy rate up by 0.227% before rounding. Coming after a strong January conclusions should be cautious, while upcoming months may be lifted by tariffs. However, the data will come as a relief to the Fed. Food and energy both rose by 0.2%, food moderating despite continued surging in the price of eggs with dairy products and fruits/vegetables declining, while energy’s gain came despite a 1.0% fall in gasoline, with energy services up by 1.4%.

Commodities ex food and energy rose by 0.2%. Used autos with a 0.9% rise slowed from 2.2% in January and apparel rose by 0.6% after a 1.4% January decline. Recreation commodities with a 0.7% decline were the main restraint, but most components were subdued. Services less energy services rose by 0.3%. The main restraint was a 0.8% decline in transport services following a 1.8% increase in January, with air fares down by 4.0% and auto services seeing moderate gains after a strong January. Owners’ equivalent rent rose by 0.3% for a fourth straight month. Recreation services were firm with a rise of 0.7%. Yr/yr CPI slipped to 2.8% from 3.0% and the ex food and energy rate fell to 3.1% from 3.3%, the latter reaching its slowest since April 2021. This suggests the Fed continues to make progress, albeit slow and bumpy, towards reducing inflation to target. It remains to be seen in tariffs will threaten that progress. We expect they will.

The Bank of Canada eased as expected by 25bps to 2.75%, a level it sees as neutral. Given massive uncertainty clear forward guidance is impossible but they made no attempt to hide the gravity of the problem, Governor Tiff Macklem stating Canada is facing a new crisis from which the economic impact could be severe. Near term downside risk looks set to be the focus but the BoC will ensure that any price rise is short term. The BoC states that it cannot offset the effects of a trade war, meaning a hit to output and a lift to prices is seen as inevitable. Its focus will be on the timing and strength of both the downward pressure on inflation from a weaker economy and the upward pressure from higher costs. The focus on timing as well as strength suggests that the immediate focus will be on supporting the economy, as seen in the latest easing. The economy is likely to respond to the trade war quicker than prices. However, if higher inflation feeds into medium or longer term expectations, the BoC will have to act against that.

The BoC conducted a survey of consumers and businesses and the economic findings look negative. 27% of consumers plan more precautionary savings and 11% less. On major purchases, 7% see more and 25% less. Business findings look even worse, with 40% reducing employment plans and only 2% increasing them, while 48% are reducing capital expenditure plans and only 9% increasing them. Business pricing plans do suggest tariffs will not be fully passed through. Around half expect to raise prices in response to tariffs, though of those, three quarters expect to pass on more than half of the tariff cost. Still, 47% expect an increase in prices charged to Canadian households with only 7% seeing a decrease. Consumer findings show 72% expecting the cost of living to be boosted while 11% expect a decline.

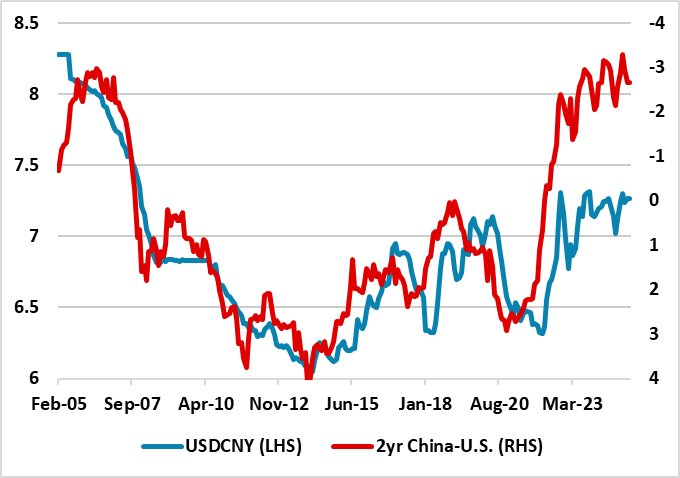

Figure: USDCNY and 2yr China-U.S. Government Bond Spread (%)

The PBOC will likely cut slowly and gradually, as China seeks to avoid Yuan depreciation that could worsen the trade war with the U.S. Additionally, MOF last week forecast nominal GDP of 5%, which with a real GDP target of 5% means that MOF is also forecasting zero inflation. Close to zero inflation is thus consistent with only slow and 10bps easing steps in the 7-day reverse repo rate in the coming quarters.

Additional PBOC monetary policy stimulus will likely be slow and gradual in 2025 for a number of reasons.

• Disinflation but 5% Nominal GDP target. The latest February CPI data shows that the aggressive disinflation remains with an excess of production over domestic demand squeezing prices. Though the headline decline of -0.7% was exaggerated due to food price declines, the core inflation rate fell to -0.1% Yr/Yr in February. The breakdown of the data shows the squeeze not only in goods inflation, but also services inflation that declined -0.4% Yr/Yr as consumption remains sluggish. Though the headline figure should rebound in March, we remain of the view that inflation will likely be +0.1% in 2025. However, it is worth noting that MOF last week forecast nominal GDP of 5%, which with a real GDP target of 5% means that MOF is also forecasting zero inflation.

• PBOC slow and gradual. Though the authorities are signalling that further monetary policy easing will be delivered, the pace will likely be slow and gradual. China does not want to widen the interest rate differentials versus the U.S. (Figure 1), as it could weaken the Yuan and prompt more tariffs from President Trump and a delay in the desired trade negotiations with the U.S. This means that the timing of Fed rate cuts will be an issue in determining cuts in the 7-day reverse repo rate currently at 1.5%. China could move ahead of the Fed still, but this will likely be a 10bps move. It could be that only three 10bps cuts are delivered in 2025. Two to three 25bps cuts in the RRR rate are also likely in 2025. Given the balance sheet repair by households, this is small to ineffective monetary policy stimulus.

• Fiscal policy and lending. This places the onus on fiscal policy. However, last week announcements were at the low end of expectations (here). Though policymakers signalled that more fiscal stimulus could be delivered, this will likely be incremental rather than aggressive – part of the delay is too assess the full implementation of trade tariffs by the U.S. Meanwhile, the extra Yuan500bln equity capital for major banks should help credit supply, but China really needs 10% M2 growth to ensure 5% real GDP. Without improved sentiment for households and private businesses, credit demand may not pick up and help delivering a lending boost. Overall, we continue to project 4.5% real GDP growth for 2025 and 2026.