FX Daily Strategy: APAC, March 12th

U.S. CPI to be Stronger with Core Rate Back to Trend

May Lead to a Rebound in DXY

BoJ Monetary Policy Ready for "Leak"

Japan Wage Negotiation Result to Move JPY

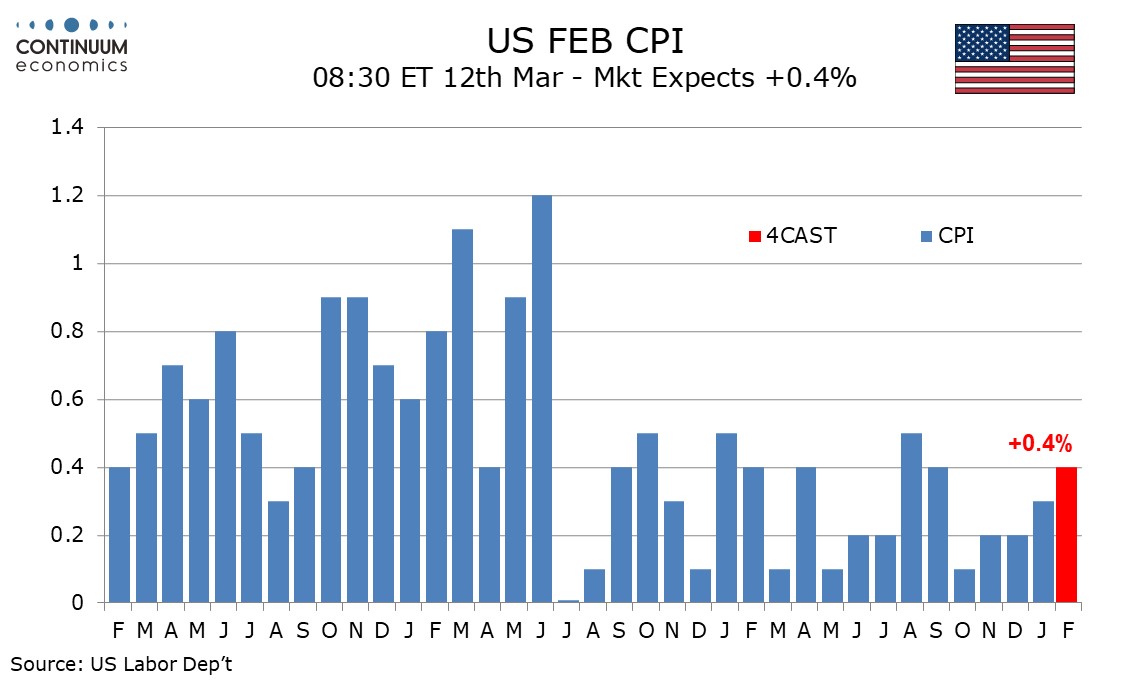

We expect February CPI to increase by 0.4%, which would be the strongest monthly increase since September, with a 0.3% increase ex food and energy, the latter a return to trend after a surprisingly strong 0.4% in January. Before rounding we expect February’s core CPI to rise by 0.29%. January’s core CPI strength was led by services, with services ex energy surging by 0.7%, while commodities ex food and energy fell by 0.3%, led by a sharp fall in used autos. Weakness in commodities reflects improving supply while strength in services reflects strength in demand and possibly wages, though we expect many of the price hikes were one-time adjustments made at the start of the year. We do not expect a repeat in February, but we do not expect a correction below trend to follow the above trend month.

Core CPI trend slowed significantly in June which delivered the first of three straight 0.2% gains, but three of the final four months of 2023 delivered gains of 0.3% with the last 0.2% gain coming back in October. Unexpectedly strong GDP growth may be sustaining moderate inflationary pressures, which may take some time to ease in 2024. We expect most service components of February’s core CPI breakdown to be close to 0.2% though housing and medical care are likely to remain firm, if a little less so than in January. Commodities ae likely to be soft, though we doubt used autos will match a steep 3.4% January decline, and that reduces downside risk.

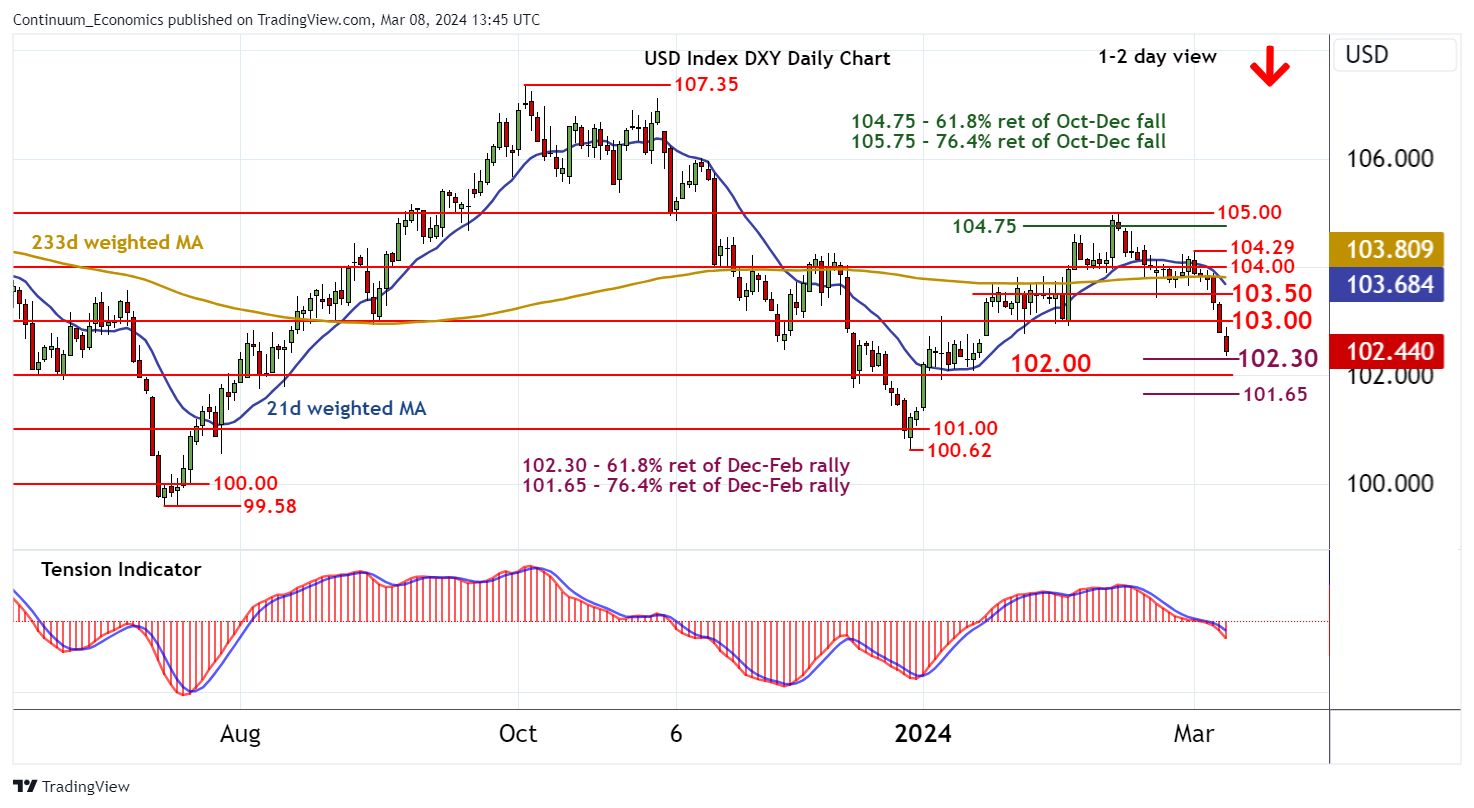

The expected rebound in CPI may push back market participants anticipation of earlier easing from the Fed after the latest round of Fed speakers mentioning potential easing in the year. The DXY has been consolidating between 100 and 106 for more than half a year as the ebb and flows of sentiment in monetary policy changes took lead. While it is inevitable for the Fed to ease when inflation reaches target band, market participants may have aggressively priced in the pace and magnitude of cut for now. The correction in equities may also drive haven bids for the greenback.

On the chart, the short-term consolidation has given way to a sharp break lower, as intraday studies come under fresh pressure, with immediate focus turning to support at the 102.30 Fibonacci retracement. Oversold daily stochastics could limit any initial tests in consolidation. However, the daily Tension Indicator is falling and broader weekly charts are turning down, highlighting room for a later break and continuation of February losses towards congestion support at 102.00. Beneath here is the 101.65 retracement, but short-covering is expected to increase towards here. Meanwhile, resistance is lowered to congestion around 103.00. A close above here, if seen, will turn sentiment neutral and prompt consolidation beneath further congestion around 103.50.

As we march closer towards the March BoJ meeting, one must prepare for "leaks" of monetary policy changes. Since Ueda took governance, the BoJ tended to "leak" only one day before the meeting with copy and paste remarks in the weeks beforehand and this time, such "leak" will be market moving for the BoJ is expected to exit ultra-loose monetary policy or at least forward guiding to that direction. Over the weekend, Jiji already reported the possibility of the BoJ to scrap YCC completely. Our central forecast remains a change of forward guidance in March and a hike towards 0% in April with the YCC being removed simultaneously.

This is the most important for market participants watching Japan as we will have most wage negotiation result coming out, with Toyota expected to reply on Wednesday. Unions said most companies have agreed to a higher wage hike than the previous year with numbers floating around current at 5.1% base pay and 6.2% overall pay increase. If the pay increase indeed reached 5%, it will be viewed as hawkish from the BoJ's standpoint because they are only looking for a 2% growth to sustain trend inflation in Japan. Realistically, anything above 4% will likely see the JPY to strengthen in a medium run.

On the chart, the pair has edged off the 146.48 low as prices consolidate sharp breakdown from the 150.00 level last week. Pause here see prices unwinding oversold intraday studies but the downside still vulnerable and lower will see room to the 146.00/145.89 congestion and February low. Lower still will see scope to target 145.55, 50% Fibonacci level. Consolidation see resistance at the 147.58/148.00 area now expected to cap corrective bounce. Only clearance here will open up stronger bounce to the 148.80 resistance.