Published: 2024-01-02T15:42:07.000Z

Preview: Due January 3 - U.S. December ISM Manufacturing Index - A modest correction from two weak months

-

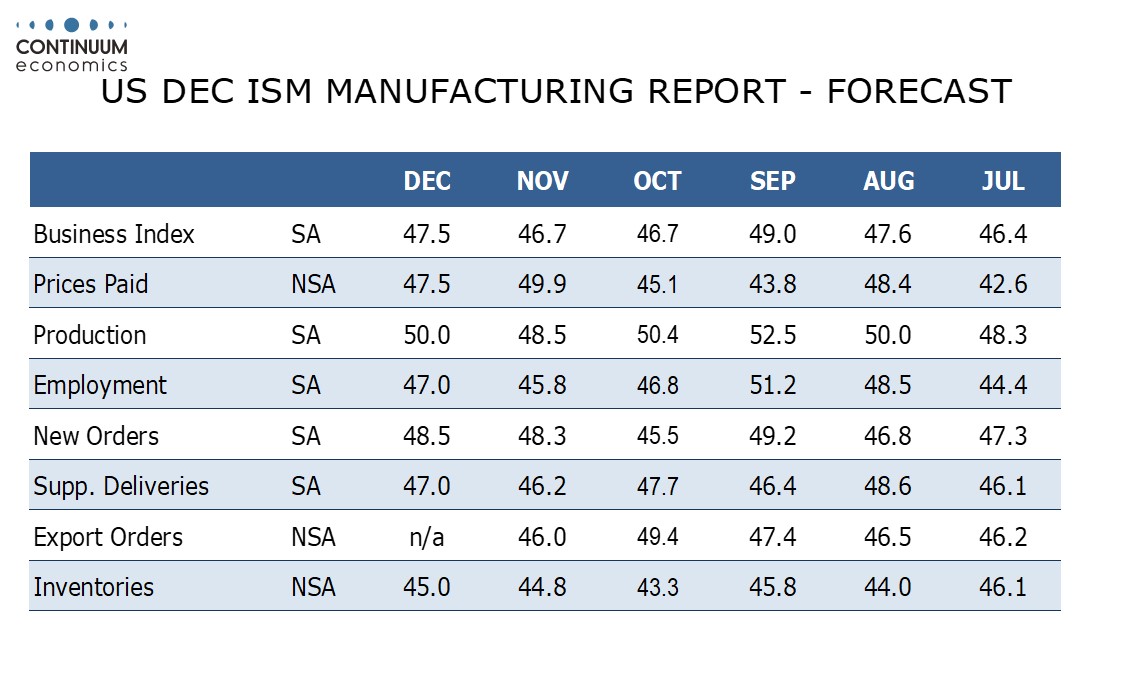

We expect a December ISM manufacturing index of 47.5, up from two straight months at 46.7 which generally underperformed most comparable manufacturing surveys. The underlying picture remains marginally negative.

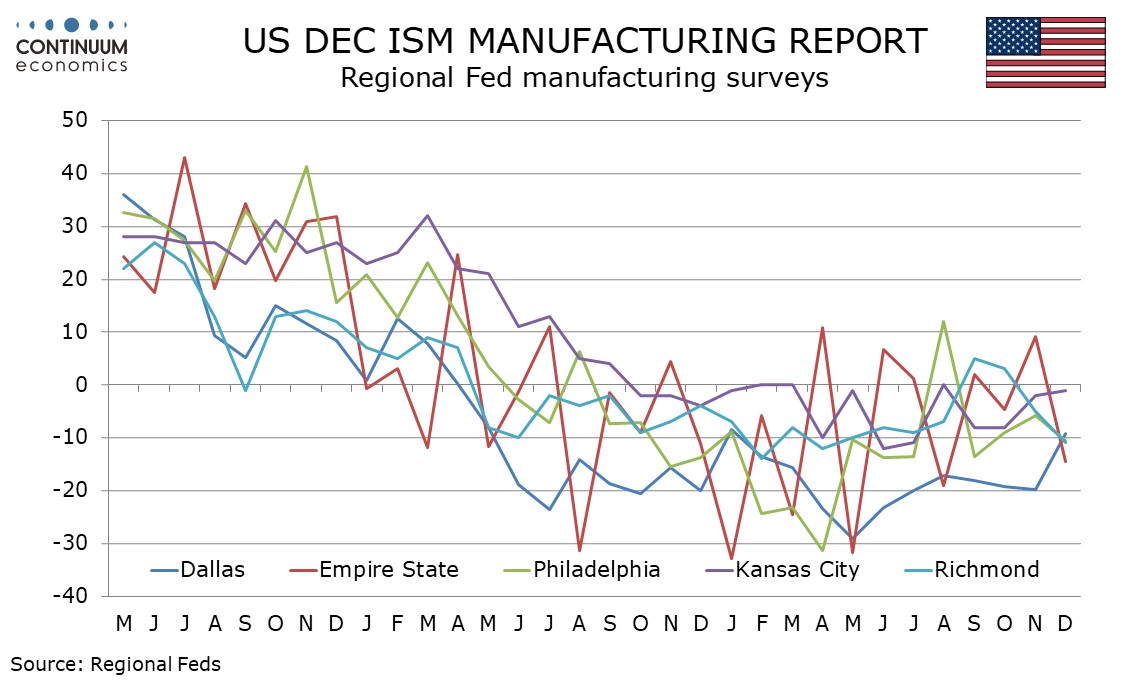

In December, the S and P manufacturing PMI slipped and while regional manufacturing PMIs were mixed, more slipped than improved. However most indices that slipped outperformed the ISM data in November.

We expect increases in all five components that make up the ISM manufacturing composite, with upside scope greatest in production, due to supportive seasonal adjustments, and employment, given a very weak November outcome of 45.8.

We expect only marginal gains in new orders, deliveries and inventories. Prices paid do not contribute to the composite. Here we expect slowing to 47.5 from 49.9, though this would leave the index above those seen from May through October.