GBP, CHF flows: GBP falls on report tax hikes abandoned, CHF strength extends

GBP falling back as FT reports that Chancellor Reeves has abandined plans to raise income tax in the November 26 budget. CHF strength extends with EUR/CHF retesting 0.92 level on optimism on tariff reduction.

GBP has fallen back overnight on an FT report indicating that Chancellor Reeves had abandoned plans to raise income tax in the November 26 Budget due to fears it would be unpopular with their backbenchers and the genal public. While it is still likely that Reeves will come up with measures to reduce the deficit, an income tax rise was seen as the simplest and most efficient way of raising the cash, and the capitulation to populist pressures is seen as another sign of weakness after the government previously failed to put their welfare spending cuts through parliament. EUR/GBP has hit another new high for the year above 0.8860, and GBP could suffer further if the gilt market sees a sell off at the open this morning.

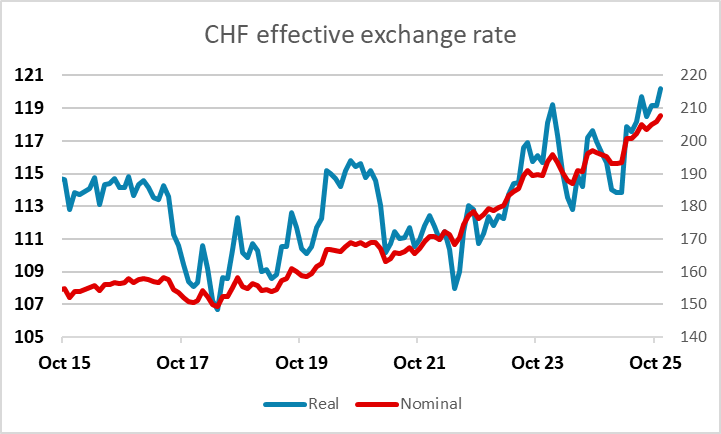

While GBP has weakened, the CHF has continued to strengthen, with EUR/CHF once again testing the 0.92 level which has been support over the last year. Positive noises about a likely reduction in the US tariff on Swiss goods from 39% to 15% are encouraging CHF bulls, but the SNB and the Swiss government will be concerned about the renewed rise in the CHF, which is already at extremely expensive levels. There is no official policy to protect the 0.92 level, and no clear evidence that there has been any intervention, but there are some suspicions that the SNB has been active and the SNB, while reluctant, has indicated it is prepared to be active in the FX market if necessary. Even so, they will not want to set up a repeat of the defence of a level that resulted in the huge spike higher in the CHF when the defence of the parity level in EUR/CHF was abandoned in 2015. It’s hard to see the attraction of the CHF for investors given zero rates and an extremely high starting point, and the reduction in the tariff would only put Switzerland back in line with the rest of Europe, but at this stage the strength is hard to oppose.