U.S. February S&P PMIs - Manufacturing extends upturn but Services turn negative

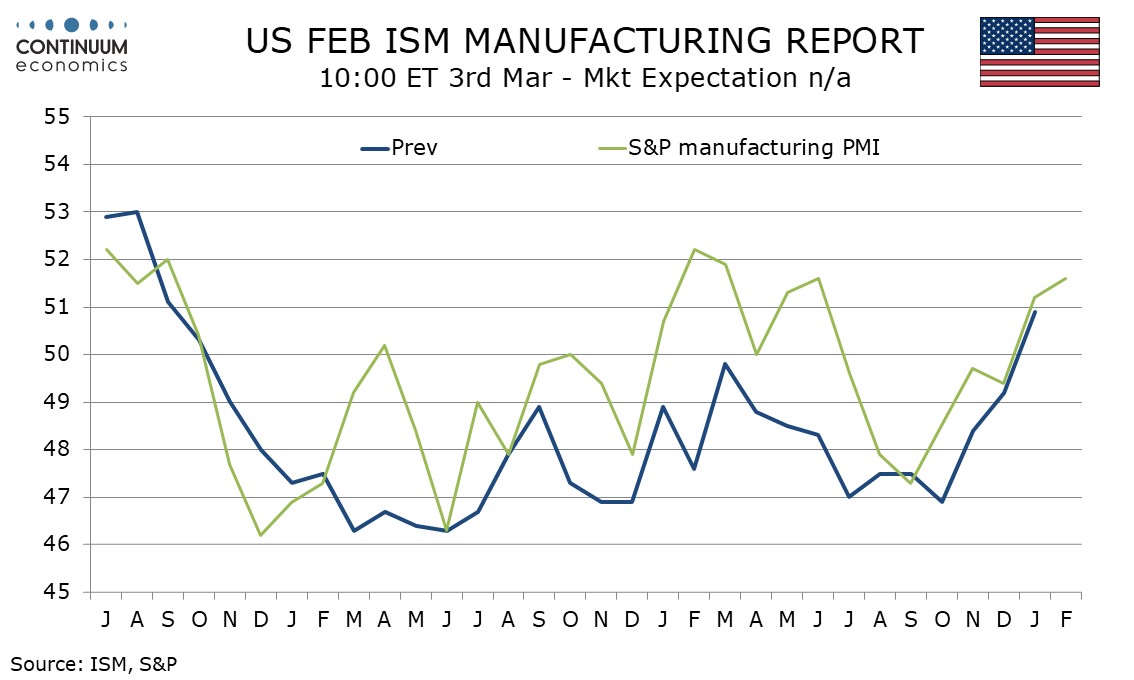

February’s preliminary S and P PMIs are mixed, with manufacturing modestly extending a recent upturn in rising to 51.6 from 51.2, but more significantly services seeing a dip below neutral, to 49.7 from 52.9.

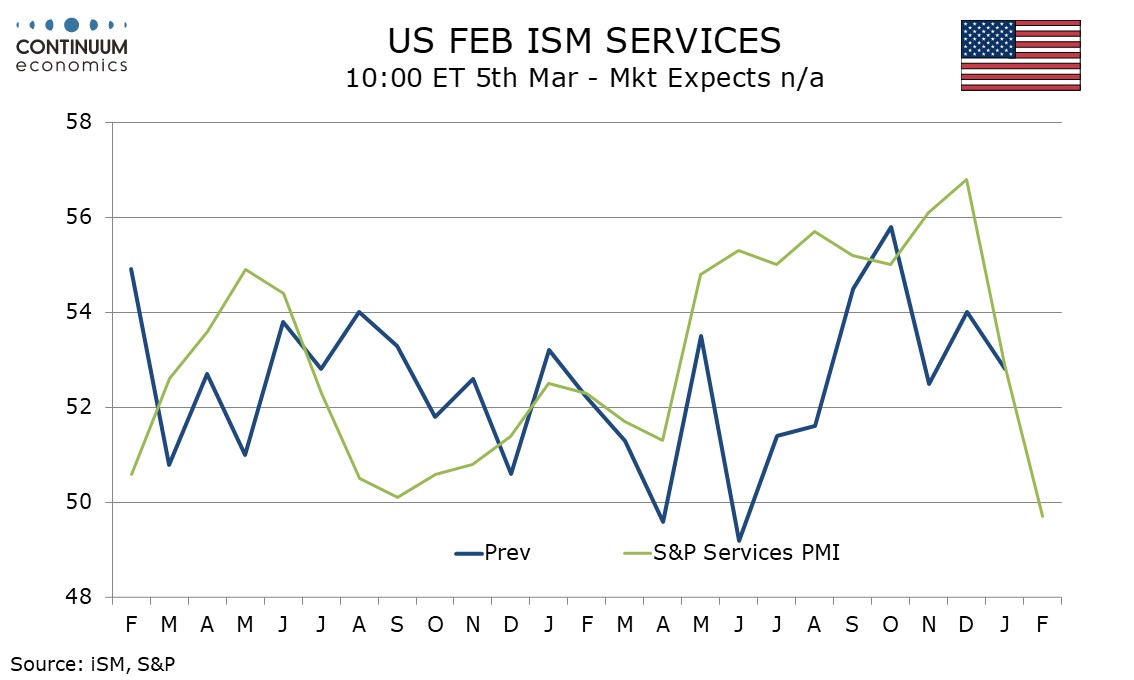

The slowing in services, which had been stable around 55 through the second half of 2024 before rising to 56.8 in December, to 52.9 in January and now 49.7, the weakest since January 2023, is significant. Most had attributed the January slowing to weather. Weather may be an issue in February too but is unlikely to be the sole factor. Fading expectations of Fed easing may be significant. The strength of the second half of 2024 coincided with the Fed moving into easing. The S and P services index does appear to be more interest-sensitive than the ISM services index.

Improvement in manufacturing is consistent with recent signals from the ISM and several regional surveys, though may not expend much further. An upturn in late 2023 and early 2024 peaked in February at 52.2. This upturn may also have little further to run, particularly if trade conflicts escalate.

.