Preview: Due April 16 - Canada March CPI - Correction after two soft months

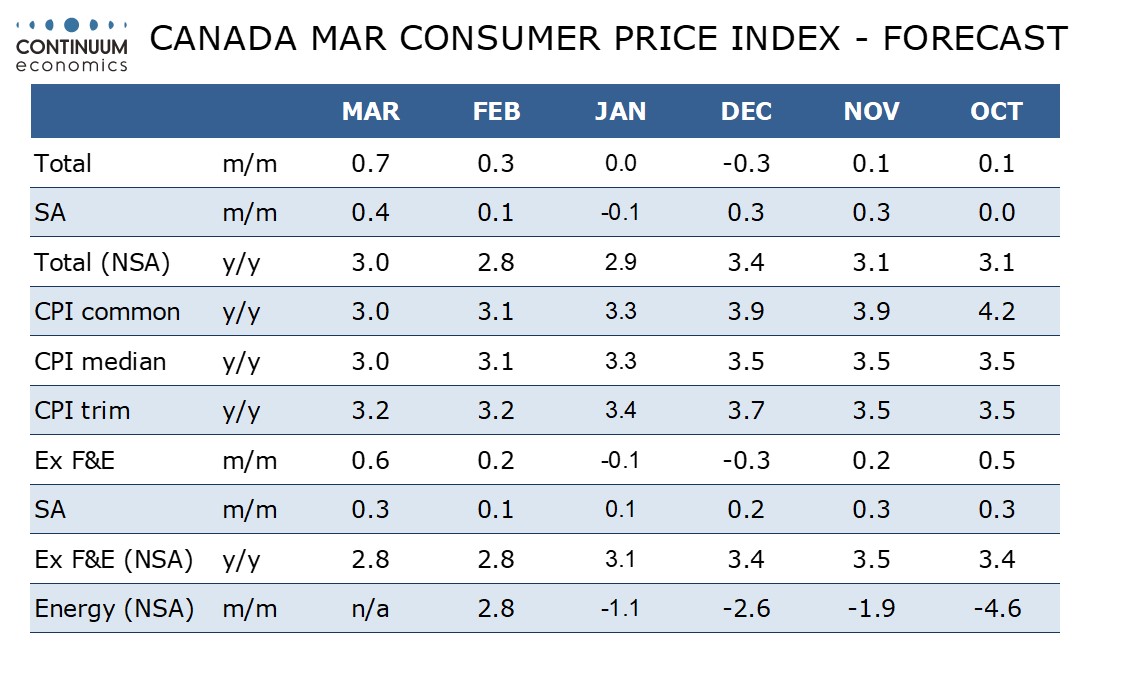

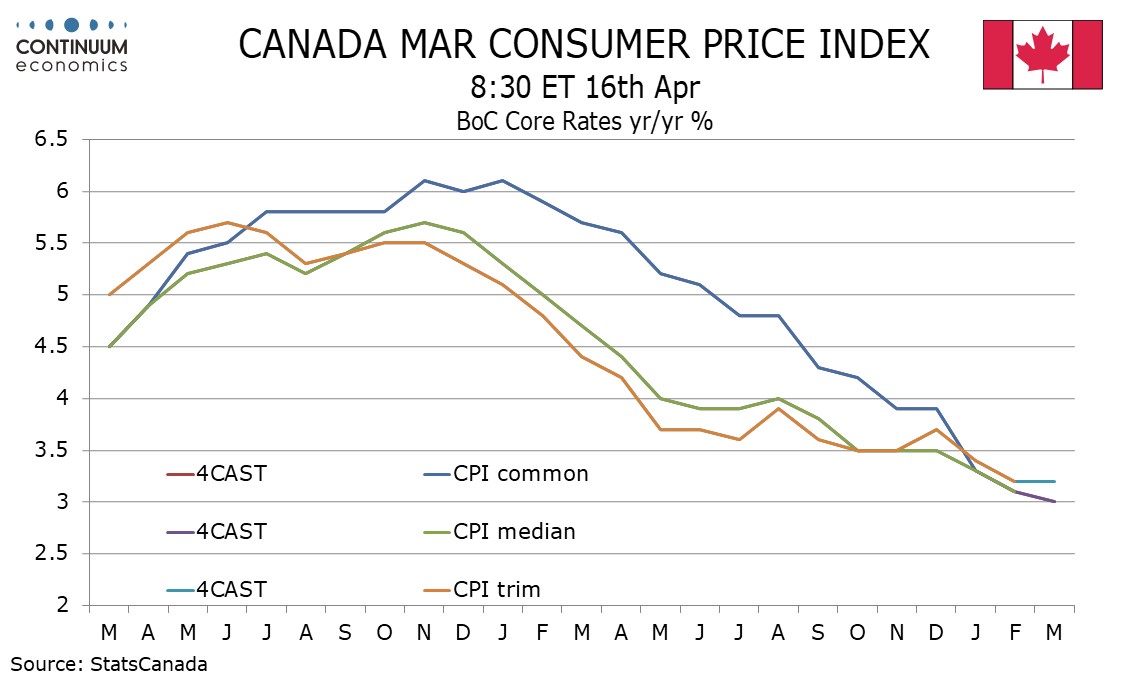

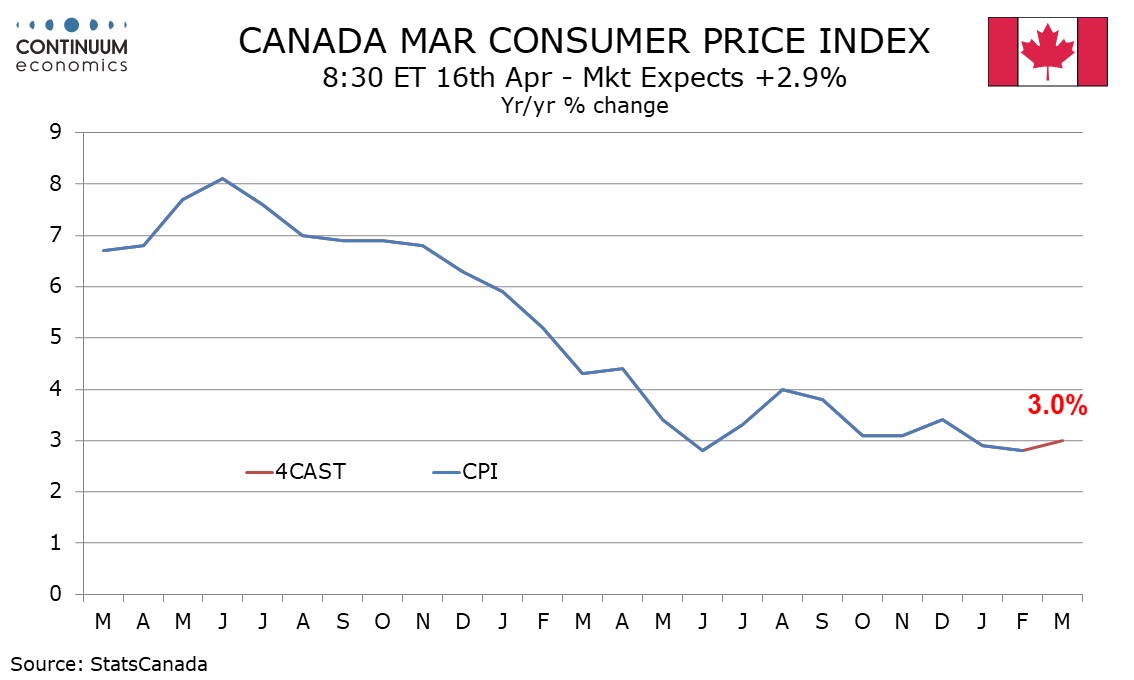

We expect March Canadian CPI to move higher to 3.0% yr/yr from 2.8% in February and 2.9% in January, with the monthly data likely to look quite firm after two soft months. However we do expect some modest progress lower in two of the three BoC’s core rates.

We expect the monthly data to show overall CPI up by 0.7%, with a 0.6% increase ex food and energy, before seasonal adjustments, though some of the increase will be seasonal. We expect seasonally adjusted data to show a 0.4% rise overall, lifted by gasoline, with a 0.3% increase ex food and energy.

The latter would be a correction from two straight gains of only 0.1%. Those data showed some components erratically soft, in particular clothing and footwear which saw declines of 1.8% in January and 2.7% in February, each taking at least 0.1% off the change. A correction in apparel alone could be enough to bring a 0.3% seasonally adjusted ex food and energy increase in March.