U.S. April Existing Home Sales - Unexpected dip, subdued outlook

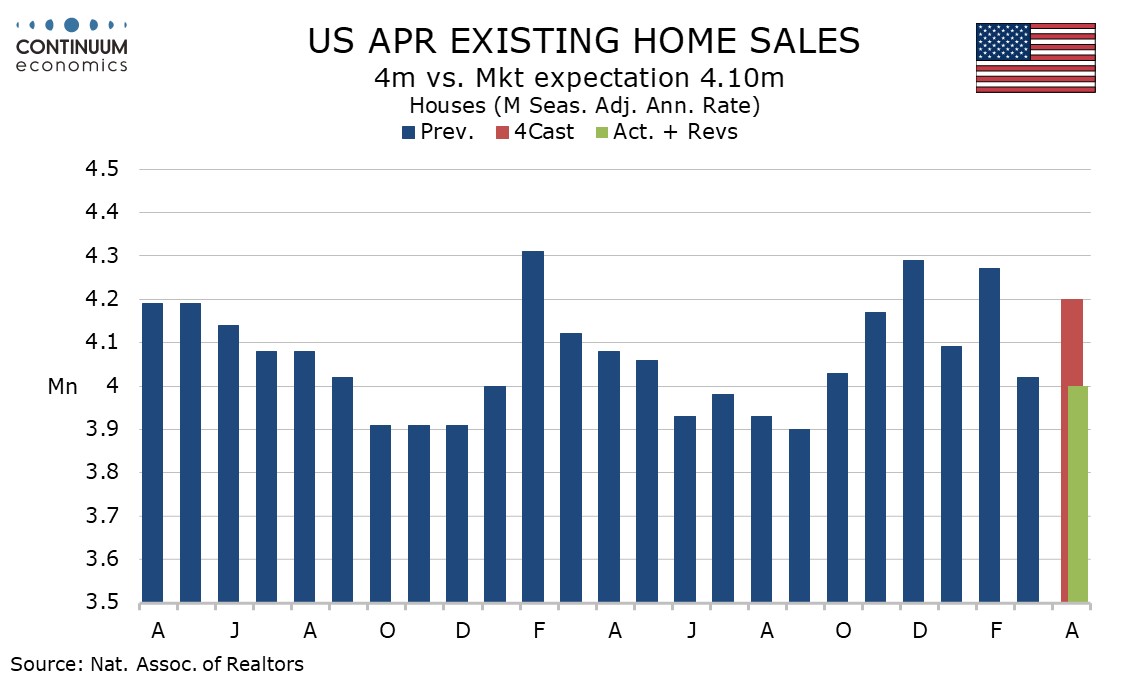

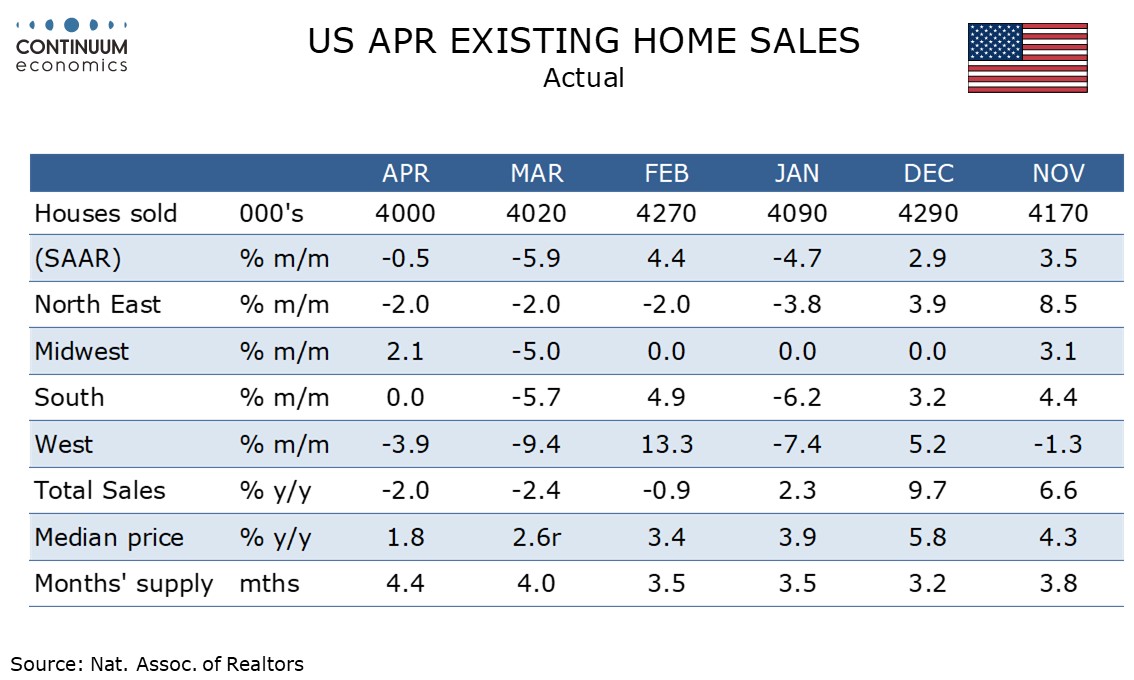

April existing home sales saw an unexpected 0.5% fall to 4.00m which contrasts a strong 6.1% rise in March pending home sales which are designed to predict existing home sales. However the outlook for the housing sector looks quite subdued overall.

The dip in existing home sales suggests April new home sales due tomorrow will be unable to sustain a March increase, while May’s NAHB homebuilders’ survey saw a significant dip. Rising long term rates add to downside risks.

Detail shows the months’ supply of new homes at 4.4, up from 4.0 and the highest since September 2016. The median price rose by 2.7% on the month but this is largely seasonal. Yr/yr growth at 1.8% from 2.6% is the lowest since June 2023.

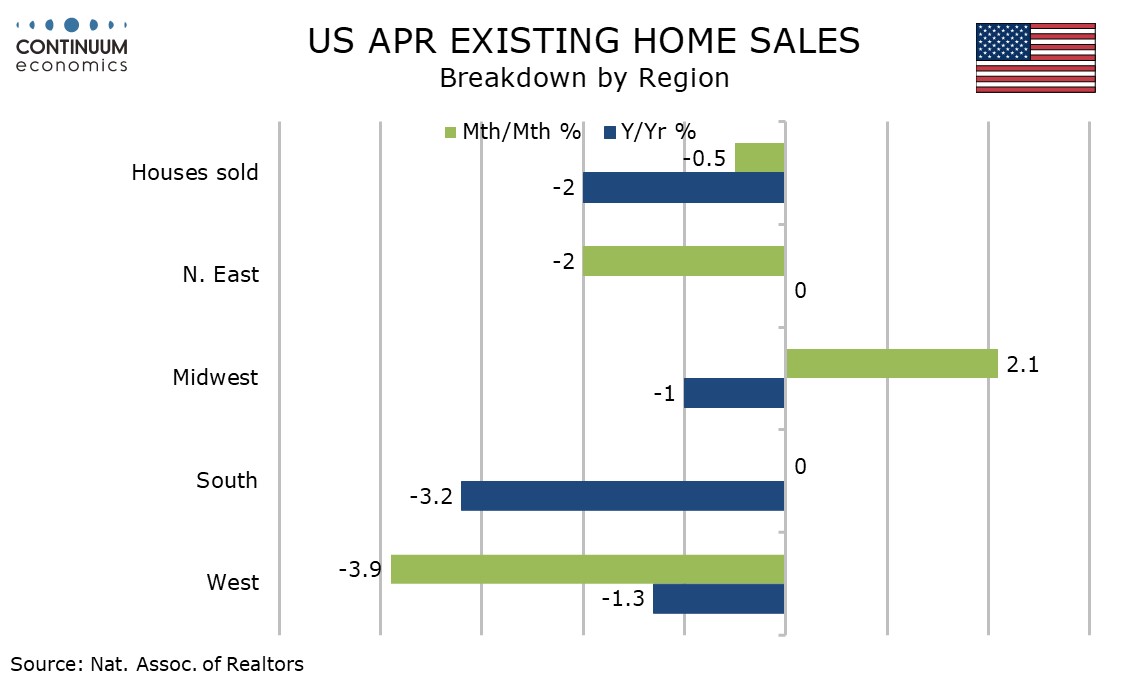

Sales rose in the Midwest, were flat in the South and fell in the Northeast and West. All regions are however close to a 2.0% yr/yr national decline, with the Northeast the strongest at flat and the South the weakest at -3.2%.