USD, JPY, SEK flows: SEK fails to benefit from higher CPI, JPY softens with jGB yields

EUR/SEK moves higher despite stronger CPI. USD/JPY rises as JGB yields fall, but spreads still suggest downside risks

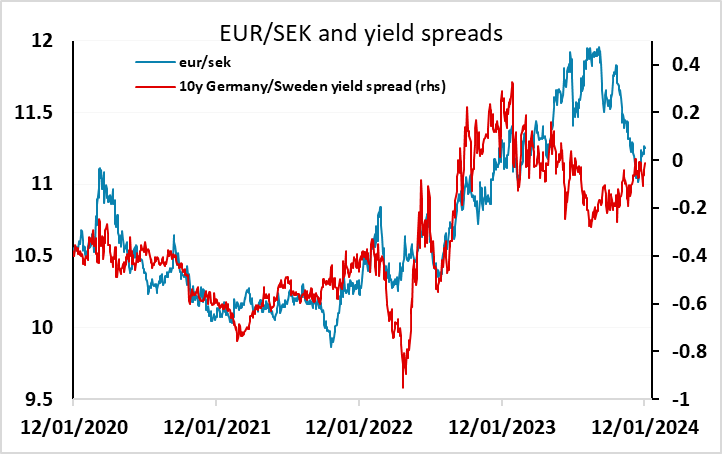

Although December Swedish CPI has come in a little higher than expected at 2.3% y/y for CPIF, EUR/SEK has moved higher after the numbers after a brief dip. We wouldn’t expect this to extend far, but the failure of the SEK to respond positively to the stronger CPI data suggests that the EUR/SEK move down from 12 to 11 seen from September to December is complete for now, and more information will be required to test the bottom of the range. We do still prefer the downside medium term, as yield spreads still favour the SEK, but there may be initial scope for a correction to a retracement target at 11.32.

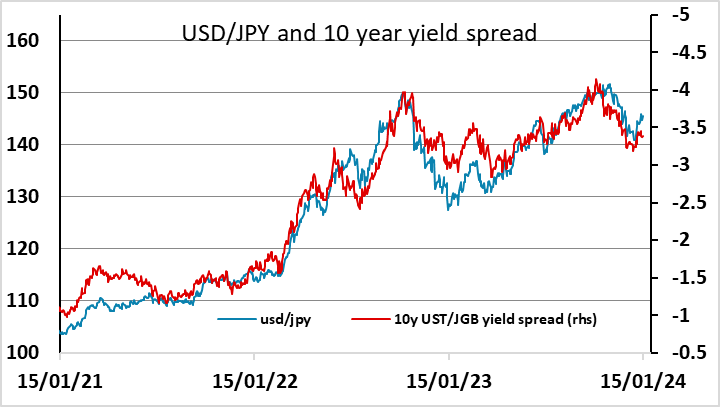

Over the weekend there was some further conflict between the Houthis and the US navy, but for the moment this isn’t having much impact either on global risk sentiment or the oil price.The JPY slipped a little lower as JGB yields softened further, following the decline in US and European yields at the end of last week. Spreads still suggest downside risks for USD/JPY, but the immediate focus is on the move in Japanese yields and this has allowed a rise back towards 146. However, we doubt this will lead to any sustained gains, and see some downside risks form here both in USD/JPY and the JPY crosses.